Toyota 2005 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2005 Toyota annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

88 >NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

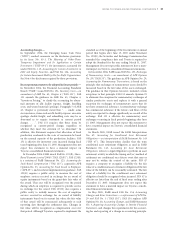

Unrealized losses continuously over a 12 month period

or more in the aggregate were not material at March 31,

2004 and 2005.

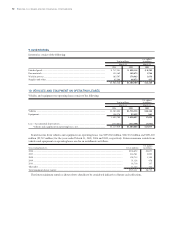

At March 31, 2004 and 2005, debt securities classified as

available-for-sale mainly consist of Japanese government

bonds and corporate debt securities with maturities from

one to ten years.

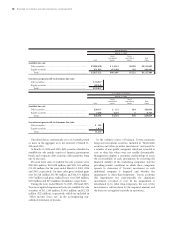

Proceeds from sales of available-for-sale securities were

¥197,985 million, ¥183,808 million and ¥121,369 million

($1,130 million) for the years ended March 31, 2003, 2004

and 2005, respectively. On those sales, gross realized gains

were ¥6,518 million, ¥8,780 million and ¥14,551 million

($135 million) and gross realized losses were ¥103 million,

¥139 million and ¥231 million ($2 million), respectively.

During the years ended March 31, 2003, 2004 and 2005,

Toyota recognized impairment losses on available-for-sale

securities of ¥111,346 million, ¥3,063 million, and ¥2,324

million ($22 million), respectively, which are included in

“Other income (loss), net” in the accompanying con-

solidated statements of income.

In the ordinary course of business, Toyota maintains

long-term investment securities, included in “Marketable

securities and other securities investments” and issued by

a number of non-public companies which are recorded at

cost, as their fair values were not readily determinable.

Management employs a systematic methodology to assess

the recoverability of such investments by reviewing the

financial viability of the underlying companies and the

prevailing market conditions in which these companies

operate to determine if Toyota’s investment in each

individual company is impaired and whether the

impairment is other-than-temporary. Toyota performs

this impairment test semi-annually for significant

investments recorded at cost. If the impairment is

determined to be other-than-temporary, the cost of the

investment is written-down by the impaired amount and

the losses are recognized currently in operations.

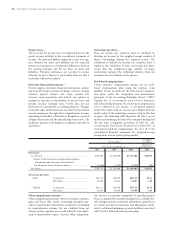

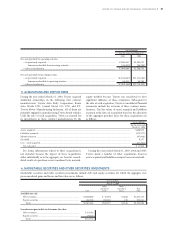

Yen in millions

March 31, 2005

Gross Gross

unrealized unrealized Fair

Cost gains losses value

Available-for-sale

Debt securities............................................................................. ¥2,205,420 ¥ 14,113 ¥6,928 ¥2,212,605

Equity securities.......................................................................... 451,903 453,494 593 904,804

Total ........................................................................................ ¥2,657,323 ¥467,607 ¥7,521 ¥3,117,409

Securities not practicable to determine fair value

Debt securities............................................................................. ¥ 19,917

Equity securities.......................................................................... 109,940

Total ........................................................................................ ¥129,857

U.S. dollars in millions

March 31, 2005

Gross Gross

unrealized unrealized Fair

Cost gains losses value

Available-for-sale

Debt securities............................................................................. $20,537 $ 131 $64 $20,604

Equity securities.......................................................................... 4,208 4,223 6 8,425

Total ........................................................................................ $24,745 $4,354 $70 $29,029

Securities not practicable to determine fair value

Debt securities............................................................................. $ 185

Equity securities.......................................................................... 1,025

Total ........................................................................................ $1,210