Toyota 2005 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2005 Toyota annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

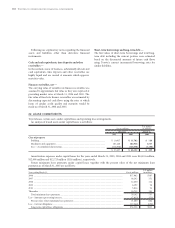

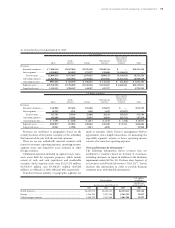

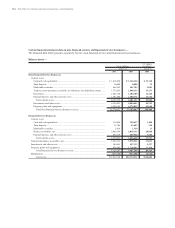

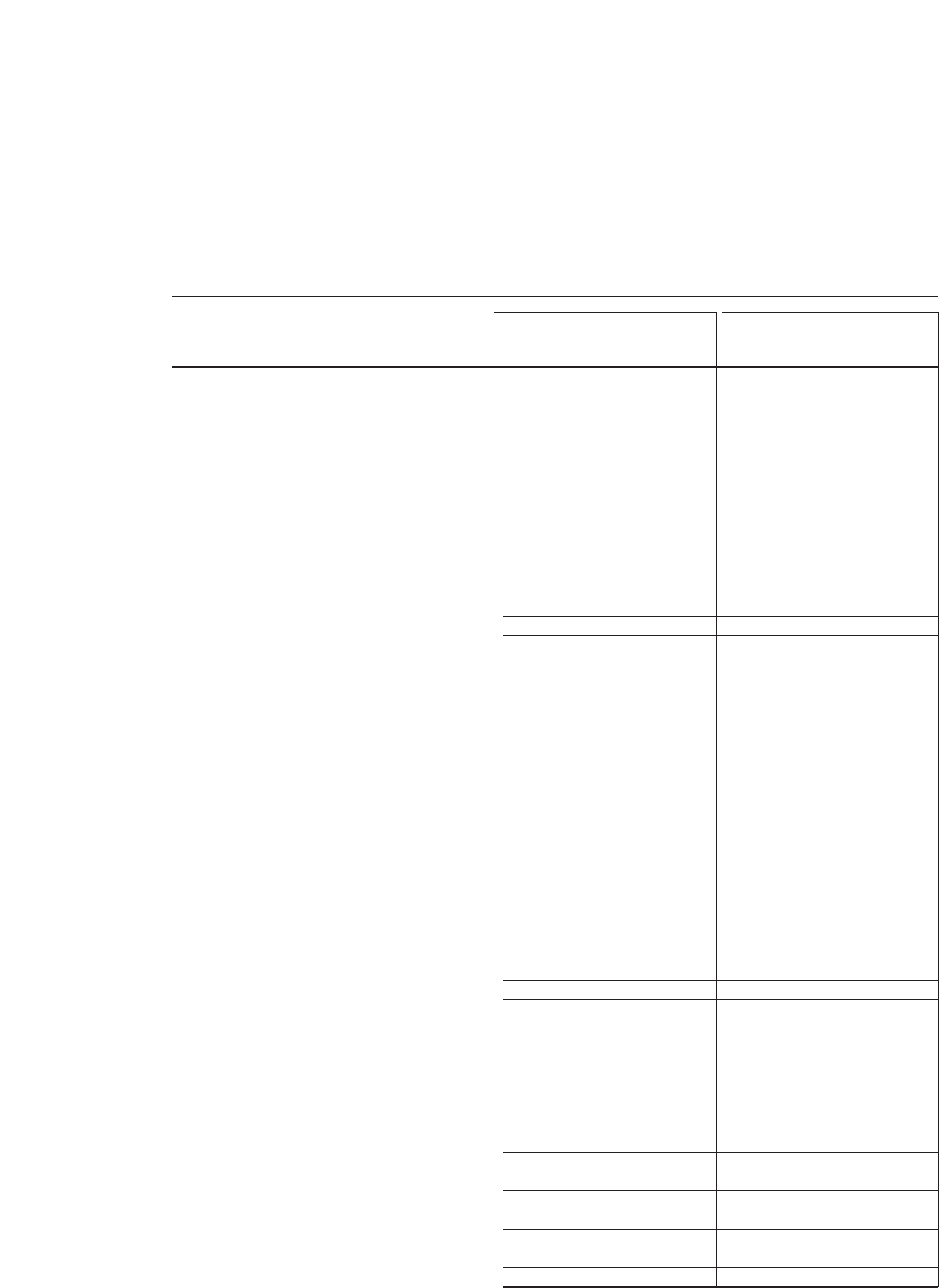

Yen in millions U.S. dollars in millions

For the year ended March 31, 2005 For the year ended March 31, 2005

Non-Financial Financial Non-Financial Financial

Services Services Services Services

Businesses Businesses Consolidated Businesses Businesses Consolidated

Cash flows from operating activities

Net income ....................................................................... ¥ 1,047,741 ¥ 123,975 ¥ 1,171,260 $ 9,756 $ 1,155 $ 10,907

Adjustments to reconcile net income to net cash

provided by operating activities

Depreciation................................................................. 777,129 220,584 997,713 7,237 2,054 9,291

Provision for doubtful accounts and credit losses ..... 15,752 47,402 63,154 147 441 588

Pension and severance costs, less payments ............... (53,401) 468 (52,933) (497) 4 (493)

Loss on disposal of fixed assets.................................... 48,334 825 49,159 450 8 458

Unrealized losses on available-for-sale securities, net.. 2,324 — 2,324 22 — 22

Deferred income taxes ................................................. 29,398 54,860 84,711 274 511 789

Minority interest in consolidated subsidiaries ........... 63,952 988 64,938 596 9 605

Equity in earnings of affiliated companies ................. (131,849) (7,622) (139,471) (1,228) (71) (1,299)

Changes in operating assets and liabilities, and other.... (97,535) 203,762 130,085 (910) 1,897 1,210

Net cash provided by operating activities .............. 1,701,845 645,242 2,370,940 15,847 6,008 22,078

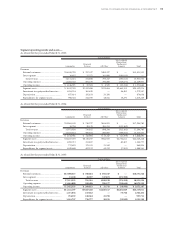

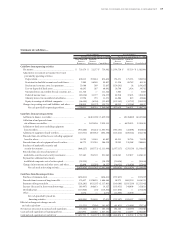

Cash flows from investing activities

Additions to finance receivables......................................... — (8,264,794) (4,296,966) — (76,961) (40,013)

Collection of and proceeds from

sale of finance receivables ................................................. — 7,289,387 3,377,510 — 67,878 31,451

Additions to fixed assets excluding equipment

leased to others ................................................................. (1,049,572) (18,715) (1,068,287) (9,774) (174) (9,948)

Additions to equipment leased to others ........................... (146,891) (708,062) (854,953) (1,367) (6,593) (7,961)

Proceeds from sales of fixed assets excluding equipment

leased to others ................................................................. 60,034 9,362 69,396 559 87 646

Proceeds from sales of equipment leased to others........... 84,450 232,006 316,456 786 2,160 2,947

Purchases of marketable securities and

security investments.......................................................... (1,053,417) (112,374) (1,165,791) (9,809) (1,047) (10,856)

Proceeds from sales of and maturity of

marketable securities and security investments............... 471,614 102,329 573,943 4,392 952 5,344

Payment for additional investments

in affiliated companies, net of cash acquired................... (901) — (901) (8) — (8)

Changes in investments and other assets, and other......... 84,979 (16,485) (11,603) 790 (152) (107)

Net cash used in investing activities.......................... (1,549,704) (1,487,346) (3,061,196) (14,431) (13,850) (28,505)

Cash flows from financing activities

Purchase of common stock................................................. (264,106) — (264,106) (2,459) — (2,459)

Proceeds from issuance of long-term debt ........................ 27,363 1,862,012 1,863,710 255 17,339 17,354

Payments of long-term debt ............................................... (59,689) (1,160,710) (1,155,223) (556) (10,808) (10,757)

Increase in short-term borrowings..................................... 564 178,956 140,302 5 1,666 1,306

Dividends paid..................................................................... (165,299) — (165,299) (1,539) — (1,539)

Other.................................................................................... (7,000) 7,000 — (65) 65 —

Net cash provided by (used in)

financing activities.................................................... (468,167) 887,258 419,384 (4,359) 8,262 3,905

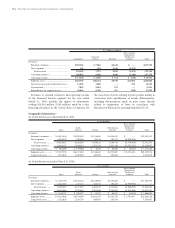

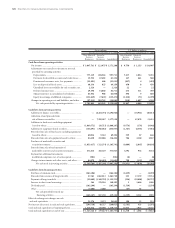

Effect of exchange rate changes on cash

and cash equivalents .............................................................. 21,276 3,573 24,849 198 33 231

Net increase (decrease) in cash and cash equivalents ............ (294,750) 48,727 (246,023) (2,745) 453 (2,291)

Cash and cash equivalents at beginning of year..................... 1,618,876 110,900 1,729,776 15,075 1,033 16,107

Cash and cash equivalents at end of year ............................... ¥ 1,324,126 ¥ 159,627 ¥ 1,483,753 $ 12,330 $ 1,486 $ 13,816

120 >NOTES TO CONSOLIDATED FINANCIAL STATEMENTS