Tyson Foods 2012 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2012 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

51

NOTE 8: INCOME TAXES

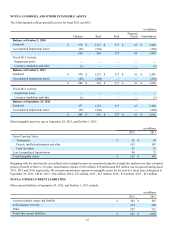

Detail of the provision for income taxes from continuing operations consists of the following:

in millions

2012 2011 2010

Federal $ 310 $ 320 $ 374

State 22 21 44

Foreign 19 — 20

$ 351 $ 341 $ 438

Current $ 211 $ 255 $ 420

Deferred 140 86 18

$ 351 $ 341 $ 438

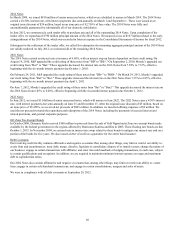

The reasons for the difference between the statutory federal income tax rate and our effective income tax rate from continuing

operations are as follows:

2012 2011 2010

Federal income tax rate 35.0% 35.0% 35.0%

State income taxes 1.6 1.6 2.4

Unrecognized tax benefits, net 0.6 (1.7) (1.4)

General business credits (0.8)(0.9) (0.7)

Domestic production deduction (1.9)(2.3) (2.0)

Foreign rate differences and valuation allowances 3.3 0.2 2.3

Other 0.1 (0.1) 0.8

37.9% 31.8% 36.4%

During fiscal 2012, foreign tax rates different than the statutory federal rate increased the effective tax rate 2.2%. Tax expense was

also impacted by foreign valuation allowances, which increased tax expense by $11 million, as well as the domestic production

deduction, which decreased tax expense by $17 million.

During fiscal 2011, tax expense was impacted by the domestic production deduction, adjustments to reserves for uncertain tax

positions due to domestic and foreign tax audit activities, and estimated general business credits, which decreased tax expense by $25

million, $19 million and $9 million, respectively.

During fiscal 2010, tax expense was impacted by the domestic production deduction and reductions in unrecognized tax benefits,

which decreased tax expense by $24 million and $16 million, respectively.

Approximately $36 million of loss, $32 million of income and $27 million of loss from continuing operations before income taxes for

fiscal 2012, 2011 and 2010, respectively, were from operations based in countries other than the United States.

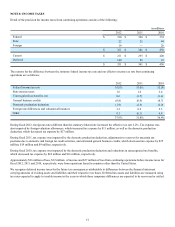

We recognize deferred income taxes for the future tax consequences attributable to differences between the financial statement

carrying amounts of existing assets and liabilities and their respective tax bases. Deferred tax assets and liabilities are measured using

tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled.