Toyota 2005 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2005 Toyota annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

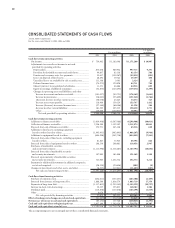

79

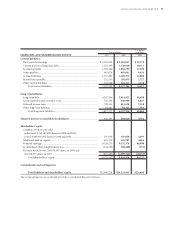

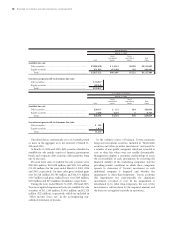

CONSOLIDATED STATEMENTS OF SHAREHOLDERS’ EQUITY

Toyota Motor Corporation

For the years ended March 31, 2003, 2004 and 2005

Yen in millions

Accumulated

Additional other Treasury

Common paid-in Retained comprehensive stock,

stock capital earnings income (loss) at cost Total

Balances at March 31, 2002 ........................................ ¥397,050 ¥490,538 ¥6,804,722 ¥(267,304) ¥ (160,894) ¥7,264,112

Issuance during the year .............................................. 3,252 3,252

Comprehensive income

Net income............................................................... 750,942 750,942

Other comprehensive income (loss)

Foreign currency translation adjustments......... (139,285) (139,285)

Unrealized losses on securities,

net of reclassification adjustments ................... (26,495) (26,495)

Minimum pension liability adjustments ........... (171,978) (171,978)

Net gains on derivative instruments .................. 790 790

Total comprehensive income.................................. 413,974

Dividends paid ............................................................. (110,876) (110,876)

Purchase and retirement of common stock ............... (142,993) (306,469) (449,462)

Balances at March 31, 2003 ........................................ 397,050 493,790 7,301,795 (604,272) (467,363) 7,121,000

Issuance during the year .............................................. 1,389 1,389

Comprehensive income

Net income............................................................... 1,162,098 1,162,098

Other comprehensive income (loss)

Foreign currency translation adjustments......... (203,257) (203,257)

Unrealized gains on securities,

net of reclassification adjustments ................... 329,672 329,672

Minimum pension liability adjustments ........... 273,265 273,265

Total comprehensive income.................................. 1,561,778

Dividends paid ............................................................. (137,678) (137,678)

Purchase and reissuance of common stock................ (367,922) (367,922)

Balances at March 31, 2004 ........................................ 397,050 495,179 8,326,215 (204,592) (835,285) 8,178,567

Issuance during the year .............................................. 528 528

Comprehensive income

Net income............................................................... 1,171,260 1,171,260

Other comprehensive income

Foreign currency translation adjustments......... 75,697 75,697

Unrealized gains on securities,

net of reclassification adjustments ................... 38,455 38,455

Minimum pension liability adjustments ........... 9,780 9,780

Total comprehensive income.................................. 1,295,192

Dividends paid ............................................................. (165,299) (165,299)

Purchase and reissuance of common stock................ (264,038) (264,038)

Balances at March 31, 2005 ........................................ ¥397,050 ¥495,707 ¥9,332,176 ¥ (80,660) ¥(1,099,323) ¥9,044,950

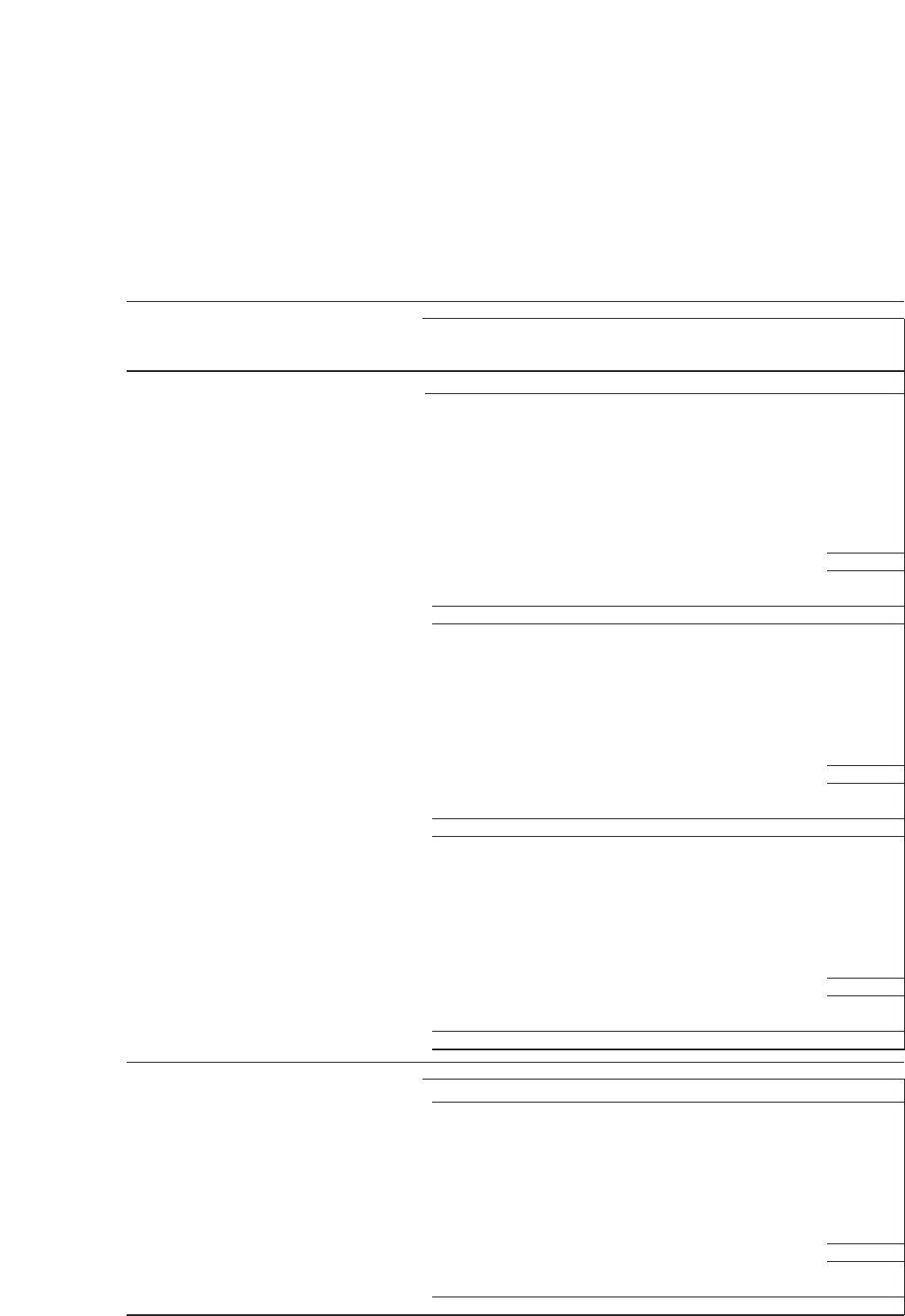

U.S. dollars in millions

Balances at March 31, 2004 ........................................ $3,697 $4,611 $77,532 $(1,905) $ (7,778) $76,157

Issuance during the year .............................................. 5 5

Comprehensive income

Net income............................................................... 10,907 10,907

Other comprehensive income

Foreign currency translation adjustments......... 705 705

Unrealized gains on securities,

net of reclassification adjustments ................... 358 358

Minimum pension liability adjustments ........... 91 91

Total comprehensive income.................................. 12,061

Dividends paid ............................................................. (1,539) (1,539)

Purchase and reissuance of common stock................ (2,459) (2,459)

Balances at March 31, 2005 ........................................ $3,697 $4,616 $86,900 $ (751) $(10,237) $84,225

The accompanying notes are an integral part of these consolidated financial statements.