Virgin Media 2006 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2006 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276

|

|

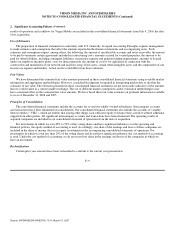

VIRGIN MEDIA INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

2. Significant Accounting Policies (Continued)

estimates and assumptions, including the expected period over which the asset will be utilized, projected future operating results of the

asset group, discount rate and long term growth rate.

As of December 31, 2006, we reviewed our long−lived assets for impairment and determined that there was no impairment of our

long−lived assets.

Deferred Financing Costs

Deferred financing costs of £99.7 million and £57.1 million as of December 31, 2006 and 2005, respectively, are included in

other assets. Deferred financing costs are incurred in connection with the issuance of debt and are amortized over the term of the

related debt using the effective interest method.

Restructuring Costs

As of January 1, 2003, we adopted FASB Statement No. 146, Accounting for Costs Associated with Exit or Disposal Activities

(FAS 146) and recognize a liability for costs associated with restructuring activities when the liability is incurred. Prior to 2003, we

recognized a liability for costs associated with restructuring activities at the time a commitment to restructure is given in accordance

with EITF 94−3, Liability Recognition for Certain Employee Termination Benefits and Other Costs to Exit an Activity (including

Certain Costs Incurred in a restructuring). Liabilities for costs associated with restructuring activities initiated prior to January 1,

2003 continue to be accounted for under EITF 94−3.

In 2006, we initiated a number of restructuring programs as part of our acquisitions of Telewest and Virgin Mobile. Provisions in

respect to exit activities of the acquired businesses are recognized under EITF 95−3, Recognition of Liabilities in Connection with a

Purchase Business Combination and included on the acquired company’s opening balance sheet. Provisions in respect to exit activities

of the historic NTL business are recognized under FAS 146.

Revenue Recognition

We recognize revenue only when it is realized or realizable and earned. We recognize revenue when all of the following are

present:

• persuasive evidence of an arrangement exists between us and our customers;

• delivery has occurred or the services have been rendered;

• the price for the service is fixed or determinable; and

• collectibility is reasonably assured.

Telephone, cable television and internet revenues are recognized as the services are provided to customers. At the end of each

period, adjustments are recorded to defer revenue relating to services billed in advance and to accrue for earned but unbilled services.

Installation revenues are recognized in accordance with the provisions of FASB Statement No. 51, Financial Reporting by Cable

Television Companies, in relation to connection and activation fees for cable television, as well as telephone and internet services, on

the basis that we market and maintain a unified fiber network through which we provide all of these services. Installation revenues are

recognized at the time the installation has been completed to the extent that those fees are less than direct selling costs.

F−13

Source: VIRGIN MEDIA INVESTM, 10−K, March 01, 2007