Tyson Foods 2004 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2004 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

51

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (CONTINUED)

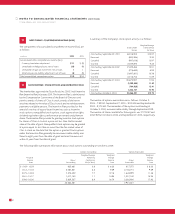

The weighted average fair value of options granted during 2004 was

approximately $5.99. The fair value of each option grant is established

on the date of grant using the Black-Scholes option-pricing model.

Assumptions include an expected life ranging from five to six years,

risk-free interest rate ranging from 3.09% to 3.27%, expected volatility

ranging from 37.7% to 40.1% and dividend yield of 1.00%.

At October 2, 2004, the Company had outstanding approximately

eight million restricted shares of Class A stock with restrictions

expiring over periods through July 1, 2020. The unearned portion

of the restricted stock is classified on the Consolidated Balance

Sheets as unamortized deferred compensation in shareholders’

equity. The Company issues restricted stock at the market value as

of the date of grant. The weighted average fair value of restricted

stock granted was $15.69 per share during 2004 and $11.20 per share

during 2003.

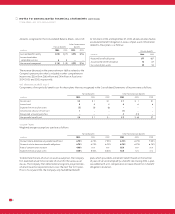

NOTE FOURTEEN : DEFERRED COMPENSATION

In July 2003, the Compensation Committee authorized the Company

to award performance-based shares of the Company’s Class A stock to

certain senior executive officers on the first business day of each

of the Company’s 2004, 2005 and 2006 fiscal years having an initial

maximum aggregate value of $4.4 million on the date of each award.

The vesting of the performance-based shares for the 2004 and 2005

awards is over three years, and the vesting of the 2006 award is over

two and one-half years (the Vesting Period), each award being subject

to the attainment of Company goals determined by the Compensation

Committee prior to the date of the award. Each quarter during the

Vesting Period, the Company reviews progress toward attainment

of Company goals and determines if it is appropriate to record any

adjustment to the deferred compensation liability for the antici-

pated vesting of the shares. The attainment of Company goals can

be finally determined only at the end of the Vesting Period. If the

shares vest, the ultimate expense to the Company recognized over

the Vesting Period will be equal to the Class A stock price on the

date the shares vest times the number of shares awarded.

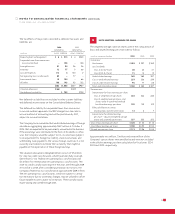

NOTE FIFTEEN : PENSIONS AND

OTHER POSTRETIREMENT BENEFITS

The Company has both funded and unfunded noncontributory

defined benefit pension plans covering specific groups of employees.

Two plans provide benefits based on a formula using years of service

and a specified benefit rate. Effective January 1, 2004, the Company

implemented a new defined benefit plan for certain contracted

officers that uses a formula based on years of service and final average

salary. The Company also has other postretirement benefit plans

for which substantially all of its employees may receive benefits

if they satisfy applicable eligibility criteria. The postretirement

healthcare plans are contributory with participants’ contributions

adjusted when deemed necessary.

The Company has defined contribution retirement and incentive

benefit programs for various groups of Company personnel.

Company contributions totaled $55 million, $48 million and

$50 million in 2004, 2003 and 2002, respectively.

The Company uses a September 30 measurement date for its

defined benefit plans and one postretirement medical plan and

a July 31 measurement date for its remaining postretirement

medical plans.

Other postretirement benefits include postretirement medical

costs and life insurance.

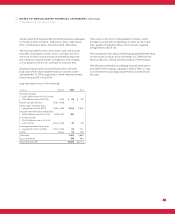

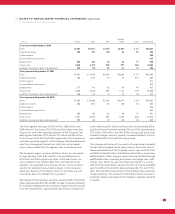

The following table provides a reconciliation of the changes in the

plans’ benefit obligations, assets and funded status as of fiscal year

ends October 2, 2004, and September 27, 2003:

Other Postretirement

Pension Benefits Benefits

in millions 2004 2003 2004 2003

Change in benefit obligation

Benefit obligation

at beginning of year $67 $70 $66 $91

Service cost 3111

Interest cost 5446

Plan participants’ contributions ––32

Amendments 9––(10)

Actuarial (gain)/loss (1) (2) 5(13)

Benefits paid (6) (6) (13) (11)

Benefit obligation at end of year 77 67 66 66

Change in plan assets

Fair value of plan assets

at beginning of year 50 43 ––

Actual return on plan assets 69––

Employer contributions 9410 9

Plan participants’ contributions ––32

Benefits paid (6) (6) (13) (11)

Fair value of plan assets

at end of year 59 50 ––

Funded status (18) (17) (66) (66)

Amounts not yet recognized:

Unrecognized prior service cost 8–(9) (10)

Unrecognized actuarial loss 68––

Net amount recognized $(4) $(9) $(75) $(76)