Toyota 2005 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2005 Toyota annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Based on currently available information, Toyota does not

expect environmental matters to have a material impact

on its financial position, results of operations, liquidity or

cash flows during fiscal 2006. However, there exists a sub-

stantial amount of uncertainty with respect to Toyota’s

obligations under current and future environment regula-

tions as described in “Information on the Company—

Business Overview—Governmental Regulations, Environment

and Safety Standards” in Toyota’s annual report on Form 20-F.

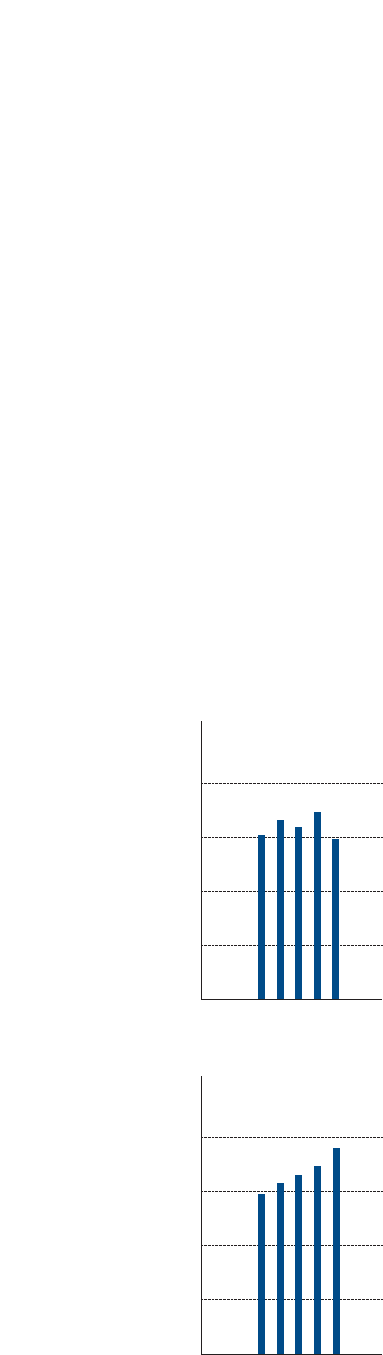

Cash and cash equivalents were ¥1,483.7 billion at

March 31, 2005. Most of Toyota’s cash and cash equi-

valents are held in Japanese yen and the U.S. dollars. In

addition, time deposits were ¥63.6 billion and marketable

securities were ¥543.1 billion at March 31, 2005.

Liquid assets, which Toyota defines as cash and cash

equivalents, time deposits, marketable debt securities and

its investment in monetary

trust funds, increased dur-

ing fiscal 2005 by ¥353.8

billion, or 10.2%, to ¥3,810.0

billion.

Trade accounts and notes

receivable, net increased dur-

ing fiscal 2005 by ¥84.7

billion, or 5.5%, to ¥1,616.3

billion, reflecting the impact

of increased revenues and

the impact of the change in

foreign currency translation

rates.

Inventories increased during

fiscal 2005 by ¥223.4 billion,

or 20.6%, to ¥1,306.7 billion,

reflecting the impact of

increased volumes and the

impact of the change in

foreign currency translation

rates.

Total finance receivables,

net increased during fiscal

2005 by ¥1,135.1 billion, or

19.4%, to ¥6,987.0 billion.

The change resulted from

the increase in retail financ-

ings due to the increase in

vehicle unit sales, the

increase in wholesale and

other dealer loans, including

real estate loans and work-

ing capital financings pro-

vided to dealers and a decrease

in securitizations of finance receivables in finance subsi-

diaries in North America. These increases were partially

offset by the decrease in finance leases. As of March 31,

2005, finance receivables were geographically distributed

as follows: in North America 64.0%, in Japan 15.7%, in

Europe 10.3% and in all other markets 10.0%. Toyota

maintains programs to sell finance receivables through

special purpose entities and obtained proceeds from

securitization transactions, net of purchased and retained

interests totaling ¥48.9 billion during fiscal 2005.

Marketable securities and other securities investments,

including those included in current assets, increased during

fiscal 2005 by ¥556.8 billion, or 20.7%, to ¥3,247.2 billion,

primarily reflecting the increase of U.S. treasury notes held

by a manufacturing subsidiary in North America and

Japanese government bonds held by the parent company.

Property, plant and equipment increased during fiscal

2005 by ¥440.9 billion, or 8.2%, reflecting an increase in

capital expenditures and the impact of changes in foreign

currency translation rates, which was partially offset by the

depreciation charges during the year.

Accounts payable increased during fiscal 2005 by ¥147.4

billion, or 8.6%, reflecting the increased product volumes

and the impact of changes in foreign currency translation rates.

Accrued expenses increased during fiscal 2005 by ¥156.1

billion, or 13.8%, reflecting the increase in expenses due to

the expansion of the business.

Income taxes payable increased during fiscal 2005 by

¥40.3 billion, or 15.9%, principally as a result of the

increase in taxable income especially in subsidiaries in

North America and Asia.

Toyota’s total borrowings increased during fiscal 2005 by

¥986.1 billion, or 13.0%. Toyota’s short-term borrowings

consist of loans with a weighted-average fixed interest rate of

1.58% and commercial paper with a weighted-average fixed

interest rate of 2.81%. Short-term borrowings increased

during fiscal 2005 by ¥192.8 billion, or 8.8%, to ¥2,381.8

billion. Toyota’s long-term debt consists of unsecured and

secured loans, medium-term notes, unsecured notes and

long-term capital lease obligations ranging from 0.01% to

27.00%, with maturity dates ranging from 2005 to 2035.

Toyota’s long-term debt also consists of notes payable

related to securitized finance receivables structured as

collateralized borrowings. The current portion of long-term

debt increased during fiscal 2005 by ¥25.7 billion, or 2.3%,

to ¥1,150.9 billion and the non-current portion increased by

¥767.6 billion, or 18.1%, to ¥5,014.9 billion. The increase in

total borrowings reflects the expansion of the financial

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS >65

1,000

500

1,500

2,000

’01 ’02 ’03 ’04 ’05

0

Cash and Cash Equivalents

at End of Year

(¥ Billion)

FY

2,000

3,000

1,000

4,000

’01 ’02 ’03 ’04 ’05

0

Liquid Assets*

(¥ Billion)

FY

* Cash and cash equivalents, time

deposits, marketable debt

securities and its investment

in monetary trust funds