Tyson Foods 2004 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2004 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

23

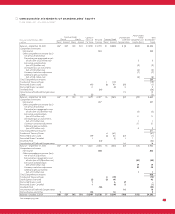

MANAGEMENT’S DISCUSSION AND ANALYSIS (CONTINUED)

In September 2003, the Company purchased Choctaw Maid Farms,

Inc. (Choctaw), an integrated poultry processor. Since 1992, Tyson had

been purchasing all of Choctaw’s production under a “cost plus”

supply agreement, which was scheduled to expire in 2007. The

Company had previously negotiated a purchase option with Choctaw’s

owners, which initially became exercisable in 2002. The Company

decided to exercise its purchase option rather than continue under

the “cost plus” arrangement of the supply agreement. The acquisition

was recorded as a purchase in accordance with Statement of Financial

Accounting Standards No. 141, “Business Combinations” (SFAS No. 141).

Accordingly, the assets and liabilities were adjusted for fair values

with the remainder of the purchase price, $18 million, recorded as

goodwill. The purchase price consisted of $1 million cash to exercise

the purchase option in Tyson’s supply agreement with Choctaw and

the settlement of $85 million owed to Tyson by Choctaw. In addi-

tion, the Company assumed approximately $4 million of Choctaw’s

debt to a third party. In June 2003, the Company exercised a

$74 million purchase option to acquire assets leased from a third

party which the Company had subleased to Choctaw. Pro forma

operating results reflecting the acquisition of Choctaw would not be

materially different from the Company’s actual results of operations.

In May 2002, the Company acquired the assets of Millard Processing

Services, a bacon processing operation, for approximately $73 million

in cash. The acquisition was accounted for as a purchase, and goodwill

of approximately $14 million was recorded.

In September 2002, the Company completed the sale of its Specialty

Brands, Inc. subsidiary. The subsidiary had been acquired with the

TFM acquisition, and its results of operations were included in the

Company’s Prepared Foods segment. The Company received cash

proceeds of approximately $131 million, which were used to reduce

indebtedness, and recognized a pretax gain of $22 million. Specialty

Brands, Inc.’s sales and operating income for the year ended

September 28, 2002, were $244 million and $2 million, respectively.

Cash provided by operations continues to be the Company’s primary

source of funds to finance operating requirements and capital

expenditures. In 2004, net cash of $932 million was provided by

operating activities, up $112 million from 2003. The increase from

fiscal 2003 primarily is due to the increase of $98 million from net

income, excluding the non-cash effect of depreciation and amorti-

zation. The Company’s foreseeable cash needs for operations growth

and capital expenditures are expected to continue to be met through

cash flows provided by operating activities. Additionally, at October 2,

2004, the Company had borrowing capacity of $1.1 billion consisting

of $640 million available under its $1 billion unsecured revolving

credit facilities and $450 million under its accounts receivable secu-

ritization. At October 2, 2004, the Company had construction projects

in progress that will require approximately $492 million to complete.

Capital spending for fiscal 2005 is expected to be in the range of

$600 to $680 million, which reflects additional spending for a third

fully dedicated case-ready plant, a new Corporate Center and a

variety of projects that will increase automation and support value-

added product growth. The Company continues to evaluate potential

international and domestic growth opportunities.

CASH

PROVIDED

BY OPERATING

ACTIVITIES

DOLLARS IN MILLIONS

1,174

820

932

2004 2003 2002