Virgin Media 2006 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2006 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

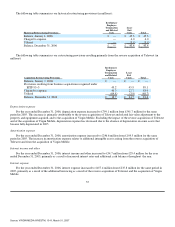

Loss from continuing operations

For the year ended December 31, 2005, loss from continuing operations was £241.7 million compared with a loss of

£509.4 million for the same period in 2004. The reduction in loss from continuing operations was primarily attributable to savings in

interest expense, the reduction in the loss on extinguishment of debt, lower depreciation and foreign currency transaction gains

compared with losses in 2004.

Loss from continuing operations per share

Basic and diluted loss from continuing operations per common share for the year ended December 31, 2005 was £1.13 and for

the year ended December 31, 2004 was £2.33. Basic and diluted loss from continuing operations per share is computed using an

average of 213.8 million shares issued in the year ended December 31, 2005 and an average of 218.0 million shares issued for the

same period in 2004. Basic and diluted loss from continuing operations per common share and average shares issued have been

restated to reflect the share exchange ratio used in the reverse acquisition of Telewest. Options to purchase 3.1 million shares at

December 31, 2005 were excluded from the calculation of diluted loss from continuing operations per share, since the inclusion of

such options is anti−dilutive.

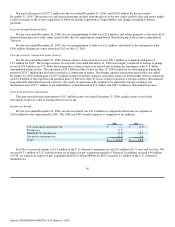

Consolidated Statement of Cash Flows

Years ended December 31, 2006 and 2005

Cash flow information provided below is for our continuing operations.

For the year ended December 31, 2006, cash provided by operating activities increased to £786.1 million from £325.6 million for

the year ended December 31, 2005. This increase is primarily attributable to the reverse acquisition of Telewest and the acquisition of

Virgin Mobile, offset by an increase in cash paid for interest. For the year ended December 31, 2006, cash paid for interest, exclusive

of amounts capitalized, increased to £327.1 million from £216.8 million during the same period in 2005. This increase resulted from

the higher levels of borrowings and repayment of existing facilities following the reverse acquisition of Telewest and the acquisition

of Virgin Mobile.

For the year ended December 31, 2006, cash used in investing activities was £2,954.0 million compared with cash provided by

investing activities of £1,172.8 million for the year ended December 31, 2005. The cash used in investing activities in the year ended

December 31, 2006 includes £2,004.6 million for the reverse acquisition of Telewest, net of cash acquired of £294.9 million, and

£418.5 million for the acquisition of Virgin Mobile, net of cash acquired of £14.1 million. The cash provided by investing activities in

the year ended December 31, 2005 includes £1.229 billion from the sale of our Broadcast operations. Purchases of fixed assets

increased to £544.8 million for the year ended December 31, 2006 from £288.1 million for the same period in 2005 primarily because

of the timing of cash payments and the reverse acquisition of Telewest.

Cash provided by financing activities for the year ended December 31, 2006 was £1,865.2 million compared with cash used in

financing activities of £895.6 million in the year ended December 31, 2005. The principal components of cash provided by financing

activities for the year ended December 31, 2006 were the new £5.3 billion senior credit facility and the $550 million senior notes due

2016. The principal uses of cash were the repayment of our previous senior credit and bridge facilities.

The principal components of the cash used in financing activities for the year ended December 31, 2005 were the repurchases of

our common stock in the open market in February and April 2005 for £114.0 million, the prepayment of £723.0 million on our senior

credit facility and redemption of the floating rate senior notes due 2012.

65

Source: VIRGIN MEDIA INVESTM, 10−K, March 01, 2007