Toyota 2005 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2005 Toyota annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

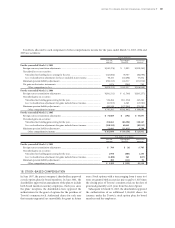

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS >103

“performance points” which are attributed to the annual

performance evaluation of each employee. Under normal

circumstances, the minimum payment prior to retirement

age is an amount reflecting an adjustment rate applied to

represent voluntary retirement. Employees receive addi-

tional benefits upon involuntary retirement, including

retirement at the age limit. As a result of this plan

amendment, the projected benefit obligation decreased by

¥32,208 million ($300 million), at October 1, 2004 and

resulted in an unrecognized prior service cost, which is

recognized in future service periods.

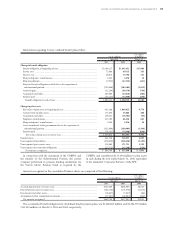

The parent company and most subsidiaries in Japan

have contributory funded defined benefit pension plans,

which are pursuant to the Japanese Welfare Pension

Insurance Law (“JWPIL”) or the Corporate Defined

Benefit Pension Plan Law (CDBPPL). The contributory

pension plans under JWPIL cover a portion of the

governmental welfare pension program, under which the

contributions are made by the companies and their

employees, and a corporate portion representing the

noncontributory pension plans. However, the contri-

butory pension plans under the CDBPPL are established

solely by the companies and are not required to cover any

portion of the governmental welfare program. The

pension benefits are determined based on the number of

points upon retirement for companies which employ the

point plan, or determined based on length of service and

current rates of pay as stipulated in the aforementioned

regulations for companies which do not employ a points-

based plan. Both benefits are payable, at the option of the

retiring employee, as a monthly pension payment or in a

lump-sum amount. The contributions to the plans are

funded with several financial institutions in accordance

with the applicable laws and regulations. These pension

plan assets consist principally of investments in govern-

ment obligations, equity and fixed income securities, and

insurance contracts. Most foreign subsidiaries have

defined benefit pension plans or severance indemnity

plans covering substantially all of their employees under

which the cost of benefits are currently invested or

accrued. The benefits for these plans are based primarily

on lengths of service and current rates of pay.

Transfer to the government of the Substitutional

Portion of the Employee Pension Fund Liabilities—

The parent company and certain subsidiaries in Japan had

maintained employees’ pension funds (EPFs) pursuant to

the JWPIL. The EPF consisted of two tiers, a Substitutional

Portion, in which the EPF, in lieu of the government’s

social insurance program, collected contributions, funded

them and paid benefits to the employees with respect to

the pay-related portion of the old-age pension benefits

prescribed by JWPIL, and a Corporate Portion which was

established at the discretion of each employer.

In June 2001, the CDBPPL was enacted and allowed any

EPF to terminate its operation relating to the Subsititutional

Portion that in the past an EPF had operated and managed

in lieu of the government, subject to approval from the

Japanese Minister of Health, Labour and Welfare. In

September 2003, Toyota Motor Pension Fund, the parent

company’s EPF under JWPIL, obtained the approval from

the Minister for the exemption from benefit payments

related to employee services of the Subsititutional Portion.

In January 2004, Toyota Motor Pension Fund completed

the transfer of the plan assets attributable to the

Subsititutional Portion to the government. In addition,

during the years ended March 31, 2004 and 2005, certain

subsidiaries and affiliates in Japan that had EPFs under

JWPIL also completed the transfer of the plan assets

attributable to the Subsititutional Portion to the govern-

ment in compliance with the same procedures followed by

the parent company. Certain other subsidiaries and affili-

ates in Japan that have EPFs under JWPIL are currently in

process of obtaining the approval from the Minister for

the exemption from the benefit payments related to

employee service of the Subsititutional Portion and upon

approval will transfer the plan assets equivalent to the

Subsititutional Portion to the government.

In accordance with the consensus on EITF Issue No. 03-

2, Accounting for the Transfer to the Japanese Government of

the Substitutional Portion of Employee Pension Fund

Liabilities (“EITF 03-2”), Toyota accounted the entire

separation process, upon completion of transfer of the

plan assets attributable to the Substitutional Portion to the

government, as a single settlement transaction. During the

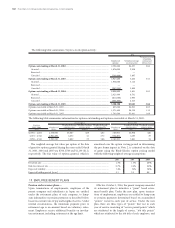

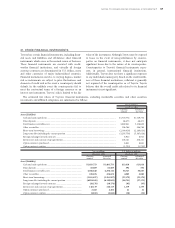

years ended March 31, 2004 and 2005, Toyota recognized

settlement losses of ¥323,715 million and ¥96,066 million

($894 million), respectively, as part of net periodic

pension costs which are the proportionate amounts of the

net unrecognized losses immediately prior to the separa-

tion related to the entire EPFs under JWPIL, and which

are determined based on the proportion of the projected

benefit obligation settled to the total projected benefit

obligation immediately prior to the separation. Toyota

also recognized as reductions of net periodic pension costs

totaling ¥109,885 million and ¥21,722 million ($202

million) for the years ended March 31, 2004 and 2005,

respectively, which resulted in gains attributed to the

derecognition of previously accrued salary progression. In

addition, Toyota recognized gains of ¥320,867 million and

¥121,553 million ($1,132 million) for the years ended

March 31, 2004 and 2005, respectively, which represented

the differences between the obligation settled and the

assets transferred to the government. These gains and

losses are reflected in the consolidated statement of income

for the years ended March 31, 2004 and 2005 as follows: