Tyson Foods 2012 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2012 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

46

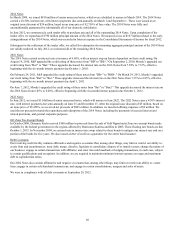

NOTE 2: CHANGES IN ACCOUNTING PRINCIPLES

In May 2011, the FASB clarified the guidance around fair value measurements and disclosures. This guidance is effective for interim

and annual periods beginning after December 15, 2011. We adopted this guidance in the second quarter of fiscal 2012. The adoption

did not have a significant impact on our consolidated financial statements.

In September 2011, the FASB issued guidance amending the way companies test for goodwill impairment, allowing the option to first

assess qualitative factors to determine whether it is necessary to perform the two-step quantitative impairment test. This guidance is

effective for interim and annual periods beginning after December 15, 2011, with early adoption permitted. We adopted the guidance

in connection with our annual goodwill impairment test in the fourth quarter of fiscal 2012. The adoption did not have a significant

impact on our consolidated financial statements.

In July 2012, the FASB issued guidance amending the way companies test for indefinite-lived intangible asset impairment, allowing

the option to first assess qualitative factors to determine whether it is necessary to perform the quantitative impairment test. This

guidance is effective for interim and annual periods beginning after September 15, 2012, with early adoption permitted. We adopted

the guidance in connection with our annual indefinite-lived intangible assets impairment test in the fourth quarter of fiscal 2012. The

adoption did not have a significant impact on our consolidated financial statements.

NOTE 3: ACQUISITIONS

In August 2009, we completed the establishment of related joint ventures in China referred to as Shandong Tyson Xinchang Foods

(currently referred to as Shandong Tyson). The aggregate purchase price for our 60% equity interest was $21 million, which excludes

$93 million of cash transferred to the joint venture for future capital needs. The purchase price included $29 million allocated to

Intangible Assets and $19 million allocated to Goodwill, as well as the assumption of $76 million of Current and Long-Term Debt. In

May 2011, the minority partner exercised put options requiring us to purchase its entire 40% equity interest. In August 2011, the

transaction closed for $66 million.

In October 2008, we acquired three vertically integrated poultry companies in southern Brazil: Macedo Agroindustrial, Avicola

Itaiopolis and Frangobras. The aggregate purchase price was $67 million. In addition, we had $15 million of contingent purchase price

based on production volumes. The purchase price included $23 million allocated to Goodwill and $19 million allocated to Intangible

Assets. Through fiscal 2012, we have paid $10 million of the contingent purchase price.

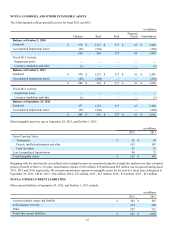

NOTE 4: PROPERTY, PLANT AND EQUIPMENT

Major categories of property, plant and equipment and accumulated depreciation at September 29, 2012, and October 1, 2011:

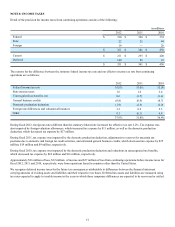

in millions

2012 2011

Land $ 101 $ 95

Building and leasehold improvements 2,868 2,698

Machinery and equipment 5,208 4,897

Land improvements and other 408 386

Buildings and equipment under construction 298 446

8,883 8,522

Less accumulated depreciation 4,861 4,699

Net property, plant and equipment $ 4,022 $ 3,823

Approximately $433 million will be required to complete buildings and equipment under construction at September 29, 2012.