Supercuts 2010 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2010 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

audit in a number of states in which the statute of limitations has been extended to fiscal years 2000 and forward. Internationally (including

Canada), the statute of limitations for tax audits varies by jurisdiction, but generally ranges from three to five years.

We adopted the FASB guidance regarding the recognition, measurement, presentation, and disclosure in the financial statements of tax

positions taken or expected to be taken on a tax return, including the decision whether to file or not to file in a particular jurisdiction. As a

result of the adoption, effective July 1, 2007, the Company recognized a $20.7 million increase in the liability for unrecognized income tax

benefits, including interest and penalties. As of June 30, 2010 the Company's liability for uncertain tax positions was $16.9 million. See

Note 13 to the Consolidated Financial Statements for further information.

Contingencies

We are involved in various lawsuits and claims that arise from time to time in the ordinary course of our business. Accruals are recorded

for such contingencies based on our assessment that the occurrence is probable, and where determinable, an estimate of the liability amount.

Management considers many factors in making these assessments including past history and the specifics of each case. However, litigation is

inherently unpredictable and excessive verdicts do occur, which could have a material impact on our Consolidated Financial Statements.

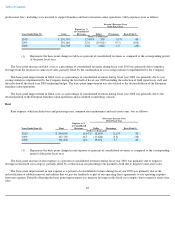

During fiscal year 2010, the Company settled two legal claims regarding certain customer and employee matters for an aggregate of

$5.2 million plus a commitment to provide discount coupons.

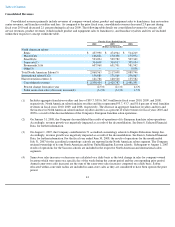

OVERVIEW OF FISCAL YEAR 2010 RESULTS

The following summarizes key aspects of our fiscal year 2010 results:

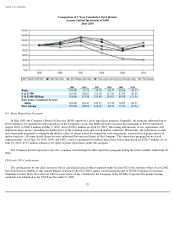

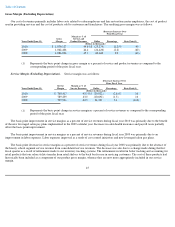

• Revenues decreased 2.9 percent to $2.4 billion during fiscal year 2010. The Company experienced a decline in customer

visitation as a result of the current global economic environment, partially offset by an increase in average ticket price, resulting

in a decrease in consolidated same-store sales of 3.2 percent. The revenue decrease was partially offset by a one-time sale of

$20.0 million of product sold to the purchaser of Trade Secret. The Company expects fiscal year 2011 same-store sales to be in

the range of negative 1.0 percent to positive 2.0 percent.

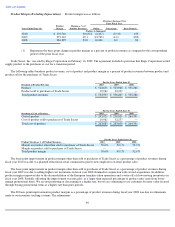

• Goodwill impairment charges of $35.3 million associated with our Regis salon concept were recorded during fiscal year 2010.

• Long-lived asset impairment charges of $6.4 million were recorded during fiscal year 2010.

• Total debt at the end of fiscal year 2010 declined to $440.0 million and our debt-to-capitalization ratio, calculated as total debt

as a percentage of total debt and shareholders' equity at fiscal year end, improved 1,380 basis points to 30.3 percent as compared

to June 30, 2009. The decrease in debt-to-capitalization ratio from fiscal year 2009 to fiscal year 2010 was primarily due to the

July 2009 common stock offering and decreased debt levels stemming from the repayment of private placement debt during

fiscal year 2010.

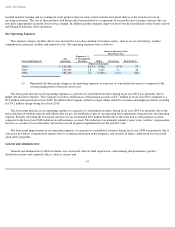

• The annual effective income tax rate of 48.1 percent was adversely impacted by the pre-tax non-cash goodwill impairment

charge of $35.3 million recorded during the three months ended March 30, 2010. During fiscal year 2010, the Company

recorded adjustments to correct its current income tax balances. The adjustments increased the Company's fiscal year 2010

income tax provision by $2.1 million and increased its effective income tax rate by 3.9 percent. Offsetting these amounts were

increased employment credits related to the Small Business and Work Opportunity Tax Act of 2007 which benefited the

effective income tax rate by 6.4 percent. Based upon current legislation these credits are scheduled to expire on September 1,

2011.

39