Supercuts 2010 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2010 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

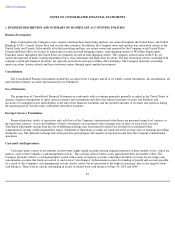

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

1. BUSINESS DESCRIPTION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

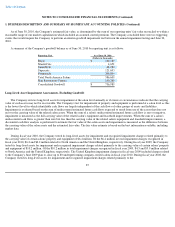

carrying value of certain salons' property and equipment of $10.5 million, related to the Company's July 2008 plan to close up to 160

underperforming company-owned salons in fiscal year 2009. Of the $10.5 million in total impairment charges recognized in fiscal year 2008,

$5.0, $1.1, and $4.4 million related to North America, United Kingdom, and discontinued operations salons, respectively. The Company also

evaluated the appropriateness of the remaining useful lives of its non-impaired property and equipment and whether a change to the

depreciation charge was warranted. Impairment charges for continuing operations are included in depreciation related to company-owned

salons in the Consolidated Statement of Operations.

Deferred Rent and Rent Expense:

The Company leases most salon and hair restoration center locations under operating leases. Rent expense is recognized on a straight-line

basis over the lease term. Tenant improvement allowances funded by landlord incentives, rent holidays, and rent escalation clauses which

provide for scheduled rent increases during the lease term or for rental payments commencing at a date other than the date of initial occupancy

are recorded in the Consolidated Statements of Operations on a straight-line basis over the lease term (including one renewal option period if

renewal is reasonably assured based on the imposition of an economic penalty for failure to exercise the renewal option). The difference

between the rent due under the stated periods of the lease compared to that of the straight-line basis is recorded as deferred rent within other

noncurrent liabilities in the Consolidated Balance Sheet.

For purposes of recognizing incentives and minimum rental expenses on a straight-line basis over the terms of the leases, the Company

uses the date that it obtains the legal right to use and control the leased space to begin amortization, which is generally when the Company

enters the space and begins to make improvements in preparation of intended use of the leased space.

Certain leases provide for contingent rents, which are determined as a percentage of revenues in excess of specified levels. The Company

records a contingent rent liability in accrued expenses on the Consolidated Balance Sheet, along with the corresponding rent expense in the

Consolidated Statement of Operations, when specified levels have been achieved or when management determines that achieving the specified

levels during the fiscal year is probable.

Revenue Recognition and Deferred Revenue:

Company-owned salon revenues and related cost of sales are recognized at the time of sale, as this is when the services have been

provided or, in the case of product revenues, delivery has occurred, and the salon receives the customer's payment. Revenues from purchases

made with gift cards are also recorded when the customer takes possession of the merchandise or services are provided. Gift cards issued by the

Company are recorded as a liability (deferred revenue) until they are redeemed. An accrual for estimated returns and credits has been recorded

based on historical customer return data that management believes to be reasonable, and is less than one percent of sales.

Product sales by the Company to its franchisees are included within product revenues on the Consolidated Statement of Operations and

recorded at the time product is shipped to franchise locations. The related cost of product sold to franchisees is included within cost of product

in the Consolidated Statement of Operations.

88