Virgin Media 2006 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2006 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

when the liability is incurred. The adoption of FAS 146 did not have a significant effect on our results of operations, financial

condition or cash flows.

Prior to 2003, we recognized a liability for costs associated with restructuring activities at the time a commitment to restructure

was given, in accordance with EITF 94−3, Liability Recognition for Certain Employee Termination Benefits and Other Costs to Exit

an Activity (including Certain Costs Incurred in a restructuring). Liabilities for costs associated with restructuring activities initiated

prior to January 1, 2003 continue to be accounted for under EITF 94−3.

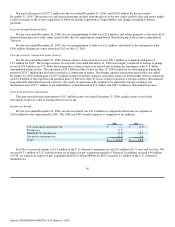

In relation to our restructuring activities, we have recorded a liability of £108.1 million as of December 31, 2006 relating to lease

exit costs of properties that we have vacated. In calculating the liability, we make a number of estimates and assumptions including

the timing of ultimate disposal of the properties, our ability to sublet the properties either in part or as a whole, amounts of sublet

rental income achievable including any incentives required to be given to sublessees, and amounts of lease termination costs.

Recent Accounting Pronouncements

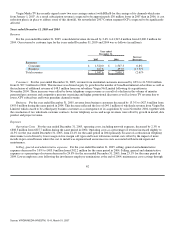

In June 2005, the FASB issued FSP FAS 143−1, Accounting for Electronic Equipment Waste Obligations (“FSP 143−1”). The

FASB issued the FSP to address the accounting for certain obligations associated with the Waste Electrical and Electronic Equipment

Directive adopted by the European Union (EU). FSP 143−1 requires that the commercial user should apply the provisions of FASB

Statement No. 143 and the related FASB Interpretation No. 47 to certain obligations associated with historical waste (as defined by the

Directive), since this type of obligation is an asset retirement obligation. The FSP is effective for the later of the first reporting period

ending after June 8, 2005 or the Directive’s adoption into law by the applicable EU−member country. The Directive was adopted by

the U.K. on December 12, 2006, and is effective January 2, 2007. Management have reviewed their obligations under the law and

concluded that an obligation exists for certain of our customer premises equipment. As a result we have recognized a retirement

obligation of £58.2 million and fixed assets of £24.4 million on the balance sheet and a cumulative effect change in accounting

principle of £33.8 million in the statement of operations.

In July 2006, the FASB issued FASB Interpretation (“FIN”) No. 48, Accounting for Uncertainty in Income Taxes—an

interpretation of FASB Statement 109 (“FIN 48”). FIN 48 prescribes a comprehensive model for recognizing, measuring, presenting

and disclosing in the financial statements tax positions taken or expected to be taken on a tax return, including a decision whether to

file or not to file in a particular jurisdiction. FIN 48 is effective for fiscal years beginning after December 15, 2006. If there are

changes in net assets as a result of application of FIN 48 these will be accounted for as an adjustment to retained earnings. We adopted

FIN 48 effective January 1, 2007. We are continuing to evaluate the impact of adopting FIN 48, but do not anticipate any significant

impact on our financial statements.

In September 2006, the FASB issued SFAS No. 157, Fair Value Measurements (“SFAS 157”). SFAS 157 provides guidance for

using fair value to measure assets and liabilities. It also responds to investors’ requests for expanded information about the extent to

which companies measure assets and liabilities at fair value, the information used to measure fair value, and the effect of fair value

measurements on earnings. SFAS 157 applies whenever other standards require (or permit) assets or liabilities to be measured at fair

value, and does not expand the use of fair value in any new circumstances. SFAS 157 is effective for financial statements issued for

fiscal years beginning after November 15, 2007 and we are required to adopt it in the first quarter of 2008. We are currently evaluating

the effect that the adoption of SFAS 157 will have on our consolidated results of operations and financial condition and are not yet in a

position to determine its effects.

In September 2006, the SEC issued SAB No.108, Considering the Effects of Prior Year Misstatements when Quantifying

Misstatements in Current Year Financial Statements (“SAB 108”). SAB 108 provides

53

Source: VIRGIN MEDIA INVESTM, 10−K, March 01, 2007