Tyson Foods 2012 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2012 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

59

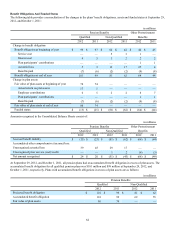

Assets and Liabilities Measured at Fair Value on a Recurring Basis

The fair value hierarchy requires the use of observable market data when available. In instances where the inputs used to measure fair

value fall into different levels of the fair value hierarchy, the fair value measurement has been determined based on the lowest level

input significant to the fair value measurement in its entirety. Our assessment of the significance of a particular item to the fair value

measurement in its entirety requires judgment, including the consideration of inputs specific to the asset or liability. The following

tables set forth by level within the fair value hierarchy our financial assets and liabilities accounted for at fair value on a recurring

basis according to the valuation techniques we used to determine their fair values (in millions):

September 29, 2012 Level 1 Level 2 Level 3 Netting (a) Total

Assets:

Commodity Derivatives $ — $ 53 $ — $ (40) $ 13

Foreign Exchange Forward Contracts — 1 — (1) —

Available for Sale Securities:

Debt securities — 27 86 — 113

Equity securities 6 1 — — 7

Deferred Compensation Assets 31 149 — — 180

Total Assets $ 37 $ 231 $ 86 $ (41) $ 313

Liabilities:

Commodity Derivatives $ — $ 102 $ — $ (100) $ 2

Foreign Exchange Forward Contracts — 3 — — 3

Interest Rate Swap —————

Total Liabilities $ — $ 105 $ — $ (100) $ 5

October 1, 2011 Level 1 Level 2 Level 3 Netting (a) Total

Assets:

Commodity Derivatives $ — $ 24 $ — $ (21) $ 3

Foreign Exchange Forward Contracts — 17 — (2) 15

Available for Sale Securities:

Debt securities — 34 83 — 117

Equity securities 7——— 7

Deferred Compensation Assets 28 122 — — 150

Total Assets $ 35 $ 197 $ 83 $ (23) $ 292

Liabilities:

Commodity Derivatives $ — $ 162 $ — $ (135) $ 27

Foreign Exchange Forward Contracts — 1 — (1) —

Interest Rate Swap — 2 — — 2

Total Liabilities $ — $ 165 $ — $ (136) $ 29

(a) Our derivative assets and liabilities are presented in our Consolidated Balance Sheets on a net basis. We net derivative assets

and liabilities, including cash collateral, when a legally enforceable master netting arrangement exists between the

counterparty to a derivative contract and us. At September 29, 2012, and October 1, 2011, we had posted with various

counterparties $59 million and $113 million, respectively, of cash collateral and held no cash collateral.