Tyson Foods 2012 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2012 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

58

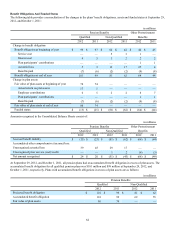

The following table sets forth the fair value of all derivative instruments outstanding in the Consolidated Balance Sheets (in millions):

Fair Value

2012 2011

Derivative Assets:

Derivatives designated as hedging instruments:

Commodity contracts $ 32 $ 3

Foreign exchange contracts — 12

Total derivative assets – designated 32 15

Derivatives not designated as hedging instruments:

Commodity contracts 21 21

Foreign exchange contracts 1 5

Total derivative assets – not designated 22 26

Total derivative assets $ 54 $ 41

Derivative Liabilities:

Derivatives designated as hedging instruments:

Commodity contracts $ 6 $ 41

Foreign exchange contracts 1 —

Total derivative liabilities – designated 7 41

Derivatives not designated as hedging instruments:

Commodity contracts 96 121

Foreign exchange contracts 2 1

Interest rate contracts — 2

Total derivative liabilities – not designated 98 124

Total derivative liabilities $ 105 $ 165

Our derivative assets and liabilities are presented in our Consolidated Balance Sheets on a net basis. We net derivative assets and

liabilities, including cash collateral when a legally enforceable master netting arrangement exists between the counterparty to a

derivative contract and us. See Note 12: Fair Value Measurements for a reconciliation to amounts reported in the Consolidated

Balance Sheets in Other current assets and Other current liabilities.

NOTE 12: FAIR VALUE MEASUREMENTS

Fair value is defined as the price that would be received to sell an asset or paid to transfer a liability (an exit price) in the principal or

most advantageous market for the asset or liability in an orderly transaction between market participants on the measurement date. The

fair value hierarchy contains three levels as follows:

Level 1 — Unadjusted quoted prices available in active markets for the identical assets or liabilities at the measurement date.

Level 2 — Other observable inputs available at the measurement date, other than quoted prices included in Level 1, either directly or

indirectly, including:

• Quoted prices for similar assets or liabilities in active markets;

• Quoted prices for identical or similar assets in non-active markets;

• Inputs other than quoted prices that are observable for the asset or liability; and

• Inputs derived principally from or corroborated by other observable market data.

Level 3 — Unobservable inputs that cannot be corroborated by observable market data and reflect the use of significant management

judgment. These values are generally determined using pricing models for which the assumptions utilize management’s estimates of

market participant assumptions.