Toyota 2005 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2005 Toyota annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

well. And, we shipped more than 100,000 units

of the Crown, thanks to a full model change of

the luxury sedan in the previous year.

Moreover, the mainstay Corolla was Japan’s

best-selling car for the second successive year,

and the Prius hybrid vehicle continued to sell

briskly. In addition, unit sales of Daihatsu-

brand minivehicles and Hino-brand trucks

were up.

MARKET STRATEGY

Stake out and retain 45% share of

non-minivehicle market

In domestic operations, Toyota’s medium-

term mission is to develop the competitive

muscle to capture and hold a 45% share of the

Japanese automotive market excluding mini-

vehicles. To that end, in February 2003 we

announced a revised product strategy and

began reforming sales channels to reflect

changing times. In May 2004, we consolidated

domestic, Toyota-brand sales channels from

five to four and defined the roles and targets of

the remaining channels more clearly. Of those

channels, the revitalized Netz channel—created

by combining the former Netz and Vista

channels—is steadily earning endorsement

among the growing numbers of customers with

distinctive values.

Further, August 2005 is slated for the

Japanese premiere of the Lexus, which we aim

to develop into a globally recognized prestige

brand. Plans call for the unveiling of the GS

and the SC in August, followed one month

later by the IS, with the fourth model, the LS,

launching in summer 2006. In the immediate

future, we are looking to market between

50,000 and 60,000 Lexus vehicles annually.

Netz—A New Incarnation

Our reinvented Netz channel targets customers that

value advanced, particular features. A love of fun

and fashion unites Netz outlets’ unique style, which

is reflected in every aspect

of operations from manu-

facturing through market-

ing. In the medium term,

the channel aims to sell

more than 600,000 vehicles

a year through 1,600

dealers nationwide.

Passo

VISTA

Price Price

Traditional

Conservative

Traditional

Conservative

Change Area

Advanced

Particular

Advanced

Particular

Change Area

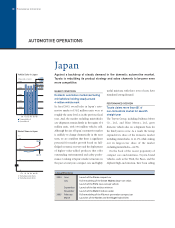

Channel and Brand Reconstruction

Sales Channel Matrix

New Vitz

BUSINESS OVERVIEW >39

Previous New