Toyota 2005 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2005 Toyota annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

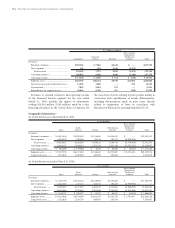

108 >NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Postretirement benefits other than pensions and

postemployment benefits—

Toyota’s U.S. subsidiaries provide certain health care and

life insurance benefits to eligible retired employees. In

addition, Toyota provides benefits to certain former or

inactive employees after employment, but before retire-

ment. These benefits are currently unfunded and provided

through various insurance companies and health care

providers. The costs of these benefits are recognized over

the period the employee provides credited service to

Toyota. Toyota’s obligations under these arrangements are

not material.

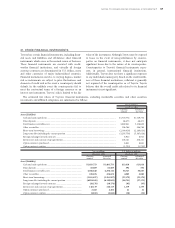

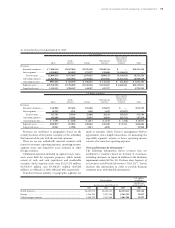

20. DERIVATIVE FINANCIAL INSTRUMENTS

Toyota employs derivative financial instruments, includ-

ing foreign exchange forward contracts, foreign currency

options, interest rate swaps, interest rate currency swap

agreements and interest rate options to manage its expo-

sure to fluctuations in interest rates and foreign currency

exchange rates. Toyota does not use derivatives for specu-

lation or trading.

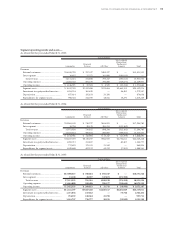

Fair value hedges—

Toyota enters into interest rate swaps, and interest rate

currency swap agreements mainly to convert its fixed-rate

debt to variable-rate debt. Toyota uses interest rate swap

agreements in managing its exposure to interest rate

fluctuations. Interest rate swap agreements are executed as

either an integral part of specific debt transactions or on a

portfolio basis. Toyota uses interest rate currency swap

agreements to entirely hedge exposure to currency

exchange rate fluctuations on principal and interest pay-

ments for borrowings denominated in foreign currencies.

Notes and loans payable issued in foreign currencies are

hedged by concurrently executing interest rate currency

swap agreements, which involve the exchange of foreign

currency principal and interest obligations for each func-

tional currency obligations at agreed-upon currency

exchange and interest rates.

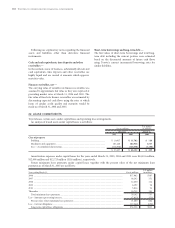

For the years ended March 31, 2003, 2004 and 2005, the

ineffective portion of Toyota’s fair value hedge relation-

ships which are included in cost of financing operations in

the accompanying consolidated statements of income

were not material. For fair value hedging relationships, the

components of each derivative’s gain or loss are included

in the assessment of hedge effectiveness.

Cash flow hedges—

Toyota enters into interest rate swaps, and interest rate

currency swap agreements to manage its exposure to

interest rate risk, and foreign currency exchange risk

mainly associated with funding in currencies in which it

operates.

Interest rate swap agreements are used by Toyota to

manage its exposure to the variability of interest payments

due to the changes in interest rates arising principally

from variable-rate debts issued by Toyota. Interest rate

swap agreements, which are designated as, and qualify as

cash flow hedges are executed as an integral part of

specific debt transactions and the critical terms of the

interest rate swaps and the hedged debt transactions are

the same. Toyota uses interest rate currency swap

agreements to manage the foreign-currency exposure to

variability in functional-currency-equivalent cash flows

principally from debts or borrowings denominated in

currencies other than functional currencies.

Net derivative gains and losses included in other

comprehensive income are reclassified into earnings at the

time that the associated hedged transactions impact the

income statement. For the year ended March 31, 2003, a

net derivative loss of ¥790 million was reclassified to

foreign exchange gain (loss), net in the accompanying

consolidated statements of income. This net loss were

offset by net gains from transactions being hedged. The

components of each derivative’s gain and loss were

included in the assessment of hedge effectiveness, and no

hedge ineffectiveness was reported because all critical

terms of derivative financial instruments designated as,

and qualify as, cash flow hedging instruments were same

as those of hedged debt transactions. For the years ended

March 31, 2004 and 2005, no gains or losses resulted from

cash flow hedges were reported as no derivative

instruments were designated as, and qualified as cash flow

hedging instruments. Toyota does not expect to reclassify

any gains or losses included in other comprehensive

income as at March 31, 2005, into earnings in next twelve

months because no derivative instruments were designated

as, and qualified as, cash flow hedges.

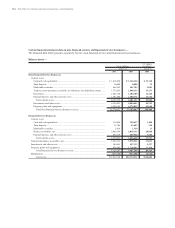

Undesignated derivative financial instruments—

Toyota uses foreign exchange forward contracts, foreign

currency options, interest rate swaps, interest rate

currency swap agreements, and interest rate options, to

manage its exposure to foreign currency exchange rate

fluctuations and interest rate fluctuations from an eco-

nomic perspective, and which Toyota is unable or has

elected not to apply hedge accounting. Unrealized gains or

losses on these derivative instruments are reported in the

cost of financing operations and foreign exchange gain,

net in the accompanying consolidated statements of

income together with realized gains or losses on those

derivative instruments.