Toyota 2005 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2005 Toyota annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

64 >MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Net cash outflows from finance receivables relating to

the sale of inventories reported in operating activities in

the consolidated statement of cash flows for the year ended

March 31, 2005 were ¥55.9 billion. See note 4 and 7 to the

consolidated financial statements.

Net cash provided by operating activities was ¥2,370.9

billion for fiscal 2005, compared with ¥2,186.7 billion for

the prior year. The increase in net cash provided by operat-

ing activities resulted primarily from increased operating

cash flows attributed to the growth in business of the

financial services operations.

Net cash used in investing activities was ¥3,061.1 billion

for fiscal 2005, compared with ¥2,216.4 billion for the

prior year. The increase in net cash used in investing

activities resulted primarily from the decrease in sales,

redemptions and maturities of marketable securities and

security investments and an increase in additions of equip-

ment leased to others,

which was partially offset

by decrease in additions

to finance receivables.

Net cash provided by

financing activities was

¥419.3 billion for fiscal

2005, compared with

¥242.2 billion for the prior

year. The increase in net

cash provided by financ-

ing activities resulted pri-

marily from an increase

in long-term debt and a

decrease in purchases of

common stock, which

was partially offset by

increased payments of

short-term borrowings.

Total capital expenditures for property, plant and equip-

ment, excluding vehicles and equipment on operating

leases, were ¥1,068.2 billion during fiscal 2005, an increase

of 13.0% over the ¥945.8 billion in total capital expendi-

tures for the prior year. The increase in capital expenditures

resulted primarily from

the impact of increased

capital expenditures in

domestic subsidiaries and

overseas capital expendi-

tures for IMV.

Total expenditures for

vehicles and equipment on

operating leases were

¥854.9 billion during fiscal

2005, an increase of 57.5%

over the ¥542.7 billion in

expenditures in the prior

year. The change resulted

primarily from increased

operating lease assets in

finance subsidiaries in

North America and Europe.

Toyota expects invest-

ments in property, plant and equipment, excluding

vehicles leased to others, to approximate ¥1,250.0 billion

during fiscal 2006. Toyota’s expected capital expenditures

include approximately ¥770.0 billion in Japan, ¥220.0

billion in North America, ¥110.0 billion in Europe and

¥150.0 billion in all other areas, respectively.

Yen in millions

For the years ended March 31,

2003 2004

Net cash provided by operating activities

As previously reported ........................................................................................................... ¥2,085,047 ¥2,283,023

Amount reclassified from investing activities........................................................................... (144,959) (96,289)

Net cash provided by operating activities

After reclassified...................................................................................................................... ¥1,940,088 ¥2,186,734

Net cash used in investing activities

As previously reported ........................................................................................................... ¥(2,146,407) ¥(2,312,784)

Amount reclassified to operating activities............................................................................... 144,959 96,289

Net cash used in investing activities

After reclassified...................................................................................................................... ¥(2,001,448) ¥(2,216,495)

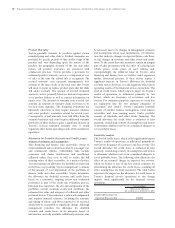

600

900

300

1,200

’01 ’02 ’03 ’04 ’05

0

Capital Expenditures

for Property, Plant and

Equipment* and Depreciation

(¥ Billion)

FY

Capital expenditures

Depreciation

* Excluding vehicles and equipment

on operating leases

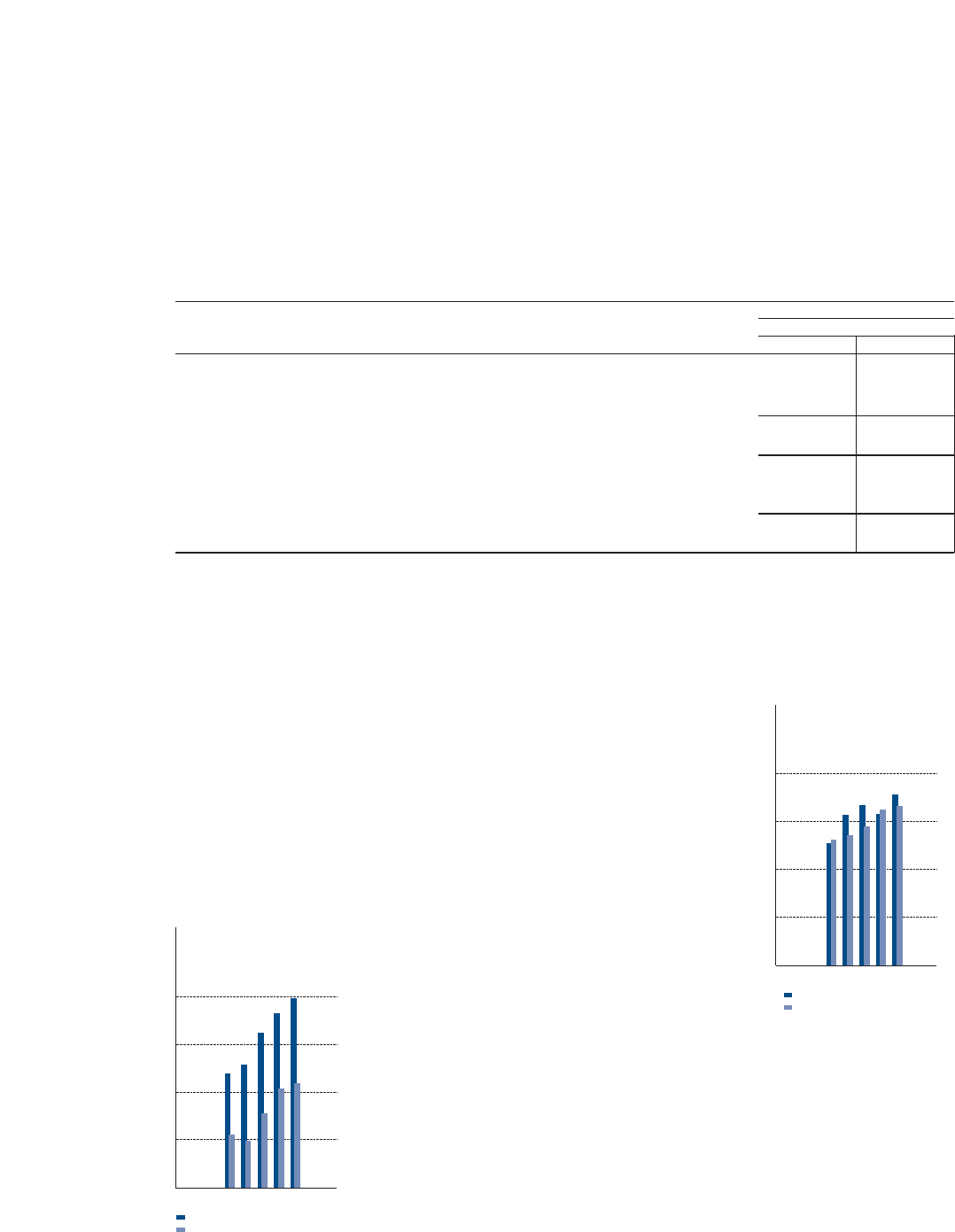

1,200

1,800

600

2,400

’01 ’02 ’03 ’04 ’05

0

Net Cash Provided by Operating

Activities and Free Cash Flow*

(¥ Billion)

FY

Net cash provided by operating activities

Free cash flow

* (Net cash provided by operating activities)

– (Capital expenditures for property, plant

and equipment, excluding vehicles and

equipment on operating leases)