Tyson Foods 2012 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2012 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

56

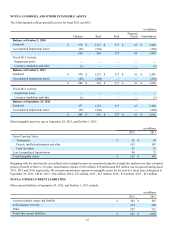

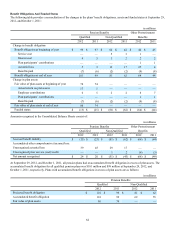

The following table sets forth the pretax impact of cash flow hedge derivative instruments on the Consolidated Statements of Income

(in millions):

Gain/(Loss)

Recognized in OCI

on Derivatives

Consolidated

Statements of Income

Classification

Gain/(Loss)

Reclassified from

OCI to Earnings

2012 2011 2010 2012 2011 2010

Cash Flow Hedge – Derivatives

designated as hedging instruments:

Commodity contracts $ 24 $ (5) $ 6 Cost of Sales $ (16) $ 25 $ (6)

Foreign exchange contracts (8) 9 1 Other Income/Expense 4 — 1

Total $ 16 $ 4 $ 7 $ (12) $ 25 $ (5)

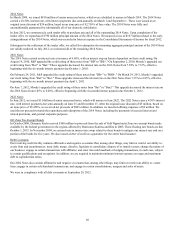

Fair value hedges

We designate certain futures contracts as fair value hedges of firm commitments to purchase livestock for slaughter. Our objective of

these hedges is to minimize the risk of changes in fair value created by fluctuations in commodity prices associated with fixed price

livestock firm commitments. We had the following aggregated notional values of outstanding forward contracts entered into to hedge

forecasted commodity purchases which are accounted for as a fair value hedge (in millions):

Metric September 29, 2012 October 1, 2011

Commodity:

Live Cattle Pounds 232 318

Lean Hogs Pounds 239 601

For these derivative instruments we designate and qualify as a fair value hedge, the gain or loss on the derivative, as well as the

offsetting gain or loss on the hedged item attributable to the hedged risk, are recognized in earnings in the same period. We include the

gain or loss on the hedged items (i.e., livestock purchase firm commitments) in the same line item, Cost of Sales, as the offsetting gain

or loss on the related livestock forward position.

in millions

Consolidated

Statements of Income

Classification 2012 2011 2010

Gain/(Loss) on forwards Cost of Sales $ 47 $ (78) $ (58)

Gain/(Loss) on purchase contract Cost of Sales (47) 78 58

Ineffectiveness related to our fair value hedges was not significant during fiscal 2012, 2011 and 2010.

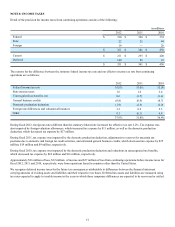

Foreign net investment hedges

We utilize forward foreign exchange contracts to protect the value of our net investments in certain foreign subsidiaries. For derivative

instruments that are designated and qualify as a hedge of a net investment in a foreign currency, the gain or loss is reported in OCI as

part of the cumulative translation adjustment to the extent it is effective, with the related amounts due to or from counterparties

included in other liabilities or other assets. We utilize the forward-rate method of assessing hedge effectiveness. Any ineffective

portions of net investment hedges are recognized in the Consolidated Statements of Income during the period of change.

Ineffectiveness related to our foreign net investment hedges was not significant during fiscal 2012, 2011 and 2010. At September 29,

2012, and October 1, 2011, we had $27 million and $35 million, respectively, aggregate outstanding notional values related to our

forward foreign currency contracts accounted for as foreign net investment hedges.

The following table sets forth the pretax impact of these derivative instruments on the Consolidated Statements of Income (in

millions):

Gain/(Loss)

Recognized in OCI

on Derivatives

Consolidated

Statements of Income

Classification

Gain/(Loss)

Reclassified from

OCI to Earnings

2012 2011 2010 2012 2011 2010

Net Investment Hedge – Derivatives

designated as hedging instruments:

Foreign exchange contracts $ (2) $ (2) $ (1) Other Income/Expense $ — $ — $ —