Toyota 2005 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2005 Toyota annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS >107

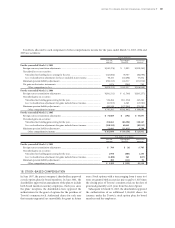

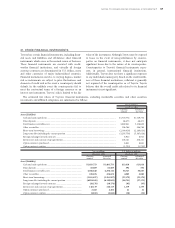

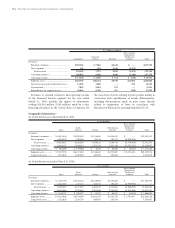

The following pension benefit payments, which reflect expected future service, as appropriate, are expected to be paid:

U.S. dollars

Years ending March 31, Yen in millions in millions

2006 ................................................................................................................................................................. ¥72,184 $672

2007 ................................................................................................................................................................. 78,137 728

2008 ................................................................................................................................................................. 77,379 721

2009 ................................................................................................................................................................. 79,998 745

2010 ................................................................................................................................................................. 79,568 741

from 2011 to 2015........................................................................................................................................... 388,551 3,617

Total ............................................................................................................................................................ 775,817 7,224

The expected rate of return on plan assets is determined

after considering several applicable factors including, the

composition of plan assets held, assumed risks of asset

management, historical results of the returns on plan

assets, Toyota’s principal policy for plan asset manage-

ment, and forecasted market conditions.

Toyota’s policy and objective for plan asset manage-

ment is to maximize returns on plan assets to meet future

benefit payment requirements under risks which Toyota

considers permissible. Asset allocations under the plan

asset management are determined based on Toyota’s plan

asset management guidelines which are established to

achieve the optimized asset compositions in terms of the

long-term overall plan asset management. Prior to making

individual investments, Toyota performs in-depth assess-

ments of corresponding factors including risks, transac-

tion costs and liquidity of each potential investment under

consideration. To measure the performance of the plan

asset management, Toyota establishes bench mark return

rates for each individual investment, combines these

individual bench mark rates based on the asset composi-

tion ratios within each asset category, and compares the

combined rates with the corresponding actual return rates

on each asset category.

Toyota expects to contribute ¥83,862 million ($781

million) to its pension plan in the year ending March 31,

2006.

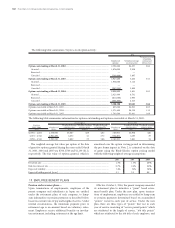

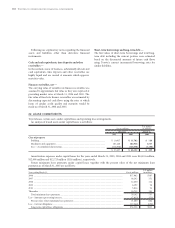

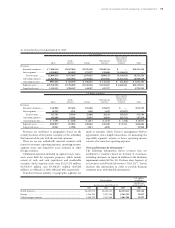

Toyota’s pension plan weighted-average asset allocations as of March 31, 2004 and 2005, by asset category are as follows:

Plan assets at March 31,

2004 2005

Equity securities................................................................................................................................................. 49.4% 64.0%

Debt securities.................................................................................................................................................... 16.9 21.5

Real estate........................................................................................................................................................... 0.3 0.5

Other .................................................................................................................................................................. 33.4 14.0

Total............................................................................................................................................................... 100.0% 100.0%

Weighted-average assumptions used to determine net periodic pension cost for the years ended March 31, 2003, 2004

and 2005 are as follows:

For the years ended March 31,

2003 2004 2005

Discount rate.......................................................................................................................... 2.5% 2.1% 2.2%

Expected return on plan assets ............................................................................................. 2.7% 2.1% 2.1%

Rate of compensation increase ............................................................................................. 1.5–6.0% 0.8–9.7% 0.5–9.7%