Tyson Foods 2004 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2004 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

24

MANAGEMENT’S DISCUSSION AND ANALYSIS (CONTINUED)

Total debt at October 2, 2004, was $3.4 billion, a decrease of

$242 million from September 27, 2003. The Company has unsecured

revolving credit facilities totaling $1 billion that support the Company’s

commercial paper program, letters of credit and other short-term

funding needs. During the third quarter of fiscal 2004, the Company

restructured and extended its revolving credit facilities. These $1 billion

in facilities now consist of $250 million that expire in September 2006

and $750 million that expire in June 2009. At October 2, 2004, there

were no borrowings outstanding under these facilities. Outstanding

debt at October 2, 2004, consisted of $2.8 billion of debt securities,

$300 million under the receivables purchase agreement, $86 million

of commercial paper and other indebtedness of $160 million.

The revolving credit facilities, senior notes, notes and accounts

receivable securitization contain various covenants, the more

restrictive of which contain a maximum allowed leverage ratio

and a minimum required interest coverage ratio. The Company

is in compliance with all of its covenants at fiscal year end.

The Company does not have any off-balance sheet arrangements

that are material to its financial position or results of operations. The

off-balance sheet arrangements the Company has are guarantees

of debt of outside third parties involving a lease, grower loans and

residual value guarantees covering certain operating leases for various

types of equipment. See Note 10 to the Consolidated Financial

Statements for further discussions of these guarantees.

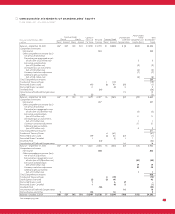

The following table summarizes the Company’s contractual obligations

as of October 2, 2004:

Payments Due by Period

Less Than One to Three to More Than

in millions One Year Three Years Five Years Five Years Total

Debt and capital

lease obligations:

Principal payments(1) $ 338 $1,309 $105 $1,610 $3,362

Interest payments(2) 213 297 295 456 1,261

Guarantees(3) 2324855

Operating lease

obligations(4) 63 68 25 2 158

Purchase obligations(5) 220 58 4 5 287

Capital expenditures(6) 347 121 24 – 492

Other long-term

liabilities(7) 4975070

Total contractual

commitments $1,187 $1,865 $462 $2,171 $5,685

(1) In the event of a default on payment or violation of debt covenants, acceleration of the

principal payments would occur. At October 2, 2004, the Company was in compliance

with all of its debt covenants.

(2) Interest payments include only interest payments on fixed-rate and fixed-term debt,

based on the expected payment dates. The Company has other interest obligations

on variable-rate, non-term debt; however, these obligations have been excluded, as

the timing of payments and expected interest rates cannot be reasonably estimated.

(3) Amounts included are for the guarantees of outside third parties, which involve a lease

and grower loans, all of which are substantially collateralized by the underlying assets.

The amounts included are the maximum potential amount of future payments.

(4) Amounts included in operating lease obligations are minimum lease payments under

lease agreements, as well as residual guarantee amounts.

(5) Amounts included in purchase obligations are agreements to purchase goods or services

that are enforceable and legally binding on the Company that specifies all significant

terms, including: fixed or minimum quantities to be purchased; fixed, minimum or variable

price provisions; and the approximate timing of the transaction. Included in the purchase

obligations amount are future purchase commitments for corn, soybeans, livestock

and natural gas contracts that provide terms that meet the above criteria. The Company

has excluded future purchase commitments for contracts that do not meet these

criteria. Purchase orders have not been included in the table, as a purchase order is an

authorization to purchase and is not considered an enforceable and legally binding

contract. Contracts for goods or services that contain termination clauses without

penalty have also been excluded.

(6) Amounts included in capital expenditures are estimated amounts to complete

construction projects in progress as of October 2, 2004.

(7) Amounts included in other long-term liabilities are items that meet the definition of a

purchase obligation and are recorded in the Company’s Consolidated Balance Sheets.

TOTAL

CAPITALIZATION

Debt

■Equity

DOLLARS IN MILLIONS

3,662

3,954

4,292

3,362 3,604 3,987

2004 2003 2002