Tyson Foods 2012 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2012 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

76

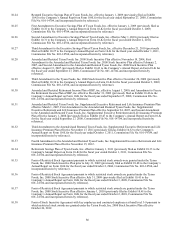

NOTE 21: CONDENSED CONSOLIDATING FINANCIAL STATEMENTS

TFM Parent, our wholly-owned subsidiary, has fully and unconditionally guaranteed the 2016 Notes. Additionally, TFM Parent has

fully and unconditionally guaranteed the 2022 Notes until such date TFM Parent has been released of its guarantee of both (i) Tyson's

$1.0 billion revolving credit facility and (ii) the 2016 Notes, at which time TFM Parent's guarantee of the 2022 Notes is permanently

released. The following financial information presents condensed consolidating financial statements, which include Tyson Foods, Inc.

(TFI Parent); TFM Parent; the Non-Guarantor Subsidiaries (Non-Guarantors) on a combined basis; the elimination entries necessary

to consolidate TFI Parent, TFM Parent and the Non-Guarantors; and Tyson Foods, Inc. on a consolidated basis, and is provided as an

alternative to providing separate financial statements for the guarantor. This presentation has been revised from the financial

presentation disclosed in prior periods to reflect changes in the subsidiary guarantees associated with the permanent release of certain

subsidiary guarantors upon the retirement of the 2014 Notes.

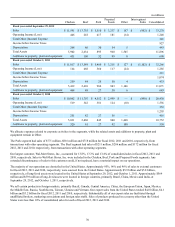

Condensed Consolidating Statement of Income for the year ended September 29, 2012 in millions

TFI

Parent TFM

Parent Non-

Guarantors Eliminations Total

Sales $ 352 $ 18,832 $ 15,375 $ (1,281) $ 33,278

Cost of Sales (4) 18,088 14,314 (1,280) 31,118

Gross Profit 356 744 1,061 (1) 2,160

Operating Expenses:

Selling, general and administrative 59 205 649 (1) 912

Goodwill impairment —————

Operating Income 297 539 412 — 1,248

Other (Income) Expense:

Interest expense, net 49 143 152 — 344

Other, net 1 — (24) — (23)

Equity in net earnings of subsidiaries (427) (43) — 470 —

Total Other (Income) Expense (377) 100 128 470 321

Income before Income Taxes 674 439 284 (470) 927

Income Tax Expense (Benefit) 91 130 130 — 351

Net Income 583 309 154 (470) 576

Less: Net Loss Attributable to Noncontrolling Interest — — (7) — (7)

Net Income Attributable to Tyson $ 583 $ 309 $ 161 $ (470) $ 583

Condensed Consolidating Statement of Income for the year ended October 1, 2011 in millions

TFI

Parent TFM

Parent Non-

Guarantors Eliminations Total

Sales $ 157 $ 18,636 $ 14,700 $ (1,227) $ 32,266

Cost of Sales 29 17,461 13,804 (1,227) 30,067

Gross Profit 128 1,175 896 — 2,199

Operating Expenses:

Selling, general and administrative 52 215 647 — 914

Goodwill impairment —————

Operating Income 76 960 249 — 1,285

Other (Income) Expense:

Interest expense, net (26) 148 109 — 231

Other, net (9) — (11) — (20)

Equity in net earnings of subsidiaries (673) (115) — 788 —

Total Other (Income) Expense (708) 33 98 788 211

Income before Income Taxes 784 927 151 (788) 1,074

Income Tax Expense (Benefit) 34 272 35 — 341

Net Income 750 655 116 (788) 733

Less: Net Loss Attributable to Noncontrolling Interest — — (17) — (17)

Net Income Attributable to Tyson $ 750 $ 655 $ 133 $ (788) $ 750