Supercuts 2010 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2010 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

The term "reasonably likely" refers to an occurrence that is more than remote but less than probable in the judgment of the Company. Because

some of the inherent assumptions and estimates used in determining the fair value of the reportable segments are outside the control of

management, changes in these underlying assumptions can adversely impact fair value. Potential impairment of a portion or all of the carrying

value of the Regis salon concept and Promenade salon concept goodwill is dependent on many factors and cannot be predicted with certainty.

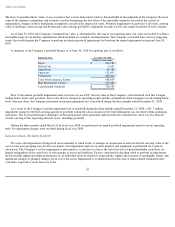

As of June 30, 2010, the Company's estimated fair value, as determined by the sum of our reporting units' fair value reconciled to within a

reasonable range of our market capitalization which included an assumed control premium. The Company concluded there were no triggering

events that would require the Company to perform an interim goodwill impairment test between the annual impairment testing and June 30,

2010.

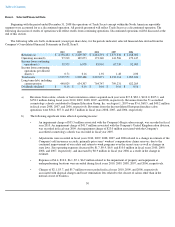

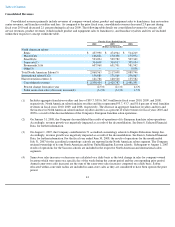

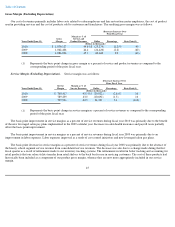

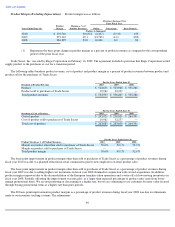

A summary of the Company's goodwill balance as of June 30, 2010 by reporting unit is as follows:

Prior to the annual goodwill impairment analysis for fiscal year 2009, the fair value of the Company's stock declined such that it began

trading below book value per share. Due to the adverse changes in operating results and the continuation of the Company's stock trading below

book value per share, the Company performed an interim impairment test of goodwill during the three months ended December 31, 2008.

As a result of the Company's interim impairment test of goodwill during the three months ended December 31, 2008, a $41.7 million

impairment charge for the full carrying amount of goodwill within the salon concepts in the United Kingdom was recorded within continuing

operations. The recent performance challenges of the international salon operations indicated that the estimated fair value was less than the

current carrying of this reporting units net assets, including goodwill.

During the three months ended March 31 of fiscal year 2008, we performed our annual goodwill impairment analysis on our reporting

units. No impairment charges were recorded during fiscal year 2008.

Long

-Lived Assets, Excluding Goodwill

We assess the impairment of long-lived assets annually or when events or changes in circumstances indicate that the carrying value of the

assets or the asset grouping may not be recoverable. Our impairment analysis on salon property and equipment is performed on a salon by

salon basis. The Company's test for impairment is performed at a salon level as this is the lowest level for which identifiable cash flows are

largely independent of the cash flows of other groups of assets and liabilities. Factors considered in deciding when to perform an impairment

review include significant under-performance of an individual salon in relation to expectations, significant economic or geographic trends, and

significant changes or planned changes in our use of the assets. Impairment is evaluated based on the sum of undiscounted estimated future

cash flows expected to result from use of the

36

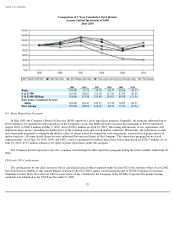

Reporting Unit As of June 30, 2010

(Dollars in thousands)

Regis

$

102,180

MasterCuts

4,652

SmartStyle

48,280

Supercuts

121,693

Promenade

309,804

Total North America Salons

586,609

Hair Restoration Centers

150,380

Consolidated Goodwill

$

736,989