Tyson Foods 2004 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2004 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

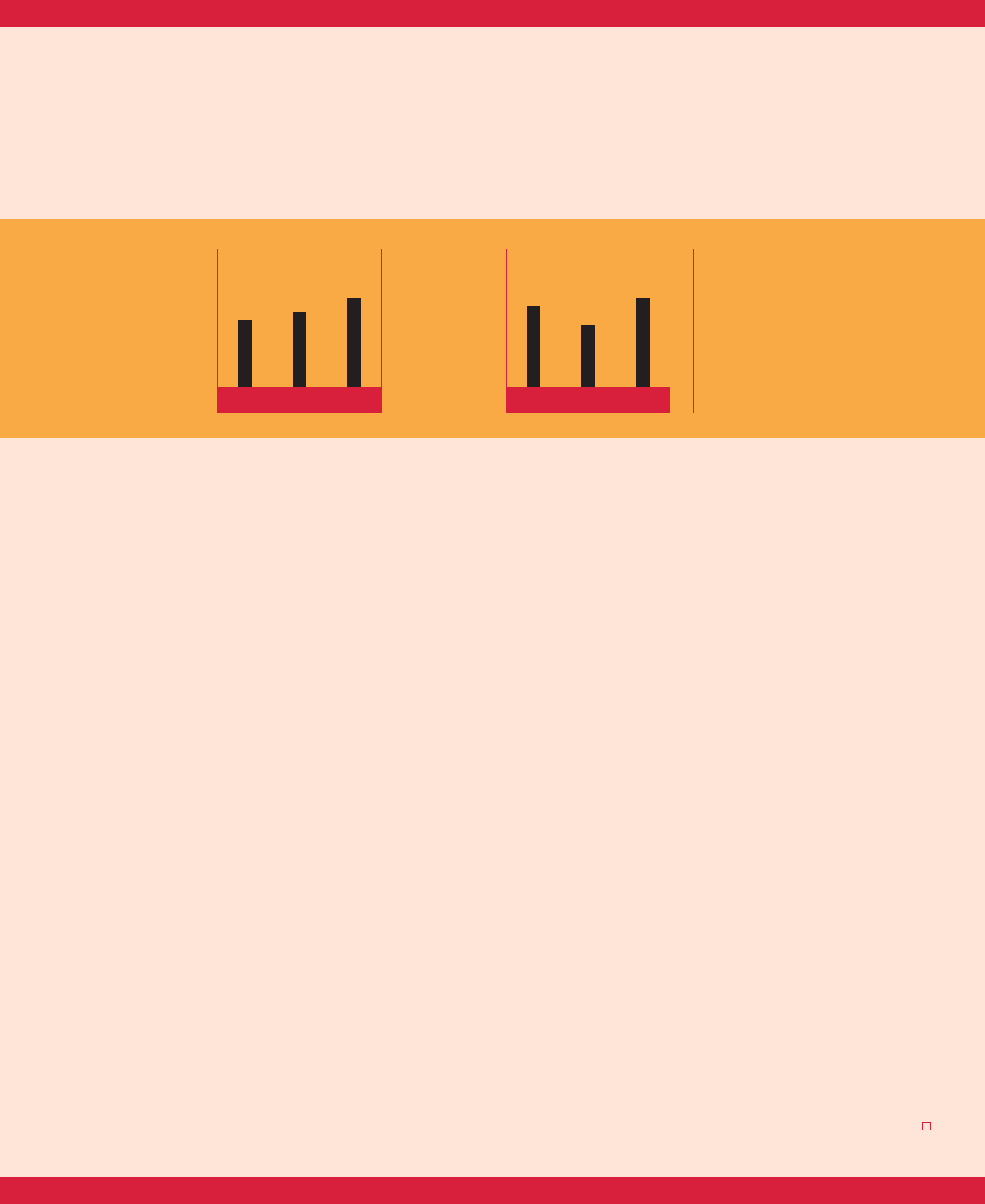

23.4 24.5

26.4

SALES

DOLLARS IN BILLIONS

1.08

0.96

1.13

EARNINGS

PER SHARE

DOLLARS

3

2002 2003 2004 2002 2003 2004

Tyson Foods reported

record sales and

earnings in 2004.

Reported diluted earnings per share (EPS) were $1.13

compared to $0.96 last year, an 18 percent increase.

Our long-term goal is to achieve average double-digit

EPS growth. Sales were $26.4 billion in 2004 compared

to $24.5 billion in 2003. Strong cash flow allowed

us to pay down debt by $242 million this year and

$1.5 billion since August 2001. One of the goals we set

for fiscal 2004 was to achieve a debt-to-capital ratio of

45 percent in 12 to 18 months. Not only did we achieve

our goal within 12 months, we exceeded it by reaching

44 percent at year’s end. Our new debt-to-capital goal

for 2005 is 40 percent.

Our return on invested capital (ROIC) was 12.2 percent,

up from 11.0 percent last year.* Our ROIC goal for 2005 is

14 percent. Our stock price finished the year 18 percent

higher than 2003 and outperformed the S&P 500 over

the three-year period from fiscal 2002 to fiscal 2004.

* Adjusted ROIC increased from 9.9 percent in 2003 to 14.1 percent in 2004.

Fiscal 2003 adjustments included costs related to plant closings, amounts

received in connection with vitamin antitrust litigation and impairment of

an equity interest in a live swine operation. Fiscal 2004 ROIC adjustments

included costs related to plant closings, BSE-related charges, fixed asset

write-downs and impairment of various intangible assets.

We set a goal to increase the percentage of sales of

value-added products to 50 percent over the next five

years. We finished 2004 at 38 percent value-added, and

our goal for 2005 is 40 percent. Our company developed

400 new products this fiscal year to meet the changing

needs of customers and consumers. However, adding

value means more to us than creating new, higher margin

products. Value also is providing a set of services to our

customers and consumers. Service is what separates us

from our competition.

We are creating value and growth by filling in the gaps

in our current product offerings, by creating new and

innovative products to expand existing categories and by

creating new categories. We are focused on penetrating

markets for these products as well as the hundreds of

products we introduced in 2003.

We are the leading product innovator in our industry.

I believe emphasizing innovation will bring great new

products to the consumer, increase value for our