Tyson Foods 2004 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2004 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

41

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (CONTINUED)

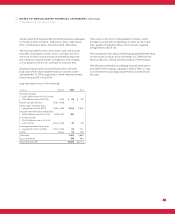

Additionally, the Company enters into certain forward sales of boxed

beef and pork at fixed prices and has positions in livestock futures

to mitigate the market risk associated with these fixed price forward

sales. The fixed price sales contract locks in the proceeds from a sale

in the future, although, the cost of the livestock and the related

boxed beef and pork market prices at the time of the sale will vary

from this fixed price, creating market risk. Therefore, as fixed forward

sales are entered into, the Company also enters into the appropriate

number of livestock futures positions. The Company believes this

is an effective economic hedge; however, the correlation does not

qualify for SFAS No. 133 hedge accounting. Consequently, changes

in market value of the open livestock futures positions are marked

to market and reported in earnings at each reporting date even

though the economic impact of the Company’s fixed sales price

being above or below the market price is only realized at the time of

sale. In connection with these livestock futures, the Company had

unrealized pretax gains on open mark-to-market futures positions

of approximately $15 million as of October 2, 2004, and $16 million

as of September 27, 2003.

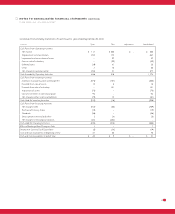

Fair Values of Financial Instruments:

Asset (Liability)

in millions 2004 2003

Commodity derivative positions $5$ (13)

Interest-rate derivative positions (1) (4)

Total debt $(3,700) $(4,011)

Fair values are based on quoted market prices or published

forward interest rate and natural gas curves. Carrying values for

derivative positions equal the fair values as of October 2, 2004,

and September 27, 2003, and the carrying values of total debt was

$3.4 billion and $3.6 billion, respectively. All other financial instruments’

fair values approximate recorded values at October 2, 2004, and

September 27, 2003.

The Company’s financial instruments

that are exposed to concentrations of credit risk consist primarily

of cash equivalents and trade receivables. The Company’s cash

equivalents are in high quality securities placed with major banks

and financial institutions. Concentrations of credit risk with respect

to receivables are limited due to the large number of customers and

their dispersion across geographic areas. The Company performs

periodic credit evaluations of its customers’ financial condition

and generally does not require collateral. At October 2, 2004, and

September 27, 2003, approximately 15.0% and 10.3%, respectively,

of the Company’s net accounts receivable balance was due from

one customer. No other single customer or customer group represents

greater than 10% of net accounts receivable.

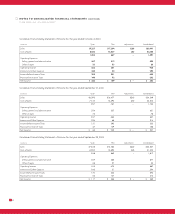

NOTE EIGHT : PROPERTY, PLANT AND EQUIPMENT

The major categories of property, plant and equipment and

accumulated depreciation at cost, at October 2, 2004, and

September 27, 2003, are as follows:

in millions 2004 2003

Land $111 $ 113

Buildings and leasehold improvements 2,307 2,293

Machinery and equipment 3,981 3,886

Land improvements and other 194 184

Buildings and equipment under construction 218 177

6,811 6,653

Less accumulated depreciation 2,847 2,614

Net property, plant and equipment $3,964 $4,039

The Company’s total depreciation expense was $458 million,

$427 million and $431 million in fiscal years 2004, 2003 and 2002,

respectively. The Company capitalized interest costs of $3 million

in 2004 and 2003, and $9 million in 2002 as part of the cost of

major asset construction projects. Approximately $492 million

will be required to complete construction projects in progress

at October 2, 2004.

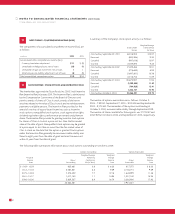

NOTE NINE : OTHER CURRENT LIABILITIES

Other current liabilities at October 2, 2004, and September 27,

2003, include:

in millions 2004 2003

Accrued salaries, wages and benefits $270 $ 263

Self insurance reserves 248 243

Income taxes payable 149 244

Other 343 397

Total other current liabilities $1,010 $1,147