Toyota 2005 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2005 Toyota annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS >87

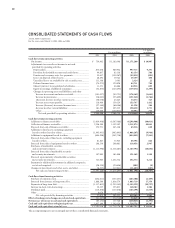

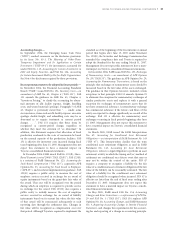

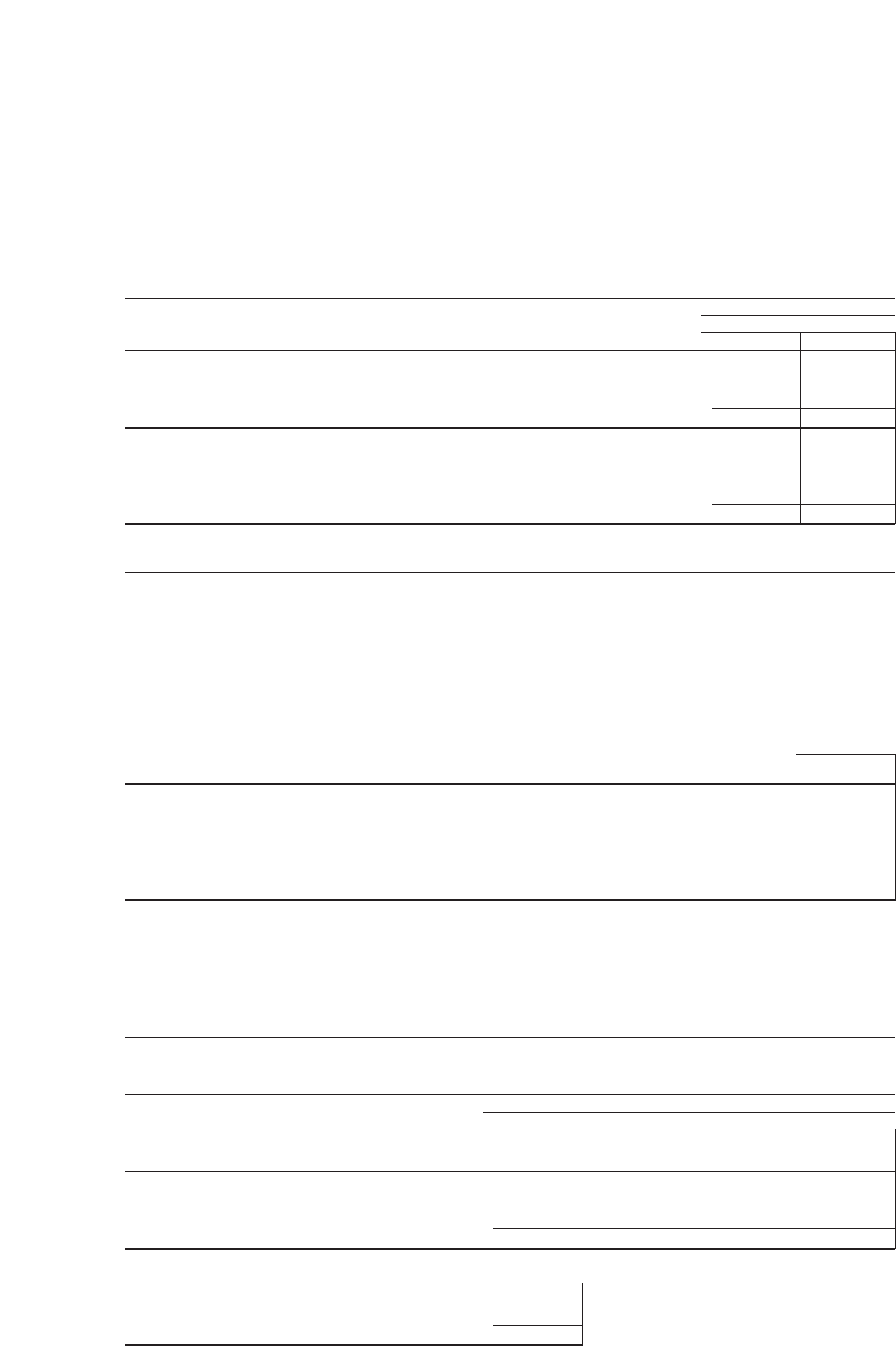

Yen in millions

For the years ended March 31,

2003 2004

Net cash provided by operating activities

—As previously reported ............................................................................................................................ ¥2,085,047 ¥2,283,023

Amount reclassified from investing activities ................................................................................... (144,959) (96,289)

—After reclassification ................................................................................................................................ ¥1,940,088 ¥2,186,734

Net cash provided by investing activities

—As previously reported ............................................................................................................................ ¥(2,146,407) ¥(2,312,784)

Amount reclassified to operating activities ....................................................................................... 144,959 96,289

—After reclassification ................................................................................................................................ ¥(2,001,448) ¥(2,216,495)

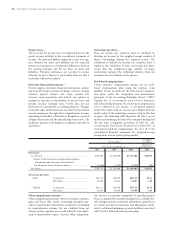

During the year ended March 31, 2004, Toyota acquired

additional ownerships in the following four contract

manufacturers, Toyota Auto Body Corporation, Kanto

Auto Works LTD, Central Motor CO., LTD, and P.T.

Toyota Motor Manufacturing Indonesia. All of them are

primarily engaged in manufacturing Toyota brand vehicles.

Until the date of each acquisition, Toyota accounted for

its investments in these contract manufacturers by the

equity method because Toyota was considered to have

significant influence of these companies. Subsequent to

the date of each acquisition, Toyota’s consolidated financial

statements include the accounts of these contract manu-

facturers. The fair values of assets acquired and liabilities

assumed at the dates of acquisition based on the allocation

of the aggregate purchase price for these acquisitions are

as follows:

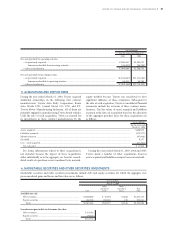

5. ACQUISITIONS AND DISPOSITIONS

Pro forma information related to these acquisitions is

not included because the impact of these acquisitions,

either individually or in the aggregate, on Toyota’s consoli-

dated results of operations is not considered to be material.

During the years ended March 31, 2003, 2004 and 2005,

Toyota made a number of other acquisitions, however

assets acquired and liabilities assumed were not material.

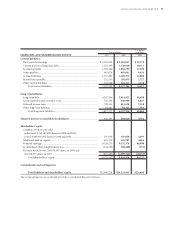

Yen in millions

For the years ended

March 31, 2004

Assets acquired ............................................................................................................................................................................. ¥488,939

Liabilities assumed ....................................................................................................................................................................... (372,277)

Minority interest .......................................................................................................................................................................... (97,008)

Goodwill ....................................................................................................................................................................................... 9,557

Less—Cash acquired.................................................................................................................................................................... (11,703)

Net cash paid............................................................................................................................................................................ ¥ 17,508

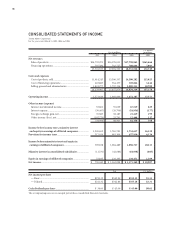

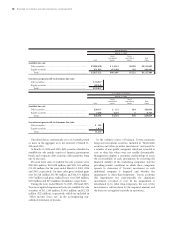

Marketable securities and other securities investments include debt and equity securities for which the aggregate cost,

gross unrealized gains and losses and fair value are as follows:

Yen in millions

March 31, 2004

Gross Gross

unrealized unrealized Fair

Cost gains losses value

Available-for-sale

Debt securities............................................................................. ¥1,606,685 ¥ 10,094 ¥1,626 ¥1,615,153

Equity securities.......................................................................... 460,778 492,483 720 952,541

Total ........................................................................................ ¥2,067,463 ¥502,577 ¥2,346 ¥2,567,694

Securities not practicable to determine fair value

Debt securities............................................................................. ¥ 43,382

Equity securities.......................................................................... 79,352

Total ........................................................................................ ¥122,734

6. MARKETABLE SECURITIES AND OTHER SECURITIES INVESTMENTS