Tyson Foods 2004 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2004 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

43

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (CONTINUED)

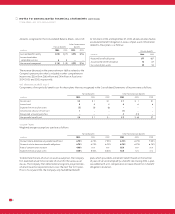

Annual maturities of long-term debt for the five fiscal years subsequent

to October 2, 2004, are: 2005 – $338 million; 2006 – $261 million;

2007 – $1,048 million; 2008 – $14 million; 2009 – $91 million.

The revolving credit facilities, senior notes, notes and accounts

receivable securitization contain various covenants, the more

restrictive of which contain a maximum allowed leverage ratio

and a minimum required interest coverage ratio. The Company

is in compliance with all of its covenants at fiscal year end.

Industrial revenue bonds are secured by facilities with a net

book value of $41 million and $159 million at October 2, 2004,

and September 27, 2003, respectively, as three industrial revenue

bonds were paid off in fiscal 2004.

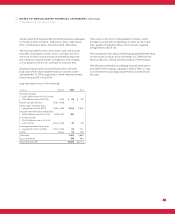

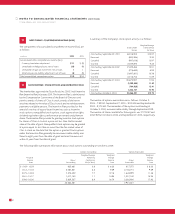

Long-term debt consists of the following:

in millions Maturity 2004 2003

Commercial paper

(2.05% effective rate at 10/2/04 and

1.38% effective rate at 9/27/03) 2009 $86 $32

Revolving Credit Facilities 2006 – 2009 ––

Senior notes and Notes (rates

ranging from 6.13% to 8.25%) 2005 – 2028 2,816 3,316

Accounts Receivable Securitization Debt

(2.51% effective rate at 10/2/04) 2005, 2007 300 –

Institutional notes

(10.84% effective rate at 10/2/04

and 9/27/03) 2005 – 2006 20 40

Leveraged equipment loans (rates

ranging from 4.67% to 5.99%) 2005 – 2008 85 111

Other Various 55 105

Total debt 3,362 3,604

Less current debt 338 490

Total long-term debt $3,024 $3,114

There were no short-term notes payable at October 2, 2004.

Included in current debt at September 27, 2003, are short-term

notes payable totaling $23 million, which carried a weighted

average interest rate of 1.5%.

The Company has fully and unconditionally guaranteed $476 million

of senior notes issued by Tyson Fresh Meats, Inc. (TFM; formerly

known as IBP, inc.), a wholly-owned subsidiary of the Company.

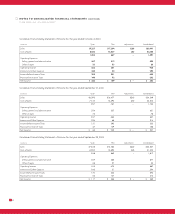

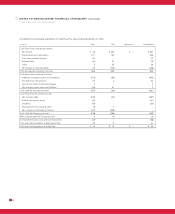

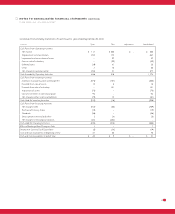

The following condensed consolidating financial information is

provided for the Company, as guarantor, and for TFM, as issuer,

as an alternative to providing separate financial statements for

the issuer.