Tyson Foods 2004 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2004 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

38

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (CONTINUED)

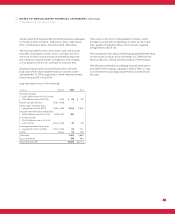

NOTE THREE : DISPOSITION

In September 2002, the Company completed the sale of its Specialty

Brands, Inc. subsidiary. The subsidiary had been acquired with the

TFM acquisition, and its results of operations were included in the

Company’s Prepared Foods segment. The Company received cash

proceeds of approximately $131 million, which were used to reduce

indebtedness, and recognized a pretax gain of $22 million, which

was included in other income on the Consolidated Statement of

Income of fiscal 2002.

NOTE FOUR : OTHER CHARGES

In the fourth quarter of fiscal 2004, the Company implemented a

control whereby all plant facilities conduct fixed asset inventories

on a recurring basis. As a result, the Company recorded fixed asset

write-down charges of approximately $21 million in the fourth quarter

of fiscal 2004, of which approximately $13 million was recorded in the

Chicken segment, $5 million in the Prepared Foods segment, $2 million

in the Beef segment and $1 million in the Pork segment. Additionally, as

discussed in Note 1, “Business and Summary of Significant Accounting

Policies,” the Company recorded $25 million related to the impairment

of various intangible assets.

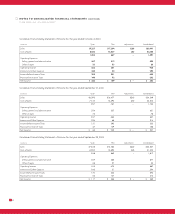

In February 2004, the Company announced its decision to consolidate

its manufacturing operations in Jackson, Mississippi, into the Company’s

Carthage, Mississippi, facility. The Company acquired the Carthage

facility when it purchased Choctaw Maid Farms in the fourth quarter

of fiscal 2003 and, since that time, performed a comprehensive

analysis of all operations in the area and determined this consolida-

tion would most effectively maintain the Company’s competitiveness

in its Mississippi operations. The Jackson location employed

approximately 800 people and was a poultry processing facility,

including processing and deboning operations. As a result of this

decision, the Company has recorded total costs of approximately

$9 million ($8 million in the second quarter of fiscal 2004 and

$1 million in the third quarter of fiscal 2004) that includes approxi-

mately $8 million of estimated impairment charges for assets to

be disposed of and $1 million of employee termination benefits.

The Company is accounting for the closing of the Jackson

operation in accordance with Statement of Financial Accounting

Standards No. 146, “Accounting for Costs Associated with Exit

or Disposal Activities” (SFAS No. 146) and Statement of Financial

Accounting Standards No. 144, “Accounting for the Impairment

or Disposal of Long-Lived Assets” (SFAS No. 144). This amount is

reflected in the Chicken segment as a reduction of operating

income and included in the Consolidated Statements of Income in

other charges. The Jackson location ceased operations in August 2004.

As of October 2, 2004, the Company had fully paid its estimated

termination benefits of $1 million.

In December 2003, the Company announced its decision to close

its Manchester, New Hampshire, and Augusta, Maine, Prepared Foods

operations to further improve long-term manufacturing efficiencies.

The Manchester operation employed approximately 550 people

and primarily produced sandwich meat for foodservice customers.

The Augusta facility employed approximately 170 people and

produced hot dogs, sausages, boneless hams and deli turkey products.

These locations ceased operations during the second quarter of

fiscal 2004. As a result of this decision, the Company recorded total

costs of $24 million ($21 million in the first quarter of fiscal 2004

and $3 million in the second quarter of fiscal 2004) that included

$4 million of costs related to closing the plants and $20 million of

estimated impairment charges for assets to be disposed. These

amounts are reflected in the Prepared Foods segment as a reduction

of operating income and included in the Consolidated Statements

of Income in other charges. The costs related to closing the plants

include $2 million of employee termination benefits and $2 million

of other plant closing related costs. The Company is accounting for

the closing of the Manchester and Augusta operations in accordance

with SFAS No. 146 and SFAS No. 144. At October 2, 2004, $2 million

related to employee termination benefits had been paid and

$2 million of other plant closing related costs had been paid.

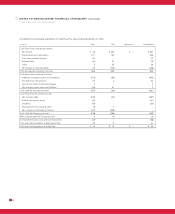

In April 2003, the Company announced its decision to close its

Berlin, Maryland, poultry operation. The Berlin poultry operation

employed approximately 650 people and included a hatchery, a

feed mill, live production and a processing facility. The facility ceased

processing chickens November 12, 2003. As a result of this decision,

the Company recorded total costs of $29 million ($4 million in the

first quarter of fiscal 2004 and $25 million in fiscal 2003) that included

$14 million related to closing the plant and $15 million of estimated

impairment charges for assets to be disposed. These amounts are

reflected in the Chicken segment as a reduction of operating income

and included in the Consolidated Statements of Income in other

charges. The costs related to closing the plant include $9 million for

estimated liabilities for the resolution of the Company’s obligations

under 209 grower contracts, and $5 million of other related costs

associated with the closing of the operation, including plant clean-up

costs and employee termination benefits. The Company is accounting