Toyota 2005 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2005 Toyota annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MESSAGE FROM THE EXECUTIVE VICE PRESIDENT RESPONSIBLE FOR FINANCE & ACCOUNTING >15

Regarding “stability,” the Company maintained its solid financial base by ensuring

sufficient liquidity and stable shareholders’ equity. At fiscal 2005 year-end, liquid assets

were approximately ¥3.5 trillion while shareholders’ equity stood at roughly ¥9.0 trillion.

A sound financial position is a prerequisite in order to continue flexible, forward-looking

investment even during sharp fluctuations in operating and market conditions. In

addition, a solid financial position underpins the high credit ratings that allow Toyota to

continuously access low-cost, stable financing. In past years, the creation of new earnings

opportunities by globalizing operations, investing in research and development and

expanding financial services operations has required considerable amounts of capital.

As a result, while total assets have grown from around ¥16 trillion in fiscal 2000 to roughly

¥24 trillion in fiscal 2005, total liquidity has remained stable overall at approximately

¥3 trillion to ¥4 trillion. Toyota’s relative cash levels have in fact decreased. Despite the

backdrop of expected growth in automotive markets worldwide, I believe that

maintaining current cash levels is crucial for the implementation of forward-looking

investment to enhance product appeal, to develop next-generation technology, to

establish production and sales systems in Japan and overseas for the global expansion of

operations and to create businesses in new fields.

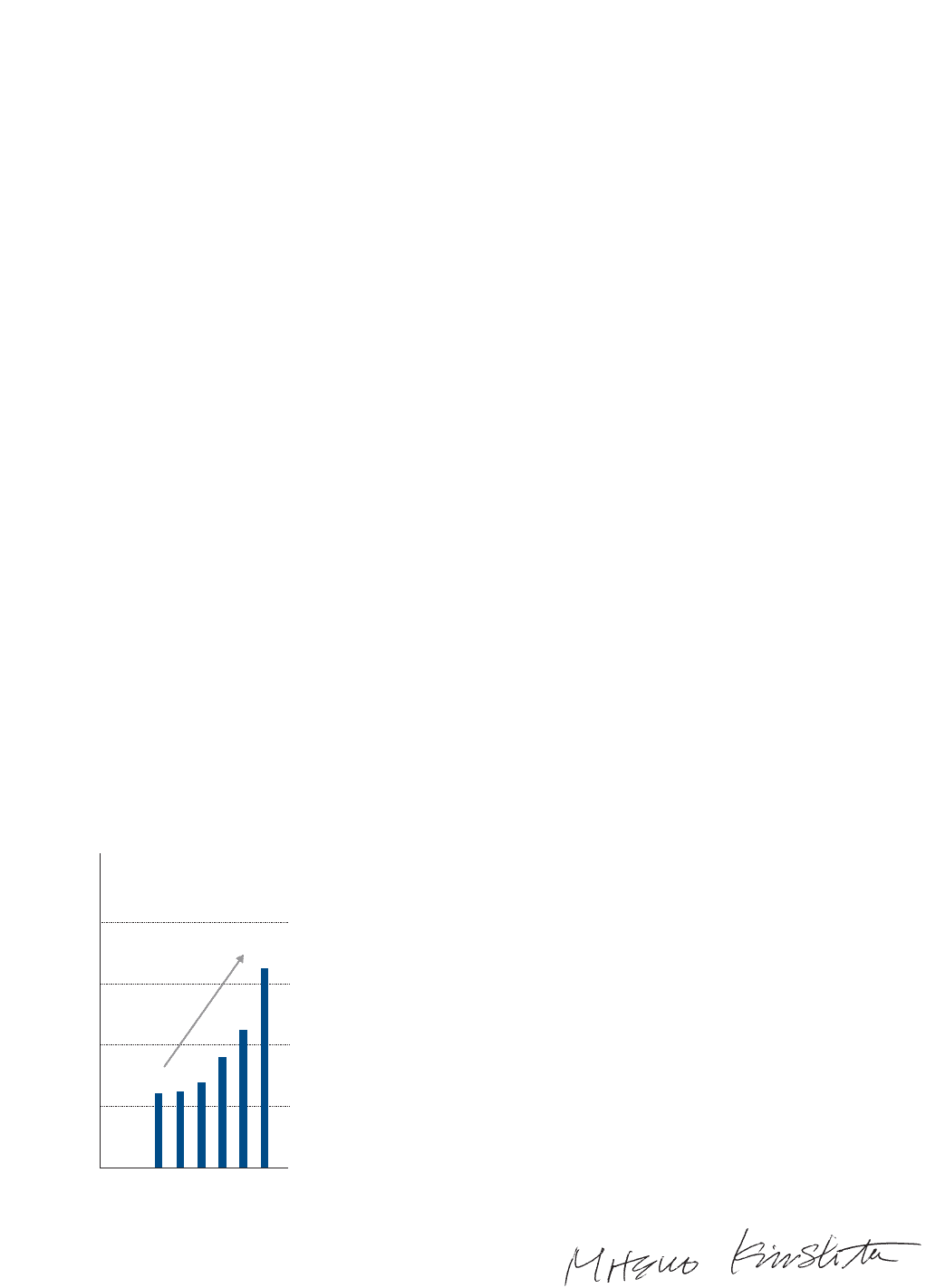

Dividends and Repurchases of Shares

Toyota believes that actively returning profits to its shareholders is an important

management policy and will make an effort to continue increasing consolidated net

income per share. In fiscal 2005, the Company’s dividend policy was to more closely

reflect favorable consolidated results in profit distribution in order to realize a substantial

increase in consolidated dividend payout ratios. Consequently, the Company paid a

significantly higher annual dividend of ¥65.00 per share, which was up ¥20.00 per share

from the previous fiscal year. That annual dividend was Toyota’s highest ever and marked

the sixth consecutive year of increased dividends. Furthermore, the consolidated dividend

payout ratio rose sharply year on year from 13.0% to 18.3%.

In addition, Toyota intends to repurchase shares of treasury stock flexibly with a view

to enhance capital efficiency and to improve the balance of share supply and demand. In

fiscal 2005, the Company repurchased a total of ¥266.2 billion, or 63.08 million shares of

treasury stock. As a result, excluding treasury stock, a total of 3.25 billion shares were

issued and outstanding as of June 30, 2005. Toyota has acquired treasury stock since the

first year of the recognition of stock repurchase under the Japanese Commercial Code in

fiscal 1997. As of June 30, 2005, the Company had repurchased a total of ¥2,107.5 billion,

or 616.14 million shares of treasury stock. Further, we received authorization to

repurchase up to 65 million shares of treasury stock, for a maximum aggregate purchase

price of ¥250 billion, from the Ordinary General Shareholders’ Meeting in June 2005.

Toyota is committed to maintaining the strong financial position that is the source of

its stable, long-term growth. At the same time, we will endeavor to reflect the fruits of that

growth in the distribution of profits to our shareholders.

July 2005

40

20

60

80

’01’00FY ’02 ’03 ’04 ’05

0

Dividends per Share

(¥)

+¥20

+¥9

+¥8

24 25 28

36

45

65

Mitsuo Kinoshita,

Executive Vice President

*Responsibilities include finance and accounting related operational areas (See Members of the Board of Directors and

Auditors, page 132)