Tyson Foods 2004 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2004 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

22

MANAGEMENT’S DISCUSSION AND ANALYSIS (CONTINUED)

increased $29 million, primarily resulting from the

$10 million write-down related to the impairment of an equity

interest in a live swine operation recorded in fiscal 2003, and the

gain of $22 million from the sale of the Specialty Brands, Inc.

subsidiary recorded in fiscal 2002.

was 35.5% in both 2003 and 2002. Several factors

impacted the effective tax rate including average state income tax

rates, the tax rates for international operations and the ETI for foreign

sales. Taxes on international earnings were comparable for 2003 and

2002. Average state taxes added 2.2% and 3.0% to the effective tax

rate for 2003 compared to 2002, and ETI reduced the effective rate

by 1.9% in 2003 compared to a 1.4% reduction in 2002.

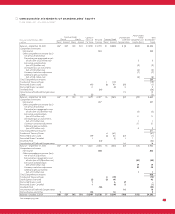

Sales by Segment

Volume Avg. Price

in millions 2003 2002 Change Change Change

Chicken $ 7,427 $ 7,222 $ 205 3.3% (0.4)%

Beef 11,935 10,488 1,447 0.5% 13.2%

Pork 2,470 2,503 (33) (4.1)% 2.9%

Prepared Foods 2,662 3,072 (410) (8.0)% (5.9)%

Other 55 82 (27) N/A N/A

Total $24,549 $23,367 $1,182 0.1% 5.0%

Operating Income by Segment

Margin Margin

in millions 2003 2002 Change 2003 2002

Chicken $158 $428 $(270) 2.1% 5.9%

Beef 320 220 100 2.7% 2.1%

Pork 75 25 50 3.0% 1.0%

Prepared Foods 57 158 (101) 2.1% 5.1%

Other 227 56 171 N/A N/A

Total $837 $887 $ (50) 3.4% 3.8%

sales increased 2.8% compared to fiscal 2002.

Foodservice chicken sales increased 4.2%, retail chicken sales increased

2.3% and international chicken sales decreased 3.6%. Excluding plant

closing costs of $76 million recorded in fiscal 2003, operating income

decreased $194 million. This decrease results primarily from higher

grain costs as compared to fiscal 2002.

sales increased 13.8% compared to fiscal 2002.

Domestic fresh meat beef sales increased 11.8%, international beef

sales increased 19.4% and case-ready beef sales increased 20.4%.

Beef segment operating income increased $100 million. The Beef

segment sales and operating income increases were caused by

strong demand during the second half of fiscal 2003 caused in part

by the U.S. ban on Canadian beef. However, these increases were

partially offset by an increase in live cattle prices.

sales decreased 1.3% compared to fiscal 2002. Domestic

fresh meat pork sales decreased 3.5%, international pork sales increased

2.8%, case-ready pork sales increased 52.3% and live swine sales

decreased 42.6%. Excluding the fourth quarter 2002 live swine

restructuring charge of $26 million, operating income increased

$24 million. The decline in sales primarily is due to a reduction in

live swine sales as a result of the fiscal 2002 live swine restructuring

and lower average selling prices for our finished product. Operating

income was positively affected by the restructuring of the live

swine operation, partially offset by higher live hog prices.

sales decreased 13.4% compared to fiscal

2002. Excluding fiscal 2002 Specialty Brands, Inc. sales of $244 million,

segment sales decreased $166 million and 5.9% and volume declined

slightly. Segment operating income decreased $128 million excluding

the Thomas E. Wilson brand write-down of $27 million recorded in

fiscal 2002. This decrease results primarily from the increases in raw

material prices, lower average selling prices, increased costs related

to the introduction of more than 75 new products in fiscal 2003 and

temporary operating inefficiencies at certain plants.

operating income increased $171 million primarily due

to settlements received in connection with vitamin antitrust litigation.

Fiscal 2003 operating income includes $167 million as compared to

$30 million received in fiscal 2002. Additionally, operating income

was positively affected by actuarial gains recorded in fiscal 2003 of

$13 million resulting from certain retiree medical benefit plans.