Toyota 2005 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2005 Toyota annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

51

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL

CONDITION AND RESULTS OF OPERATIONS

All financial information discussed in this section is

derived from Toyota’s consolidated financial statements

that appear elsewhere in this annual report on Form 20-F.

The financial statements have been prepared in confor-

mity with accounting principles generally accepted in

the United States of America.

OVERVIEW

The business segments of Toyota Motor Corporation

(“the parent company”) and its subsidiaries (collectively,

“Toyota”) include automotive operations, financial services

operations and all other operations. Automotive opera-

tions is Toyota’s most significant business segment,

accounting for 90% of Toyota’s total revenues before the

elimination of intersegment revenues and 86% of Toyota’s

total operating income before the elimination of interseg-

ment revenues and costs for the year ended March 31,

2005. The operating income from automotive operations

as a percentage of total operating income decreased by 4%

due to an increase in operating income from the financial

services operations. Toyota’s primary markets based on

vehicle unit sales for the year ended March 31, 2005 were:

Japan (32%), North America (31%) and Europe (13%).

Automotive Market Environment

The worldwide automotive market is highly competitive

and volatile. The demand for automobiles is affected by a

number of factors including social, political and general

economic conditions; introduction of new vehicles and

technologies; and costs incurred by customers to purchase

and operate vehicles. These factors can cause consumer

demand to vary substantially from year to year in different

geographic markets and for different types of automobiles.

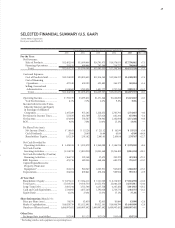

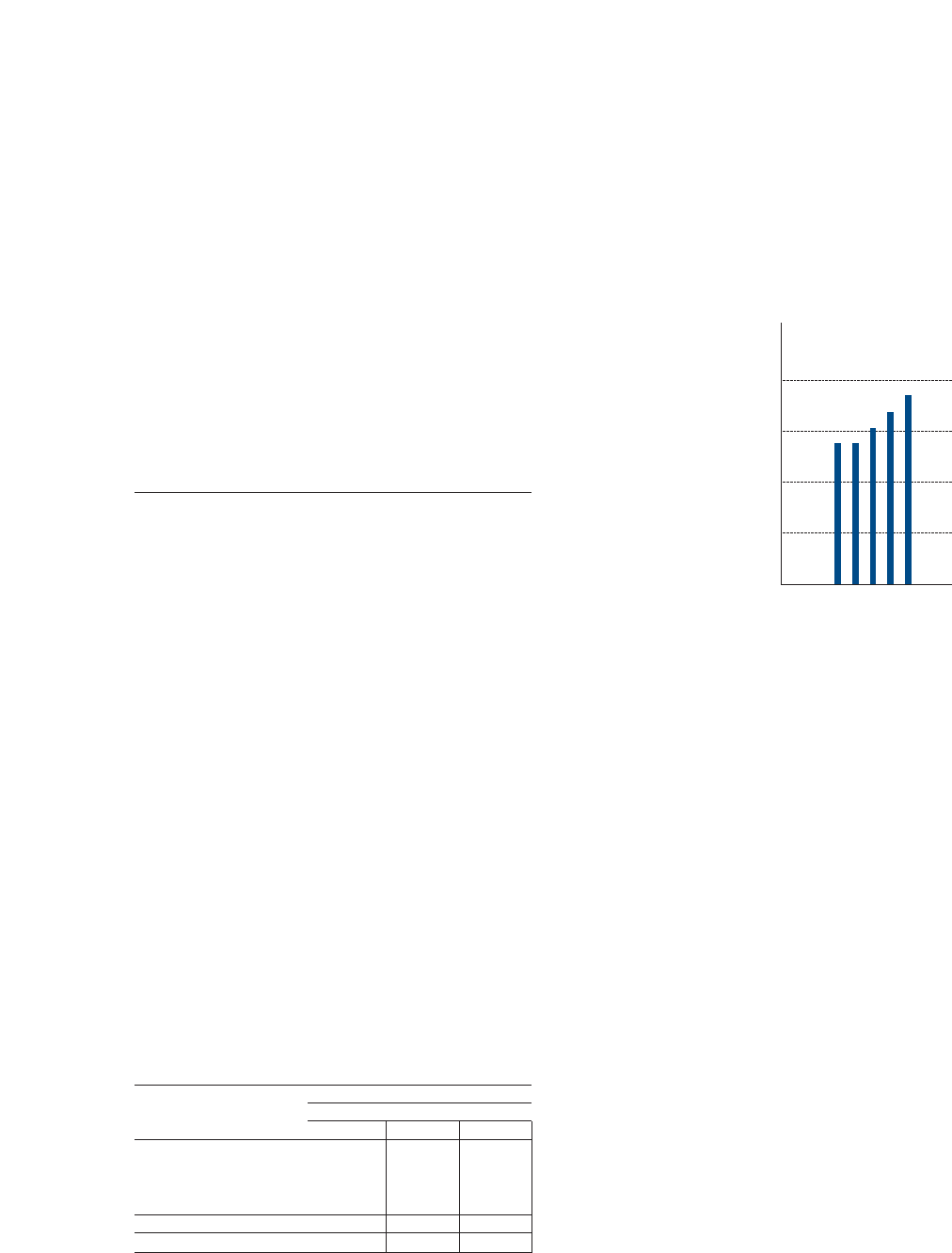

The following table sets forth Toyota’s consolidated

vehicle unit sales by geographical market for the past three

fiscal years.

Thousands of units

Year Ended March 31,

2003 2004 2005

Japan................................. 2,217 2,303 2,381

North America................. 1,982 2,103 2,271

Europe.............................. 776 898 979

All Other Markets............ 1,138 1,415 1,777

Overseas Total.................. 3,896 4,416 5,027

Total ................................. 6,113 6,719 7,408

Toyota’s consolidated unit sales in Japan increased

during both fiscal 2004 and 2005 as compared to the prior

year as the result of the active introduction of new products

that met customer needs and the strong sales efforts of

domestic dealers despite a decline in the overall domestic

market in each of those years. In addition, overseas vehicle

unit sales increased in North America, Europe and all other

markets due to extensive product offerings that catered to

regional needs during fiscal 2004 and 2005.

Toyota’s share of total vehicle

unit sales in each market is

influenced by the quality,

price, design, performance,

safety, reliability, economy

and utility of Toyota’s

vehicles compared with those

offered by other manufac-

turers. The timely introduc-

tion of new or redesigned

vehicles is also an important

factor in satisfying customer

demand. Toyota’s ability to

satisfy changing customer pre-

ferences can affect its

rev-

enues and earnings significantly.

The profitability of Toyota’s automotive operations is

affected by many factors. These factors include:

•vehicle unit sales volumes,

•the mix of vehicle models and options sold,

•the level of parts and service sales,

•the levels of price discounts and other sales incentives

and marketing costs,

•the cost of customer warranty claims and other

customer satisfaction actions,

•the cost of research and development and other fixed costs,

•the ability to control costs,

•the efficient use of production capacity, and

•changes in the value of the Japanese yen and other

currencies in which Toyota does business.

Changes in laws, regulations, policies and other govern-

mental actions can also materially impact the profitability

of Toyota’s automotive operations. These laws, regulations

and policies include those attributed to environmental

matters and vehicle safety, fuel economy and emissions

that can add significantly to the cost of vehicles. The

European Union has approved a directive that requires

manufacturers to be financially responsible for taking back

end-of-life vehicles and to take measures to ensure that

adequate used vehicle disposal facilities are established and

that hazardous materials and recyclable parts are removed

from vehicles prior to scrapping. Please see “— Legislation

Regarding End-of-Life Vehicles” and “Information on the

Company—Business Overview—Governmental Regulation,

Environmental and Safety Standards” in Toyota’s annual

report on Form 20-F and note 23 to the consolidated

financial statements for a more detailed discussion of

these laws, regulations and policies.

4,000

2,000

6,000

8,000

’01 ’02 ’03 ’04 ’05

0

FY

Consolidated Vehicle Sales

(Thousands of units)