Supercuts 2010 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2010 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

14. BENEFIT PLANS (Continued)

2009 to estimate the obligations associated with these deferred compensation contracts. Compensation associated with these agreements is

charged to expense as services are provided. Associated costs included in general and administrative expenses on the Consolidated Statement

of Operations totaled $5.2, $3.7, and $2.4 million for fiscal years 2010, 2009, and 2008, respectively. The accrued liability and projected

benefit obligation of these deferred compensation contracts totaled $30.2 and $23.4 million at June 30, 2010 and 2009, respectively, in the

Consolidated Balance Sheet. As of June 30, 2010 and 2009, $29.6 and $23.4 million is included in other noncurrent liabilities, respectively. As

of June 30, 2010, $0.6 million of the balance is included in accrued liabilities. The tax-effected accumulated other comprehensive loss for the

deferred compensation contracts, consisting of primarily unrecognized actuarial loss, was $1.9 and $0.6 million at June 30, 2010 and 2009,

respectively. The amount included in accumulated other comprehensive loss expected to be recognized as a component of net periodic deferred

compensation expense in fiscal year 2011 is approximately $0.2 million. The Company intends to fund its future obligations under these

arrangements through company-owned life insurance policies on the participants. Cash values of these policies totaled $20.2 and $18.8 million

at June 30, 2010 and 2009, respectively, and are included in other assets in the Consolidated Balance Sheet.

The Company has agreed to pay the former Vice Chairman an annual amount of $0.6 million, adjusted for inflation to $0.9 million in

fiscal years 2010 and 2009, for the remainder of his life. The former Vice Chairman has agreed that during the period in which payments are

made, as provided in the agreement, he will not engage in any business competitive with the business conducted by the Company. Additionally,

the Company has a survivor benefit plan for the former Vice Chairman's spouse, payable upon his death, at a rate of one half of his deferred

compensation benefit, adjusted for inflation, for the remaining life of his spouse. Estimated associated costs included in general and

administrative expenses on the Consolidated Statement of Operations totaled $0.6, $0.8, and $0.7 million for each of fiscal years 2010, 2009,

and 2008, respectively. Related obligations totaled $6.2 and $6.4 million at June 30, 2010 and 2009, respectively, and are included in other

noncurrent liabilities in the Consolidated Balance Sheet. The Company intends to fund all future obligations under this agreement through

company-owned life insurance policies on the former Vice Chairman. Cash values of these policies totaled $3.9 and $3.6 million at June 30,

2010 and 2009, respectively, and are included in other assets in the Consolidated Balance Sheet. The policy death benefits exceed the

obligations under this agreement.

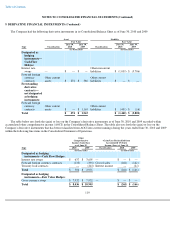

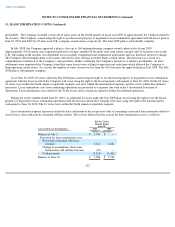

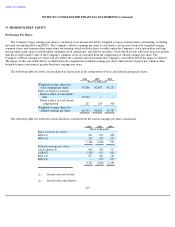

Compensation expense included in income before income taxes related to the aforementioned plans, excluding amounts paid for expenses

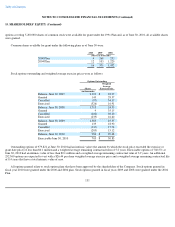

and administration of the plans, for the three years ended June 30, 2010, 2009 and 2008, included the following:

128

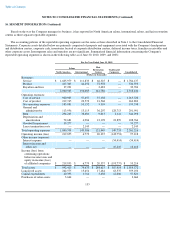

2010 2009 2008

(Dollars in thousands)

Profit sharing plan

$

3,206

$

1,697

$

3,373

Executive Profit Sharing Plan

654

303

497

ESPP

484

634

711

FSPP

8

12

18

Deferred compensation contracts

5,814

4,479

3,122