Toyota 2005 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2005 Toyota annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Income taxes—

The provision for income taxes is computed based on the

pretax income included in the consolidated statement of

income. The asset and liability approach is used to recog-

nize deferred tax assets and liabilities for the expected

future tax consequences of temporary differences between

the carrying amounts and the tax bases of assets and

liabilities. Valuation allowances are recorded to reduce

deferred tax assets when it is more likely than not that a

tax benefit will not be realized.

Derivative financial instruments—

Toyota employs derivative financial instruments, includ-

ing forward foreign currency exchange contracts, foreign

currency options, interest rate swaps, interest rate

currency swap agreements and interest rate options to

manage its exposure to fluctuations in interest rates and

foreign currency exchange rates. Toyota does not use

derivatives for speculation or trading purposes. Changes

in the fair value of derivatives are recorded each period in

current earnings or through other comprehensive income,

depending on whether a derivative is designated as part of

a hedge transaction and the type of hedge transaction. The

ineffective portion of all hedges is recognized currently in

operations.

Net income per share—

Basic net income per common share is calculated by

dividing net income by the weighted-average number of

shares outstanding during the reported period. The

calculation of diluted net income per common share is

similar to the calculation of basic net income per share,

except that the weighted-average number of shares

outstanding includes the additional dilution from the

assumed exercise of dilutive stock options.

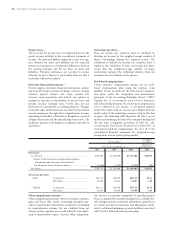

Stock-based compensation—

Toyota measures compensation expense for its stock-

based compensation plan using the intrinsic value

method. Toyota accounts for the stock-based compensa-

tion plans under the recognition and measurement

principles of the Accounting Principles Board (“APB”)

Opinion No. 25, Accounting for Stock Issued to Employees,

and related Interpretations. No stock-based compensation

cost is reflected in net income, as all options granted

under those plans had an exercise price higher than the

market value of the underlying common stock on the date

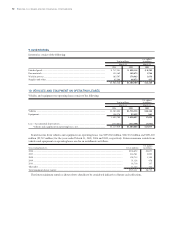

of grant. The following table illustrates the effect on net

income and earnings per share if the company had applied

the fair value recognition provisions of FAS No. 123,

Accounting for Stock-Based Compensation (“FAS 123”), to

stock-based employee compensation. See note 18 to the

consolidated financial statements for weighted-average

assumptions used in option pricing model.

84 >NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

U.S. dollars

Yen in millions in millions

For the year

For the years ended March 31, ended March 31,

2003 2004 2005 2005

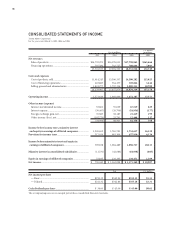

Net income

As reported..................................................................................... ¥750,942 ¥1,162,098 ¥1,171,260 $10,907

Deduct: Total stock-based compensation expenses

determined under fair value based method

for all awards, net of related tax effects .................................. (1,406) (1,292) (1,571) (15)

Pro forma ....................................................................................... ¥749,536 ¥1,160,806 ¥1,169,689 $10,892

Net income per share

—Basic As reported............................................. ¥211.32 ¥342.90 ¥355.35 $3.31

Pro forma ............................................... 210.92 342.51 354.87 3.30

—Diluted As reported ............................................. ¥211.32 ¥342.86 ¥355.28 $3.31

Pro forma ............................................... 210.92 342.48 354.80 3.30

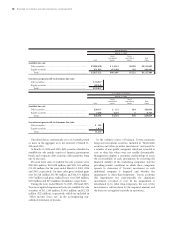

Other comprehensive income—

Other comprehensive income refers to revenues, expenses,

gains and losses that, under accounting principles gen-

erally accepted in the United States of America are included

in comprehensive income, but are excluded from net

income as these amounts are recorded directly as an adjust-

ment to shareholders’ equity. Toyota’s other comprehen-

sive income is primarily comprised of unrealized gains/

losses on marketable securities designated as available-for-

sale, foreign currency translation adjustments, gains/losses

on certain derivative instruments and adjustments attrib-

uted to additional minimum pension liabilities associated

with Toyota’s defined benefit pension plans.