Toyota 2005 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2005 Toyota annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

14

Performance Overview

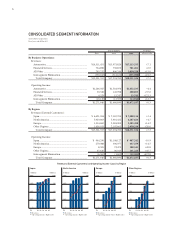

In fiscal 2005, ended March 31, 2005, Toyota posted record results across the board, with

increases of 7.3% in consolidated net revenues, to ¥18.55 trillion; 0.3% in operating

income, to ¥1.67 trillion; and 0.8% in net income, to ¥1.17 trillion. Among those results,

operating income remained at the previous fiscal year’s high level, absorbing such

income-reducing factors as ¥140.0 billion for the effect of currency exchange rate changes

and a ¥59.8 billion decrease in net gains on the transfer of the substitutional portion of

the employee pension funds to the government. Further, net income was above ¥1 trillion

for the second consecutive year.

I believe that we were able to maintain high annual earnings while investing for future

growth. Toyota has been able to realize long-term growth by continuously evolving the

quality of its business strategy. To establish a foundation for further growth, the

Company believes that it is critical to develop market-creating products while increasing

self-reliance of overseas operations by making capital expenditures to advance global

operations worldwide and to build research and development. We aim to heighten

management efficiency through the creation of a more balanced profit structure among

the four regions: Japan, North America, Europe, and Other Regions including Asia.

Financial Strategy

The three key strategies of Toyota’s financial strategy are “growth,” “efficiency,” and

“stability.” In other words, our financial strategy is founded on continued forward-

looking investment for growth, the enhancement of profitability and capital efficiency, and

the maintenance of a solid financial position. In the medium-to-long term, Toyota will

balance its pursuit of those three priorities to achieve steady and sustainable growth.

Regarding “growth,” I believe we have to continue investing effectively, regardless of

such factors as currency exchange rate fluctuations and corporate performance. It is

essential to implement capital expenditures for operations worldwide as well as prior

investment in environmental and safety technologies, which will become the key drivers

of sustainable growth. Further, our management policy emphasizes cash flows in order to

steadily raise corporate value for our shareholders. Guided by that policy, in fiscal 2005

Toyota was able to maintain positive free cash flow while implementing investments in

property, plant and equipment of more than ¥1 trillion (excluding vehicles and

equipment on operating leases) and recording approximately ¥750 billion in research and

development expenses. In fiscal 2006, aiming to realize further growth through effective

investment, we will continue to earmark free cash flow generated through our efforts

to maximize earnings for stepped-up investment in property, plant and equipment

and in research and development.

Regarding “efficiency” in fiscal 2005, the Company recorded an operating income

margin of 9.0% and ROE of 13.6%. In comparison with fiscal 2000’s operating income

margin of 5.6% and ROE of 7.1%, the Company achieved substantial improvement, and

has balanced both “growth” and “efficiency.” In order to advance cost reduction activities,

—one of Toyota’s perennial strengths—the Company has launched the “VI Activity,” in

pursuit of “value innovation” and strives to promote cost reduction on a new level.

Toyota is making a concerted effort to take profitability and efficiency to new heights.

Financial Strategy

1. Growth

Continue forward-looking

investment for growth

2. Efficiency

Enhance profitability

and capital efficiency

3. Stability

Maintain solid financial base

Balanced implementation

of 1. – 3. over the medium

to long term

Sustainable growth

MESSAGE FROM THE EXECUTIVE VICE PRESIDENT

RESPONSIBLE FOR FINANCE & ACCOUNTING*