Supercuts 2010 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2010 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

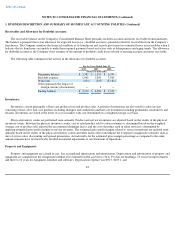

1. BUSINESS DESCRIPTION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

including allocation of shared or corporate balances among reporting units. Allocations are generally based on the number of salons in each

reporting unit as a percent of total company-owned salons.

The Company calculates the estimated fair value of the reporting units based on discounted future cash flows that utilize estimates in

annual revenue, gross margins, fixed expense rates, allocated corporate overhead, and long-term growth for determining terminal value. The

Company's estimated future cash flows also take into consideration acquisition integration and maturation. Where available and as appropriate,

comparative market multiples are used to corroborate the results of the discounted cash flow. The Company considers its various concepts to be

reporting units when testing for goodwill impairment because that is where the Company believes the goodwill resides. The Company

periodically engage third-party valuation consultants to assist in evaluation of the Company's estimated fair value calculations. The Company's

policy is to perform its annual goodwill impairment test during its third quarter of each fiscal year ending June 30.

In the situations where a reporting unit's carrying value exceeds its estimated fair value, the amount of the impairment loss must be

measured. The measurement of impairment is calculated by determining the implied fair value of a reporting unit's goodwill. In calculating the

implied fair value of goodwill, the fair value of the reporting unit is allocated to all other assets and liabilities of that unit based on the relative

fair values. The excess of the fair value of the reporting unit over the amount assigned to its assets and liabilities is the implied fair value of

goodwill. The goodwill impairment is measured as the excess of the carrying value of goodwill over its implied fair value.

The Regis salon concept reported same-store sales results of negative 5.8 percent for the three months ended March 31, 2010, which was

unfavorable compared to the Company's budgeted same-store sales. Such results indicated customer visitation patterns were not rebounding as

quickly as the Company had originally projected. Accordingly, the Company reduced the budgeted financial projections for the remainder of

fiscal 2010 and all of fiscal year 2011. The lowered projections assume the higher price point Regis salon concept remains strong and viable

but will require a longer, slower recovery. As a result of the lowered projections for the remainder of fiscal year 2010 and all of fiscal year

2011, the estimated fair value of the Regis salon concept decreased to a level below the Regis salon concept's carrying value. As a result of the

Company's annual impairment analysis of goodwill during the third quarter of fiscal year 2010, a $35.3 million impairment charge was

recorded within continuing operations for the excess of the carrying value of goodwill over the implied fair value of goodwill for the Regis

salon concept.

As of March 31, 2010, the estimated fair value of the Promenade salon concept exceeded its respective carrying value by approximately

10.0 percent. The respective fair values of the Company's remaining reporting units exceeded fair value by greater than 20.0 percent. While the

Company has determined the estimated fair values of Regis and Promenade to be appropriate based on the historical level of revenue growth,

operating income and cash flows, it is reasonably likely that Regis and Promenade may become impaired in future periods. The term

"reasonably likely" refers to an occurrence that is more than remote but less than probable in the judgment of the Company. Because some of

the inherent assumptions and estimates used in determining the fair value of this reportable segment are outside the control of management,

changes in these underlying assumptions can adversely impact fair value. Potential impairment of a portion or all of the carrying value of the

Regis salon concept and Promenade salon concept goodwill is dependent on many factors and cannot be predicted with certainty.

86