Tyson Foods 2012 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2012 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

67

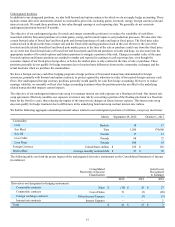

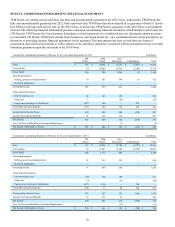

A reconciliation of the change in the fair value measurement of the defined benefit plans’ consolidated assets using significant

unobservable inputs (Level 3) is as follows (in millions):

Alternative funds Insurance contract Total

Balance at October 1, 2011 $ 6 $ 15 $ 21

Actual return on plan assets:

Assets still held at reporting date — 2 2

Assets sold during the period — — —

Purchases, sales and settlements, net (6) — (6)

Transfers in and/or out of Level 3 — — —

Balance at September 29, 2012 $ — $ 17 $ 17

We believe there are no significant concentrations of risk within our plan assets as of September 29, 2012.

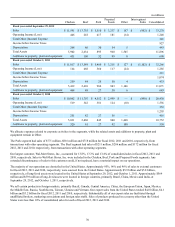

Contributions

Our policy is to fund at least the minimum contribution required to meet applicable federal employee benefit and local tax laws. In our

sole discretion, we may from time to time fund additional amounts. Expected contributions to pension plans for fiscal 2013 are

approximately $8 million. For fiscal 2012, 2011 and 2010, we funded $8 million, $7 million and $4 million, respectively, to defined

benefit plans.

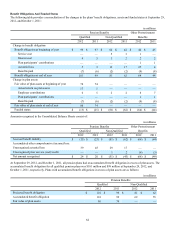

Estimated Future Benefit Payments

The following benefit payments are expected to be paid:

in millions

Pension Benefits Other Postretirement

Qualified Non-Qualified Benefits

2013 $ 7 $ 2 $ 5

2014 7 3 5

2015 7 3 5

2016 6 3 5

2017 6 4 5

2018-2022 29 24 24

The above benefit payments for other postretirement benefit plans are not expected to be offset by Medicare Part D subsidies in 2013

or thereafter.