Tyson Foods 2004 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2004 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

53

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (CONTINUED)

The Company has four postretirement health plans. Two of these

consist of fixed, annual payments by the Company and account for

$36 million of the Company’s postretirement medical obligation at

October 2, 2004. A healthcare cost trend is not required to determine

this obligation. A third plan has a negotiated annual maximum payment

by the Company and accounts for $12 million of the Company’s post-

retirement medical obligation at October 2, 2004. Claims in excess

of the Company’s negotiated annual maximum payment are paid by

the plan participants. Since current medical claims exceed the annual

maximum cap for this plan, the liability was calculated assuming that

annual claims will be equal to the total annual maximum cap for all

future years. A healthcare cost trend is not required to determine

this obligation. The fourth plan, which accounts for $18 million of

the Company’s postretirement medical obligation at year end, uses

a healthcare cost trend of 9% in the current year that grades down

to 5% in fiscal year 2009. Assumed healthcare cost trend rates have

a significant effect on the amounts reported for this healthcare plan.

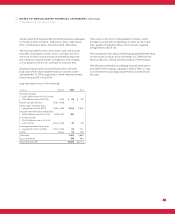

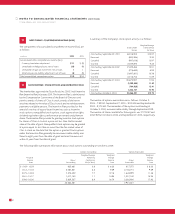

A one-percentage-point change in assumed healthcare cost trend

rates would have the following effects:

One-Percentage- One-Percentage-

in millions Point Increase Point Decrease

Effect on total of service and interest cost $1 $–

Effect on postretirement benefit obligation 18 14

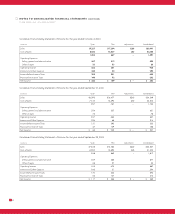

The fair value of plan assets for the Company’s pension benefit

plans was $59 million and $50 million as of October 2, 2004, and

September 27, 2003, respectively. The following table sets forth

the actual and target asset allocation for the Company’s pension

plan assets:

Target Asset

2004 2003 Allocation

Cash 0.8% 6.1% 0.0%

Fixed income securities 24.7% 26.7% 25.0%

US Stock Funds–Large- and Mid-Cap 49.6% 31.5% 50.0%

US Stock Funds–Small-Cap 10.0% 16.8% 10.0%

International Stock Funds 14.9% 18.9% 15.0%

Total 100.0% 100.0% 100.0%

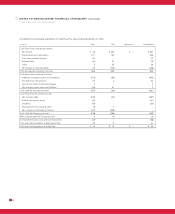

The Plan Trustees have established a set of investment objectives

related to the assets of the pension plans and regularly monitor the

performance of the funds and portfolio managers. Objectives for

the pension assets are (1) to provide growth of capital and income,

(2) to achieve a target weighted average annual rate of return that

is competitive with other funds with similar investment objectives

and (3) to diversify in order to reduce risk. The investment objec-

tives and target asset allocation were updated in January 2004.

The Company’s policy is to fund at least the minimum contribution

required to meet applicable federal employee benefit and local tax

laws. In its sole discretion, the Company may from time to time

fund additional amounts. Expected contributions to the Company’s

pension plans for fiscal year 2005 are approximately $9 million. For

the fiscal years ended 2004, 2003 and 2002, the Company funded

$9 million, $4 million and $5 million, respectively, to its defined

benefit plans.

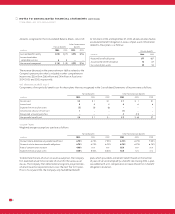

The following benefit payments are expected to be paid:

Other

Pension Postretirement

in millions Benefits Benefits

2005 $6 $6

2006 66

2007 66

2008 66

2009 66

2010–2014 30 29

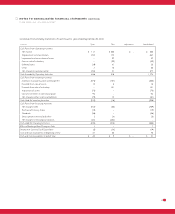

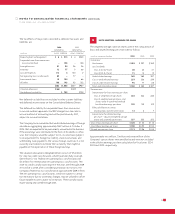

NOTE SIXTEEN : SUPPLEMENTAL CASH FLOW INFORMATION

The following non-cash transaction was excluded from the

Consolidated Statements of Cash Flows for fiscal year 2004. The

$91 million change in goodwill in fiscal 2004 from the September 27,

2003, balance and the corresponding change in other current liabilities

is due to an adjustment of pre-acquisition tax liabilities assumed as

part of the TFM acquisition. The Company received formal approval

during fiscal 2004 from The Joint Committee on Taxation of the

U.S. Congress for issues relating to certain pre-acquisition years. As

a result of this approval, the accrual of $91 million of pre-acquisition

tax liability was no longer needed.