Tyson Foods 2004 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2004 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

54

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (CONTINUED)

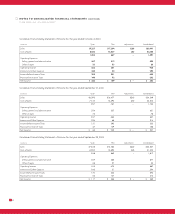

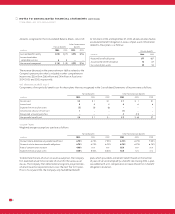

The following table summarizes cash payments for interest and

income taxes:

in millions 2004 2003 2002

Interest $316 $269 $208

Income taxes, net of refunds 244 36 90

Cash payments for interest in fiscal year 2004 increased, despite

lower debt levels, due to the timing of interest payments made

related to the senior notes caused by fiscal 2004 ending in October

rather than September. The increase in income taxes paid from

2003 to 2004 is due primarily to a refund received in fiscal 2003.

NOTE SEVENTEEN : TRANSACTIONS WITH RELATED PARTIES

The Company has operating leases for farms, equipment and other

facilities with Don Tyson, a director of the Company, certain members

of his family and the Randal W. Tyson Testamentary Trust. Total

payments of $8 million in 2004 and 2003, and $9 million in 2002,

were paid to entities in which these parties had an ownership inter-

est. Additionally, other facilities have been leased from other officers

and directors. Rentals paid to entities in which these parties had

an ownership interest totaled $1 million in 2004 and $2 million in

2003 and 2002.

A former director who resigned from the Board of Directors during

2003 received, from the sale of cattle to a subsidiary of the Company,

$10 million in fiscal years 2003 and 2002.

Certain officers and directors were engaged in chicken and swine

growout operations with the Company whereby these individuals

purchased animals, feed, housing and other items to raise the animals

to market weight. The total value of these transactions, which were

discontinued during fiscal 2003, amounted to $11 million in each fiscal

year of 2003 and 2002.

On May 21, 2004, the Company purchased a parcel of land adjacent

to the Company’s Corporate Center for approximately $356,000

from JHT, LLC, a limited liability company of which Don Tyson, a

director of the Company, and the Randal W. Tyson Testamentary

Trust are members. The purchase was approved by the Governance

Committee of the Board of Directors on April 29, 2004, and the land

is to be used for construction of facilities that will house expanded

product development kitchens, a new pilot production plant, provide

space for the consumer insights group and make provisions for

team member development activities.

In the second quarter of fiscal 2004, the Company purchased

1,028,577 shares of Class A stock in a private transaction with

Don Tyson, a director and managing partner of the Tyson Limited

Partnership, a principal shareholder of the Company. The purchase of

those shares from Mr. Tyson, which was approved by the Governance

Committee of the Board of Directors on January 29, 2004, was based

on the closing price of the Class A stock on the New York Stock

Exchange on the date of such approval.

During fiscal 2004, the Company received cash payments from

Don Tyson, a director of the Company, totaling approximately

$1.5 million, as reimbursement for certain perquisites and personal

benefits received during fiscal years 1997 through 2003.

NOTE EIGHTEEN : INCOME TAXES

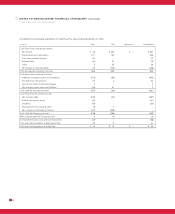

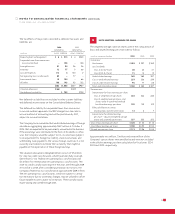

Detail of the provision for income taxes consists of:

in millions 2004 2003 2002

Federal $183 $156 $173

State 12 10 17

Foreign 37 20 20

$232 $186 $210

Current $224 $ 73 $188

Deferred 8113 22

$232 $186 $210

The reasons for the difference between the effective income tax

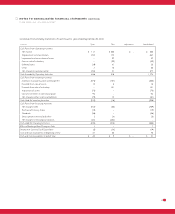

rate and the statutory U.S. federal income tax rate are as follows:

2004 2003 2002

U.S. federal income tax rate 35.0% 35.0% 35.0%

State income taxes 1.8 2.2 3.0

Extraterritorial income exclusion (0.5) (1.9) (1.4)

Other 0.3 0.2 (1.1)

36.6% 35.5% 35.5%

During the fourth quarter of fiscal 2004, the Company adjusted

the tax rates used to record deferred taxes at one of its Mexican

subsidiaries resulting in a reduction of deferred tax liabilities of

$16 million. This adjustment is included in “Other” in the above table

for fiscal 2004. Other items included in “Other” are miscellaneous

nondeductible expenses, general business credits and amounts

relating to on-going examinations by taxing authorities.

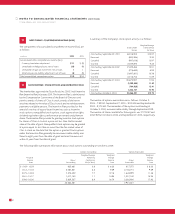

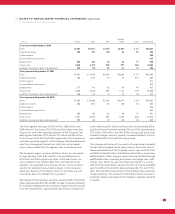

Deferred income taxes are recognized for the future tax consequences

attributable to differences between the financial statement carrying

amounts of existing assets and liabilities and their respective tax basis.

Deferred tax assets and liabilities are measured using tax rates

expected to apply to taxable income in the years in which those

temporary differences are expected to be recovered or settled.