Tyson Foods 2004 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2004 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

52

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (CONTINUED)

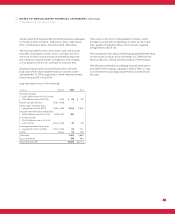

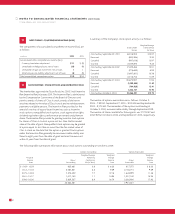

Amounts recognized in the Consolidated Balance Sheets consist of:

Other Postretirement

Pension Benefits Benefits

in millions 2004 2003 2004 2003

Accrued benefit liability $(10) $(17) $(75) $(76)

Accumulated other

comprehensive loss 68––

Net amount recognized $(4) $(9) $(75) $(76)

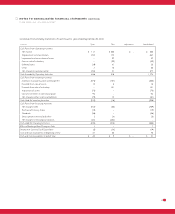

The increase (decrease) in the pretax minimum liability related to the

Company’s pension plans that is included in other comprehensive

income was $(2) million, $(6) million and $14 million in fiscal years

2004, 2003 and 2002, respectively.

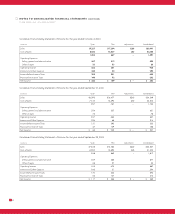

At October 2, 2004, and September 27, 2003, all pension plans had an

accumulated benefit obligation in excess of plan assets. Information

related to these plans is as follows:

Pension Benefits

in millions 2004 2003

Projected benefit obligation $77 $67

Accumulated benefit obligation 76 67

Fair value of plan assets 59 50

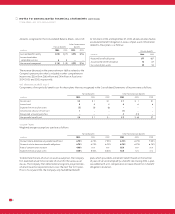

Components of net periodic benefit cost for these plans that was recognized in the Consolidated Statements of Income were as follows:

Pension Benefits Other Postretirement Benefits

in millions 2004 2003 2002 2004 2003 2002

Service cost $3 $1 $1 $1 $1 $1

Interest cost 545466

Expected return on plan assets (5) (4) (6) –––

Amortization of prior service cost 1––(1) ––

Recognized actuarial (gain)/loss –––5(13) –

Net periodic benefit cost $4 $1 $– $9 $(6) $7

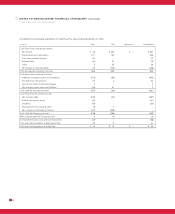

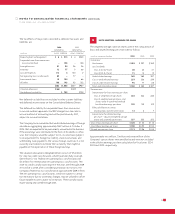

Weighted average assumptions used are as follows:

Pension Benefits Other Postretirement Benefits

in millions 2004 2003 2002 2004 2003 2002

Discount rate to determine net periodic benefit cost 6.75% 6.75% 7.25% 6.75% 6.75% 7.25%

Discount rate to determine benefit obligations 6.75% 6.75% 6.75% 6.75% 6.75% 6.75%

Rate of compensation increase 4.00% N/A N/A N/A N/A N/A

Expected return on plan assets 8.50% 8.50% 8.50% N/A N/A N/A

To determine the rate-of-return on assets assumption, the Company

first examined actual historical rates of return for the various asset

classes. The Company then determined a long-term projected rate-

of-return based on expected returns over the next five to 10 years.

Prior to fiscal year 2004, the Company only had defined benefit

plans which provided a retirement benefit based on the number

of years of service multiplied by a benefit rate. During 2004, a plan

was added with a 4% compensation increase inherent in its benefit

obligation calculation.