Tyson Foods 2012 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2012 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

50

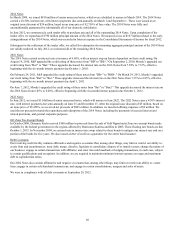

2014 Notes

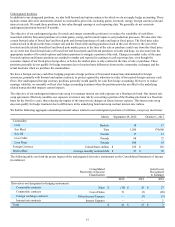

In March 2009, we issued $810 million of senior unsecured notes, which were scheduled to mature in March 2014. The 2014 Notes

carried a 10.50% interest rate, with interest payments due semi-annually on March 1 and September 1. These were issued at an

original issue discount of $59 million, based on an issue price of 92.756% of face value. The 2014 Notes were fully and

unconditionally guaranteed by substantially all of our domestic subsidiaries.

In June 2012, we commenced a cash tender offer to purchase any and all of the outstanding 2014 Notes. Upon completion of the

tender offer, we repurchased $790 million principal amount of the 2014 Notes. We incurred a loss of $167 million related to the early

extinguishment of the 2014 Notes, which was recorded in Interest expense in the Consolidated Statements of Income for fiscal 2012.

Subsequent to the settlement of the tender offer, we called for redemption the remaining aggregate principal amount of the 2014 Notes

not validly tendered. In July 2012, we redeemed all of the remaining 2014 Notes.

2016 Notes

The 2016 Notes carried an interest rate at issuance of 6.60%, with an interest step up feature dependent on their credit rating. On

August 19, 2010, S&P upgraded the credit rating of these notes from "BB" to "BB+." On September 2, 2010, Moody’s upgraded our

credit rating from "Ba3" to "Ba2." These upgrades decreased the interest rate on the 2016 Notes from 7.85% to 7.35%, effective

beginning with the six-month interest payment due October 1, 2010.

On February 24, 2011, S&P upgraded the credit rating of these notes from "BB+" to "BBB-." On March 29, 2011, Moody’s upgraded

our credit rating from "Ba2" to "Ba1." These upgrades decreased the interest rate on the 2016 Notes from 7.35% to 6.85%, effective

beginning with the six-month interest payment due April 1, 2011.

On June 7, 2012, Moody's upgraded the credit rating of these notes from "Ba1" to "Baa3." This upgrade decreased the interest rate on

the 2016 Notes from 6.85% to 6.60%, effective beginning with the six-month interest payment due October 1, 2012.

2022 Notes

In June 2012, we issued $1.0 billion of senior unsecured notes, which will mature in June 2022. The 2022 Notes carry a 4.50% interest

rate, with interest payments due semi-annually on June 15 and December 15. After the original issue discount of $5 million, based on

an issue price of 99.458%, we received net proceeds of $995 million. In addition, we incurred offering expenses of $9 million. We

used the net proceeds towards the repurchase and redemption of the 2014 Notes, including the payments of accrued interest and

related premiums, and general corporate purposes.

GO Zone Tax-Exempt Bonds

In October 2008, Dynamic Fuels received $100 million in proceeds from the sale of Gulf Opportunity Zone tax-exempt bonds made

available by the federal government to the regions affected by Hurricanes Katrina and Rita in 2005. These floating rate bonds are due

October 1, 2033. In November 2008, we entered into an interest rate swap related to these bonds to mitigate our interest rate risk on a

portion of the bonds for five years. We also issued a letter of credit as a guarantee for the entire bond issuance.

Debt Covenants

Our revolving credit facility contains affirmative and negative covenants that, among other things, may limit or restrict our ability to:

create liens and encumbrances; incur debt; merge, dissolve, liquidate or consolidate; dispose of or transfer assets; change the nature of

our business; engage in certain transactions with affiliates; and enter into sale/leaseback or hedging transactions, in each case, subject

to certain qualifications and exceptions. In addition, we are required to maintain minimum interest expense coverage and maximum

debt to capitalization ratios.

Our 2022 Notes also contain affirmative and negative covenants that, among other things, may limit or restrict our ability to: create

liens; engage in certain sale/leaseback transactions; and engage in certain consolidations, mergers and sales of assets.

We were in compliance with all debt covenants at September 29, 2012.