Toyota 2005 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2005 Toyota annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Toyota has continued to originate leases to finance new

Toyota vehicles. These leasing activities are subject to

residual value risk. Residual value risk arises when the

lessee of a vehicle does not exercise the option to purchase

the vehicle at the end of the lease. The number of vehicles

returned at the end of leases has decreased in recent years.

Approximately 50% of vehicles leased by Toyota Motor

Credit Corporation, Toyota’s financing subsidiary located

in the United States, were returned at the end of the

applicable lease periods during fiscal 2003 and 2004,

compared to a decrease in the return rate to approxi-

mately 40% in fiscal 2005 due to a narrowing spread

between contractual residual values and end of lease

market values. To avoid a loss on a vehicle returned to

Toyota at the end of its lease, Toyota must resell or re-

lease the vehicle at or above the residual value of the

vehicle. If Toyota is unable to recover the residual value of

the vehicle, it will incur a loss at the end of the lease, which

may offset a portion of the earnings on the lease. To the

extent that sales incentives remain an integral part of sales

promotions (reducing new vehicle prices and cost of

ownership), resale prices of used vehicles and, correspond-

ingly, the fair value of Toyota’s leased vehicles could be

subject to downward pressure. During fiscal 2004 and

2005, losses have decreased mainly due to a decrease in the

number of vehicles returned. See discussion in the Critical

Accounting Estimates section regarding “Investment in

Operating Leases” and note 2 to consolidated financial

statements regarding the allowance for residual values losses.

Toyota maintains an overall risk management strategy

to mitigate its exposure to fluctuations in interest rates

and currency exchange rates. Toyota enters into interest

rate swap agreements and cross currency interest rate

swap agreements to convert its fixed-rate debt to variable-

rate functional currency debt. Toyota formally documents

relationships between the derivative instrument and the

hedged item, as well as its risk-management strategy for

undertaking hedge transactions. If Toyota elects fair value

hedge accounting, derivative instruments are designated

with specific liabilities on Toyota’s consolidated balance

sheet, and the fair value quarterly change component of

each derivative instrument and hedged item is included in

the assessment of hedge effectiveness. Most interest rate

swap agreements are executed as an integral part of

specific debt transactions, achieving designated hedges.

Toyota uses cross currency interest rate swap agreements

to entirely hedge exposure to currency exchange rate

fluctuations on principal

and/or interest payments

and to manage its expo-

sure to interest rate fluctua-

tions. Certain derivative

instruments are entered

into to hedge interest rate

risk from an economic

perspective and are not

designated to specific assets

or liabilities on Toyota’s

consolidated balance sheet.

Accordingly, unrealized gains

or losses related to deriva-

tives that are not designated

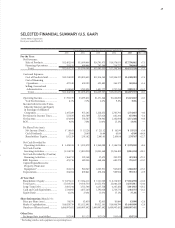

Yen in millions

March 31,

2004 2005

Finance Receivables

Retail ......................................................................................................................................... ¥ 3,643,998 ¥ 4,780,250

Finance leases.............................................................................................................................. 912,622 758,632

Wholesale and other dealer loans.............................................................................................. 1,680,907 1,773,440

6,237,527 7,312,322

Unearned income ....................................................................................................................... (298,153) (233,417)

Allowance for credit losses......................................................................................................... (87,462) (91,829)

Finance receivables, net.......................................................................................................... 5,851,912 6,987,076

Less – Current portion ............................................................................................................... (2,622,939) (3,010,135)

Noncurrent finance receivables, net...................................................................................... ¥ 3,228,973 ¥ 3,976,941

Operating Leases

Vehicles ....................................................................................................................................... ¥ 1,387,404 ¥ 1,736,238

Equipment .................................................................................................................................. 106,376 92,459

1,493,780 1,828,697

Less – Accumulated depreciation .............................................................................................. (375,861) (424,609)

Vehicles and equipment on operating leases, net................................................................. ¥ 1,117,919 ¥ 1,404,088

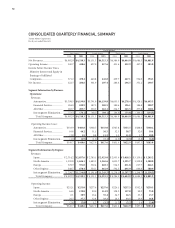

5,000

2,500

7,500

10,000

’01 ’02 ’03 ’04 ’05

0

FY

Total Assets by Financial

Services Operations

(¥ Billion)

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS >53