Supercuts 2010 Annual Report Download - page 177

Download and view the complete annual report

Please find page 177 of the 2010 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221

|

|

PROVALLIANCE SAS

CONSOLIDATED FINANCIAL STATEMETS

DECEMBER 31, 2009 AND 2008

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(INFORMATION AS OF DECEMBER 31, 2009 AND FOR THE YEAR THEN ENDED NOT

COVERED BY AUDITORS' REPORT INCLUDED HEREIN)

1.1 SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

• Amendment to IAS 39, Financial Instruments: Recognition and Measurement—Eligible Hedged Items

• Revised version of IFRS 1, First-time Adoption of International Financial Reporting Standards

• Amendments to IFRS 1—Additional Exemptions for First-time Adopters

• Amendments to IFRS 2—Group Cash-settled Share-based Payment Transactions

• Improvements to IFRSs (April 2009)

• Amendment to IAS 32—Classification of Rights Issues

• Revised version of IAS 24, Related Party Disclosures

• IFRS 9, Financial Instruments

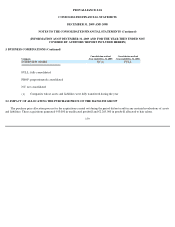

Provalliance SAS is currently in the process of determining the potential impact of these new standards, interpretations and amendments

on the Group's consolidated financial statements. At this stage, the Group does not expect the impact to be material, except for (i) the revised

version of IFRS 3 which introduces changes in accounting for business combinations that are required to be applied prospectively and

(ii) IFRS 9, for which the Group has not yet begun its analysis in view of the fact that the standard has only recently been published and is still

incomplete.

1.2 FINANCIAL RISK MANAGEMENT

The Group is exposed to the following inter-related risks:

• Credit risk

• Liquidity risk

• Market risk

This note sets out information on the Group's exposure to each of these risks, as well as the Group's objectives, strategy and procedures for

risk management and assessment and its capital management practices. Quantitative information on these issues is provided in other sections of

the consolidated financial statements.

It is the responsibility of the Chairman to define and oversee the Group's risk management process.

1.2.1 Credit risk

Credit risk refers to the risk that a customer or counterparty to a financial instrument will default on its contractual obligations resulting in

a financial loss to the Group. This risk mainly arises from trade receivables and marketable securities.

170