Tyson Foods 2012 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2012 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

41

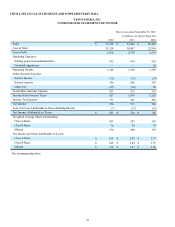

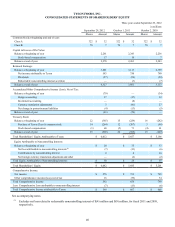

TYSON FOODS, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

Three years ended September 29, 2012

in millions

2012 2011 2010

Cash Flows From Operating Activities:

Net income $ 576 $ 733 $ 765

Adjustments to reconcile net income to cash provided by operating activities:

Depreciation 443 433 416

Amortization 56 73 81

Deferred income taxes 140 86 18

Loss on early extinguishment of debt 167 — —

Impairment of goodwill — — 29

Impairment of assets 34 18 36

Other, net 18 49 76

Increase in accounts receivable (69)(114) (79)

Increase in inventories (259)(299) (239)

Increase in accounts payable 106 152 101

Increase (decrease) in income taxes payable/receivable 8 (73) (53)

Increase (decrease) in interest payable 5 19 (4)

Net change in other current assets and liabilities (38)(31) 285

Cash Provided by Operating Activities 1,187 1,046 1,432

Cash Flows From Investing Activities:

Additions to property, plant and equipment (690)(643) (550)

Purchases of marketable securities (58)(146) (53)

Proceeds from sale of marketable securities 47 66 49

Proceeds from notes receivable — 51 —

Change in restricted cash to be used for investing activities — — 43

Other, net 41 28 11

Cash Used for Investing Activities (660)(644) (500)

Cash Flows From Financing Activities:

Payments on debt (993)(500) (1,034)

Net proceeds from borrowings 1,116 115 —

Purchase of redeemable noncontrolling interest — (66) —

Change in restricted cash to be used for financing activities — — 140

Purchases of Tyson Class A common stock (264)(207) (48)

Dividends (57)(59) (59)

Other, net 27 59 42

Cash Used for Financing Activities (171)(658) (959)

Effect of Exchange Rate Change on Cash (1)(6) 1

Increase (Decrease) in Cash and Cash Equivalents 355 (262) (26)

Cash and Cash Equivalents at Beginning of Year 716 978 1,004

Cash and Cash Equivalents at End of Year $ 1,071 $ 716 $ 978

See accompanying notes.