Tyson Foods 2004 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2004 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

37

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (CONTINUED)

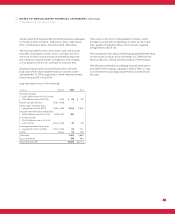

In December 2003, the FASB revised Statement of Financial Accounting

Standards No. 132, “Employers’ Disclosures about Pensions and Other

Postretirement Benefits” (SFAS No. 132). The revision of SFAS No. 132

requires expanded disclosures for defined benefit plans. The standard’s

revisions are effective for fiscal years ending after December 15, 2003,

and for interim periods beginning after December 15, 2003. See

Note 15 to the Consolidated Financial Statements for pensions and

other postretirement benefits disclosures.

In December 2003, the Medicare Prescription Drug, Improvement

and Modernization Act of 2003 (the Act) was signed. The Act allows

a possible subsidy to retirement health plan sponsors to help offset

the costs of participant prescription drug benefits. In March 2004, the

FASB issued Staff Position No. 106-2, “Accounting and Disclosure

Requirements Related to the Act” (the Position). The Position is effec-

tive for interim or annual periods beginning after June 15, 2004. The

Position allows plan sponsors to recognize or defer recognizing

the effects of the Act in its financial statements. Specific accounting

guidance for this federal subsidy is pending and, when issued, could

require the Company to change previously reported information.

The Company’s accumulated postretirement benefit obligation and

net periodic pension cost do not reflect the effects of the Act.

The Company has elected to defer accounting for the Act and has

estimated any future effect on its consolidated financial statements

will not be material.

In January 2003, the FASB issued Interpretation No. 46, “Consolidation

of Variable Interest Entities, an Interpretation of Accounting

Research Bulletin No. 51” (the Interpretation). The Interpretation

requires the consolidation of variable interest entities (VIE) in which

an enterprise absorbs a majority of the entity’s expected losses,

receives a majority of the entity’s expected residual returns, or both,

as a result of ownership, contractual or other financial interests in

the entity. Previously, entities were generally consolidated by an

enterprise that had a controlling financial interest through ownership

of a majority voting interest in the entity. In December 2003, the FASB

issued a revision of the Interpretation (the Revised Interpretation 46).

Revised Interpretation 46 codifies both the proposed modifications

and other decisions previously issued through certain FASB Staff

Positions and supersedes the original Interpretation to include:

(1) deferring the effective date of the Interpretation’s provisions for

certain variable interests, (2) providing additional scope exceptions

for certain other variable interests, (3) clarifying the impact of

troubled debt restructurings on the requirement to reconsider

(a) whether an entity is a VIE or (b) which party is the primary

beneficiary of a VIE, and (4) revising Appendix B of the original

Interpretation to provide additional guidance on what constitutes

a variable interest. Under the new guidance, application of the Revised

Interpretation 46 is required in financial statements of public entities

that have interests in structures that are commonly referred to as

special-purpose entities for periods ending after December 15, 2003,

and for all other types of variable interest entities is required in

financial statements for periods ending after March 15, 2004. The

Company’s adoption of Revised Interpretation 46 did not have a

material impact on its consolidated financial statements.

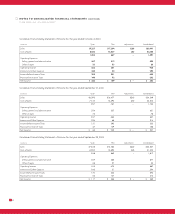

NOTE TWO : ACQUISITIONS

In September 2003, the Company purchased Choctaw Maid Farms, Inc.

(Choctaw), an integrated poultry processor. Since 1992, Tyson had

been purchasing all of Choctaw’s production under a “cost plus”

supply agreement, which was scheduled to expire in 2007. The

Company had previously negotiated a purchase option with Choctaw’s

owners, which initially became exercisable in 2002. The Company

decided to exercise its purchase option rather than continue under

the “cost plus” arrangement of the supply agreement. The acquisi-

tion was recorded as a purchase in accordance with Statement of

Financial Accounting Standards No. 141, “Business Combinations.”

Accordingly, the assets and liabilities were adjusted for fair values

with the remainder of the purchase price, $18 million, recorded as

goodwill. The purchase price consisted of $1 million cash to exer-

cise the purchase option in Tyson’s supply agreement with Choctaw

and settlement of $85 million owed to Tyson by Choctaw. In addi-

tion the Company assumed approximately $4 million of Choctaw’s

debt to a third party. In June 2003, the Company exercised a

$74 million purchase option to acquire assets leased from a third

party, which the Company had subleased to Choctaw. Pro forma

operating results reflecting the acquisition of Choctaw would

not be materially different from the Company’s actual results of

operations. During 2004, goodwill was reduced $3 million due to

an adjustment of pre-acquisition liabilities assumed as part of the

Choctaw acquisition.

In May 2002, the Company acquired the assets of Millard Processing

Services, a bacon processing operation, for approximately $73 million

in cash. The acquisition was accounted for as a purchase and goodwill

of approximately $14 million was recorded.