Tyson Foods 2004 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2004 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

42

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (CONTINUED)

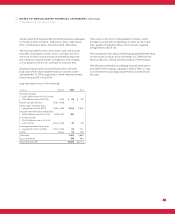

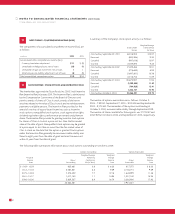

NOTE TEN : COMMITMENTS

The Company leases certain farms and other properties and equipment

for which the total rentals thereon approximated $111 million in 2004,

$104 million in 2003 and $105 million in 2002. Most leases have terms

ranging from one to seven years with varying renewal periods. The

most significant obligations assumed under the terms of the leases

are the upkeep of the facilities and payments of insurance and

property taxes.

Minimum lease commitments under non-cancelable leases at

October 2, 2004, totaled $158 million composed of $63 million for

fiscal 2005, $39 million for fiscal 2006, $29 million for fiscal 2007,

$16 million for fiscal 2008, $9 million for fiscal 2009 and $2 million

for later years.

The Company guarantees debt of outside third parties, which involve

a lease and grower loans, all of which are substantially collateralized

by the underlying assets. Terms of the underlying debt range from

seven to 11 years and the maximum potential amount of future

payments as of October 2, 2004, was $55 million. The Company also

maintains operating leases for various types of equipment, some of

which contain residual value guarantees for the market value for assets

at the end of the term of the lease. The terms of the lease maturities

range from one to seven years. The maximum potential amount of

the residual value guarantees is approximately $110 million, of which

approximately $28 million would be recoverable through various

recourse provisions and an undeterminable recoverable amount

based on the fair market value of the underlying leased assets. The

likelihood of payments under these guarantees is not considered

probable. At October 2, 2004, and September 27, 2003, no liabilities

for guarantees were recorded.

Additionally, the Company also enters into future purchase

commitments for various items such as corn, soybeans, livestock

and natural gas contracts. At October 2, 2004, the commitments

totaled $287 million, composed of $220 million for fiscal 2005,

$50 million for fiscal 2006, $8 million for fiscal 2007, $2 million for

fiscal 2008, $2 million for fiscal 2009 and $5 million for later years.

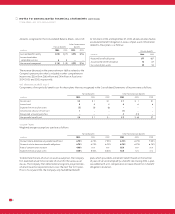

NOTE ELEVEN : LONG-TERM DEBT

The Company has unsecured revolving credit facilities totaling $1 billion

that support the Company’s commercial paper program, letters of

credit and other short-term funding needs. During the third quarter

of fiscal 2004, the Company restructured and extended its revolving

credit facilities. These facilities now consist of $250 million that

expire in September 2006 and $750 million that expire in June 2009.

At October 2, 2004, the Company had outstanding letters of credit

totaling approximately $274 million issued primarily in support of

workers’ compensation insurance programs, derivative activities and

leveraged equipment loans. There were no draw downs under these

letters of credit at October 2, 2004. At October 2, 2004, and

September 27, 2003, there were no amounts drawn under the

revolving credit facilities; however, the outstanding letters of credit

reduce the amount available under the revolving credit facilities.

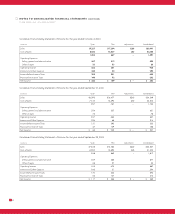

The Company has a receivables purchase agreement with three

co-purchasers to sell up to $750 million of trade receivables. These

agreements were restructured and extended in the fourth quarter of

fiscal 2004 and now consist of $375 million expiring in August 2005,

and $375 million expiring in August 2007. The receivables purchase

agreement has been accounted for as a borrowing and has an interest

rate based on commercial paper issued by the co-purchasers. Under

this agreement, substantially all of the Company’s accounts receivable

are sold to a special purpose entity, Tyson Receivables Corporation

(TRC), which is a wholly-owned consolidated subsidiary of the

Company. TRC has its own separate creditors that are entitled to be

satisfied out of all of the assets of TRC prior to any value becoming

available to the Company as TRC’s equity holder. At October 2, 2004,

there was $150 million outstanding under the receivables purchase

agreement expiring in August 2005 and $150 million under the agree-

ment expiring August 2007, while at September 27, 2003, there was

no outstanding balance.

Under the terms of the leveraged equipment loans, the Company had

cash deposits totaling approximately $57 million, which was included

in other assets at October 2, 2004. Under these leveraged loan agree-

ments, the Company entered into interest rate swap agreements to

effectively lock in a fixed interest rate for these borrowings.