Tyson Foods 2012 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2012 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

31

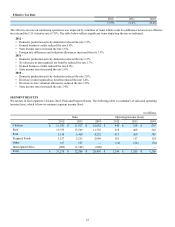

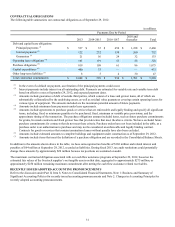

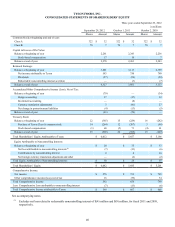

CONTRACTUAL OBLIGATIONS

The following table summarizes our contractual obligations as of September 29, 2012:

in millions

Payments Due by Period

2013 2014-2015 2016-1017 2018 and

thereafter Total

Debt and capital lease obligations:

Principal payments (1) $ 537 $ 35 $ 650 $ 1,238 $ 2,460

Interest payments (2) 122 232 138 260 752

Guarantees (3) 21 56 24 32 133

Operating lease obligations (4) 101 119 53 55 328

Purchase obligations (5) 819 109 61 86 1,075

Capital expenditures (6) 400 33 — — 433

Other long-term liabilities (7) 8 5 4 30 47

Total contractual commitments $ 2,008 $ 589 $ 930 $ 1,701 $ 5,228

(1) In the event of a default on payment, acceleration of the principal payments could occur.

(2) Interest payments include interest on all outstanding debt. Payments are estimated for variable rate and variable term debt

based on effective rates at September 29, 2012, and expected payment dates.

(3) Amounts include guarantees of debt of outside third parties, which consist of a lease and grower loans, all of which are

substantially collateralized by the underlying assets, as well as residual value guarantees covering certain operating leases for

various types of equipment. The amounts included are the maximum potential amount of future payments.

(4) Amounts include minimum lease payments under lease agreements.

(5) Amounts include agreements to purchase goods or services that are enforceable and legally binding and specify all significant

terms, including: fixed or minimum quantities to be purchased; fixed, minimum or variable price provisions; and the

approximate timing of the transaction. The purchase obligations amount included items, such as future purchase commitments

for grains, livestock contracts and fixed grower fees that provide terms that meet the above criteria. We have excluded future

purchase commitments for contracts that do not meet these criteria. Purchase orders have not been included in the table, as a

purchase order is an authorization to purchase and may not be considered an enforceable and legally binding contract.

Contracts for goods or services that contain termination clauses without penalty have also been excluded.

(6) Amounts include estimated amounts to complete buildings and equipment under construction as of September 29, 2012.

(7) Amounts include items that meet the definition of a purchase obligation and are recorded in the Consolidated Balance Sheets.

In addition to the amounts shown above in the table, we have unrecognized tax benefits of $168 million and related interest and

penalties of $64 million at September 29, 2012, recorded as liabilities. During fiscal 2013, tax audit resolutions could potentially

change these amounts by approximately $20 million because tax positions are sustained on audit.

The maximum contractual obligation associated with our cash flow assistance programs at September 29, 2012, based on the

estimated fair values of the livestock supplier’s net tangible assets on that date, aggregated to approximately $275 million, or

approximately $250 million remaining maximum commitment after netting the cash flow assistance related receivables.

RECENTLY ISSUED/ADOPTED ACCOUNTING PRONOUNCEMENTS

Refer to the discussion under Part II, Item 8, Notes to Consolidated Financial Statements, Note 1: Business and Summary of

Significant Accounting Policies for recently issued accounting pronouncements and Note 2: Changes in Accounting Principles for

recently adopted accounting pronouncements.