Virgin Media 2006 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2006 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

VIRGIN MEDIA INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

17. Related Party Transactions (Continued)

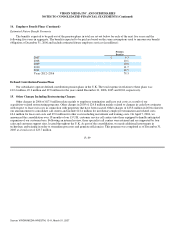

Refinancing Transactions

In November 2003, we effected a $1.4 billion, or £0.8 billion, rights offering in which we distributed to each of our stockholders

proportionate rights to purchase shares of our common stock. The rights were transferable, subject to various exceptions. The proceeds

from the rights offering were used in part to prepay in full an outstanding principal amount of $554.1 million, or £324.2 million under

our 19% Senior Secured Notes due 2010 and to repay in full a working capital facility with an outstanding principal amount of

£408.3 million.

In connection with our rights offering, on September 26, 2003, we entered into two separate participating purchaser agreements

with each of W.R. Huff Asset Management Co., L.L.C., on behalf of certain of our affiliates and managed accounts, and Franklin

Mutual Advisers LLC, as agent and investment advisor for certain funds. Each participating purchaser held shares of our common

stock or was the general partner or investment manager of managed funds and third party accounts that directly held shares of our

common stock.

Pursuant to these agreements, W.R. Huff Asset Management Co., L.L.C., on behalf of managed accounts and affiliates, and

Franklin Mutual Advisers LLC, on behalf of funds for which it acts as an agent or investment advisor, each agreed in advance of the

rights offering to exercise the basic subscription privilege for all of the rights distributed to their respective managed accounts,

affiliates and funds in the rights offering. The rights offering prospectus indicated to our stockholders that these parties had made

advance commitments. Other stockholders did not have to commit to exercise their subscription privileges in advance.

W.R. Huff Asset Management Co., L.L.C., on behalf of managed accounts and affiliates, purchased 4,582,594 shares of our

common stock for $40.00 and Franklin Mutual Advisers LLC, on behalf of funds for which it acts as an agent or investment advisor,

purchased 2,974,908 shares of our common stock for $40.00. This was the same price offered to all recipients of rights in the offering.

W.R. Huff Asset Management Co., L.L.C., on behalf of managed accounts and affiliates, also purchased approximately 25,000 shares

of our common stock for $40.00 pursuant to the over−subscription privilege available to all rights holders in the offering. Franklin

Mutual Advisers LLC, on behalf of funds for which it acts as an agent or investment advisor, also purchased 35,752 shares of our

common stock for $40.00 pursuant to the over−subscription privilege available to all rights holders in the offering.

The shares of our common stock that each participating purchaser received upon the exercise of the rights that the participating

purchaser had committed to exercise constituted restricted stock for the purposes of the Securities Act of 1933. Accordingly, we

entered into a registration rights agreement with each participating purchaser. We filed a registration statement on February 13, 2004

to fulfill our obligations under these agreements.

We completed a transaction on April 13, 2004 in which our indirect wholly−owned subsidiary, Virgin Media Finance PLC

(formerly NTL Cable PLC), issued £375 million aggregate principal amount of 9.75% senior notes due 2014, $425 million aggregate

principal amount of 8.75% senior notes due 2014, € 225 million aggregate principal amount of 8.75% senior notes due 2014 and

$100 million aggregate principal amount of floating rate senior notes due 2012. Some of our significant stockholders were holders of

the 10% senior sterling notes due 2008 and 9.125% senior notes due 2008 of Diamond Holdings Limited and of the 11.2% discount

debentures due 2007 of NTL (Triangle) LLC, which were redeemed on May 13,

F−46

Source: VIRGIN MEDIA INVESTM, 10−K, March 01, 2007