Toyota 2005 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2005 Toyota annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS >105

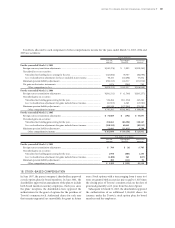

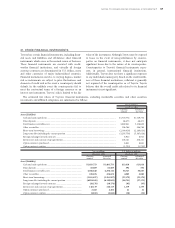

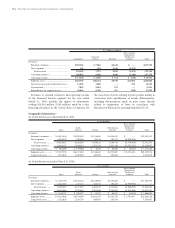

Information regarding Toyota’s defined benefit plans follow:

U.S. dollars

Yen in millions in millions

March 31, March 31,

2004 2005 2005

Change in benefit obligation

Benefit obligation at beginning of year ...................................................................... ¥2,346,127 ¥1,891,051 $17,609

Service cost .................................................................................................................. 75,988 60,715 565

Interest cost ................................................................................................................. 48,674 37,790 352

Plan participants’ contributions................................................................................. 2,245 1,078 10

Plan amendments........................................................................................................ (7,903) (47,535) (443)

Projected benefit obligation settled due to the separation of

substitutional portion ............................................................................................... (752,646) (304,184) (2,832)

Actuarial gain............................................................................................................... (11,280) (80,370) (748)

Acquisition and other ................................................................................................. 265,969 (32,816) (306)

Benefits paid ................................................................................................................ (76,123) (74,990) (698)

Benefit obligation at end of year ............................................................................ 1,891,051 1,450,739 13,509

Change in plan assets

Fair value of plan assets at beginning of year............................................................. 932,166 1,049,815 9,776

Actual return on plan assets........................................................................................ 171,600 43,866 408

Acquisition and other ................................................................................................. 128,031 (10,304) (96)

Employer contributions.............................................................................................. 213,790 86,128 802

Plan participants’ contributions................................................................................. 2,245 1,078 10

Assets transferred to the government due to the separation of

substitutional portion ............................................................................................... (321,894) (160,909) (1,498)

Benefits paid ................................................................................................................ (76,123) (74,990) (698)

Fair value of plan assets at end of year.................................................................. 1,049,815 934,684 8,704

Funded status................................................................................................................... 841,236 516,055 4,805

Unrecognized actuarial loss ............................................................................................ (478,830) (256,628) (2,389)

Unrecognized prior service costs .................................................................................... 129,965 171,753 1,599

Unrecognized net transition obligations........................................................................ (27,572) (13,290) (124)

Net amount recognized .......................................................................................... ¥ 464,799 ¥ 417,890 $ 3,891

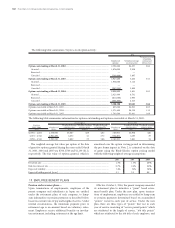

In connection with the enactment of the CDBPPL and

the transfer of the Substitutional Portion, the parent

company performed its pension funding calculations for

the Toyota Motor Pension Fund as required by the

CDBPPL and contributed ¥115,294 million to plan assets

in cash during the year ended March 31, 2004, equivalent

to the unfunded “Corporate Portion” of the EPF.

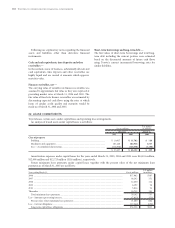

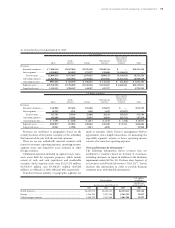

Amounts recognized in the consolidated balance sheets are comprised of the following:

U.S. dollars

Yen in millions in millions

March 31, March 31,

2004 2005 2005

Accrued pension and severance costs............................................................................. ¥725,569 ¥646,989 $6,025

Prepaid pension and severance costs.............................................................................. (164,176) (173,078) (1,612)

Investments and other assets........................................................................................... (18,627) (7,027) (66)

Accumulated other comprehensive income................................................................... (77,967) (48,994) (456)

Net amount recognized .............................................................................................. ¥464,799 ¥417,890 $3,891

The accumulated benefit obligation for all defined benefit pension plans was ¥1,688,666 million and ¥1,284,339 million

($11,959 million) at March 31, 2004 and 2005, respectively.