Virgin Media 2006 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2006 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

(b) Not applicable.

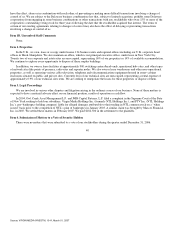

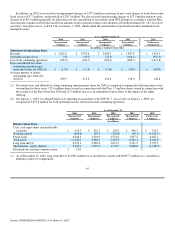

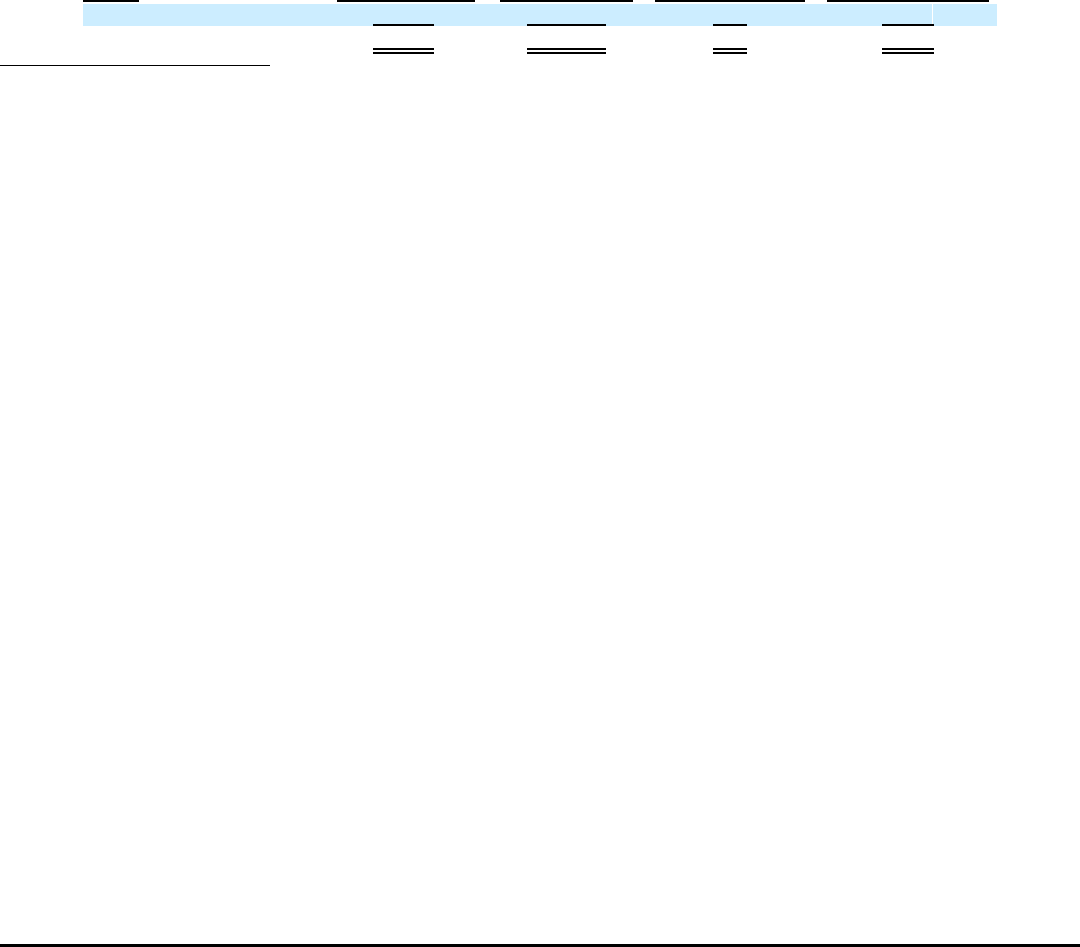

(c) Purchases of Equity Securities by the Issuer

Period

(a)

Total Number of

Shares (or Units)

Purchased

(b)

Average Price

Paid per Share

(or Unit)

(c)

Total Number of

Shares (or Units)

Purchased as Part of

Publicly Announced

Plans or Programs

(d)

Maximum Number

(or Approximate

Dollar Value of

Shares (or Units)

That May Yet Be

Purchased Under the

Plans or Programs

May 17, 2006 6,027(1) $ 27.51 — $ —

Total 6,027 $ 27.51 — $ —

(1) In connection with the merger with Telewest, the U.K. tax rules caused a deemed tax liability to be created for holders of

restricted stock who were subject to U.K. tax. Prior to May 17, 2006, Robert C. Gale, our Vice President−Controller, held 32,275

shares of our common stock and restricted stock units, including 17,250 shares of restricted stock vesting in three equal

instalments of 5,750 shares on each of May 6, 2006, May 6, 2007 and May 6, 2008. As a result of the merger, Mr. Gale incurred

a tax liability with respect to his shares of restricted stock. To satisfy this tax liability, which we paid in cash, we withheld 2,009

shares of common stock from each 5,750 share tranche. The average price paid per share shown in column (b) is our mid−market

share price on May 17, 2006, the date of this transaction. Accordingly, 3,741 shares of common stock were delivered in

satisfaction of the shares of restricted stock that vested on May 6, 2006, and 3,741 shares of common stock remain subject to

restrictions that will lapse (subject to Mr. Gale’s continued employment) on each of May 6, 2007, and May 6, 2008.

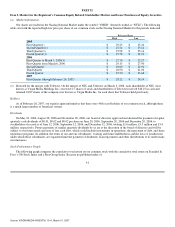

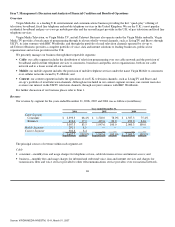

Item 6. Selected Financial Data

The selected consolidated financial information presented below should be read in conjunction with the consolidated financial

statements and notes thereto and the information contained in our Management’s Discussion and Analysis of Financial Condition and

Results of Operations appearing elsewhere in this annual report. Historical results are not necessarily indicative of future results.

On July 4, 2006, we acquired 100% of the outstanding shares and options of Virgin Mobile Holdings (UK) plc, or Virgin Mobile,

through a U.K. Scheme of Arrangement. Virgin Mobile is the largest mobile virtual network operator in the United Kingdom, with

approximately 4.5 million customers.

On March 3, 2006, NTL merged with a subsidiary of Telewest, which changed its name to NTL Incorporated. Because this

transaction is accounted for as a reverse acquisition, the financial statements included in this Form 10−K for the period through

March 3, 2006 are those of NTL, which is now known as Virgin Media Holdings Inc. For the period since March 3, 2006 these

financial statements reflect the reverse acquisition of Telewest. See note 1 to the consolidated financial statements of Virgin Media

Inc.

On May 9, 2005, we sold our operations in the Republic of Ireland. We have restated the historical consolidated financial

information to account for the Ireland operations as a discontinued operation. The assets and liabilities of the Ireland operations have

been reclassified as assets held−for−sale and liabilities of discontinued operations, respectively, and the results of operations of the

Ireland operations have been removed from our results of continuing operations for all periods presented.

Following the disposal of our operations in the Republic of Ireland, all of our revenue from continuing operations and

substantially all of our assets are denominated in U.K. pounds sterling. Consequently, we now report our results in pounds sterling.

Financial information for all periods presented has been restated accordingly.

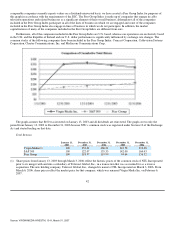

We entered into an agreement for the sale of our Broadcast Operations on December 1, 2004 and closed the sale on January 31,

2005. As of December 31, 2004, we accounted for the Broadcast operations

43

Source: VIRGIN MEDIA INVESTM, 10−K, March 01, 2007